Small-cap stocks could follow the S&P 500 boost depending on the recession outcome. Which industries are future-proof?

The last two years have been dominated by the Fed’s hiking cycle. On Sunday, Democratic senators once again called for the Federal Reserve to lower the “astronomical rates” to make living more affordable.

“The Fed’s decision to raise interest rates rapidly, and keep them high, has resulted in higher costs for home purchasers, higher rents, and reductions in new home and apartment building—and the job growth that comes with these investments.”

From the letter to the Fed by Senators Warren, Hickenlooper, Rosen and Whitehouse.

During this period, it is no coincidence that Magnificent Seven stocks took an investing focus, picking 70% of stock market gains. Investors see them as a safe haven in a high-interest-rate environment because their big profits and strong balance sheets make them more resilient to higher borrowing costs.

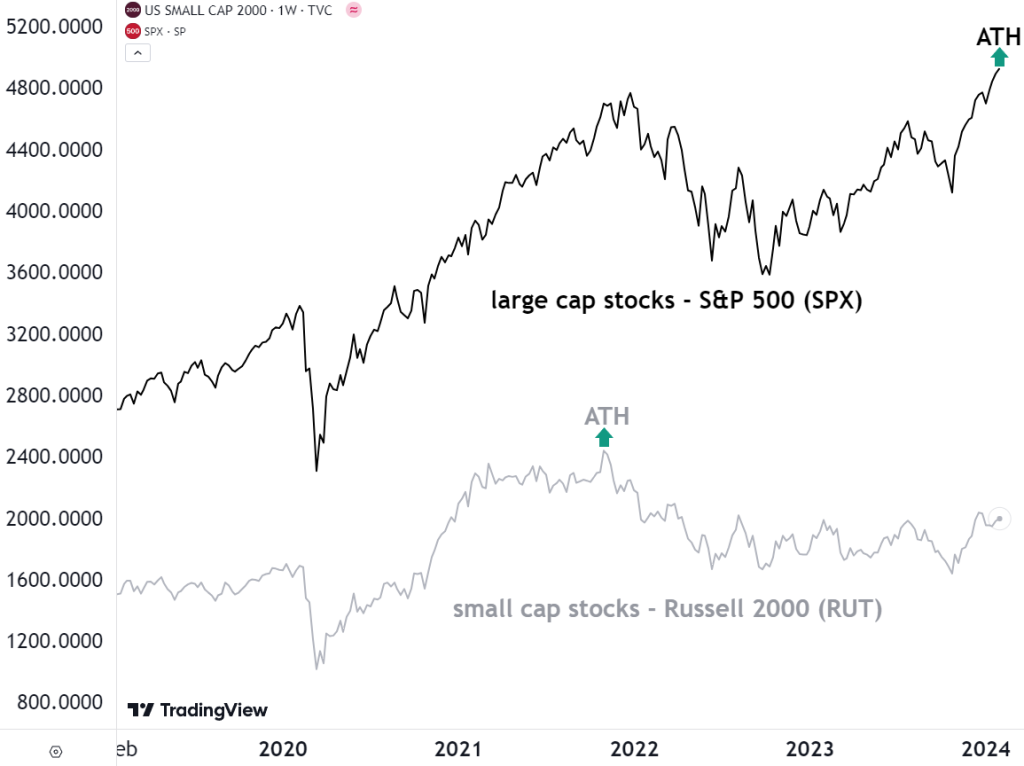

Anomalous Lag Between S&P 500 and Russell 2000

The S&P 500 (SPX) market benchmark reached an all-time high of 4,925 points on January 30th. Over one year, SPX gained 22.6%. In contrast, small-cap stocks that are typically perceived to be riskier only gained 6% over the same period, as expressed by the Russell 2000 (RUT) index.

However, with rate cuts on the horizon in mid-2024 or sooner, RUT has outpaced SPX over the last three months, at 21% vs 19% respectively. Yet, while SPX outpaced its previous ATH in December 2021, RUT is still 19% away from revisiting its November 2021 peak.

Image credit: TradingView

This trend, in which the S&P 500 (SPX) is in a bull market while Russell 2000 (RUT) is in a bear market, is highly anomalous in market history. At the same time, it indicates a lag before the small-cap breakout.

The question is, which small-cap stocks could benefit from this breakout?

1. Super Micro Computer

Since the last coverage of Super Micro Computer (NASDAQ:SMCI) in October 2023, SMCI stock is up 75%, drastically outperforming the Russell 2000 index. The investment case remains the same. Broadly diversified across custom server solutions, data centers, and cloud computing to power AI, the company is more flexible in its offerings.

Case in point, MicroCloud offers hyperscaling to businesses of all sizes as they host and manage online content. On January 29th, Super Micro Computer delivered its Q2 2024 earnings, increasing its revenue by 103% year-over-year to $3.66 billion.

The bulk of the revenue, at 94%, comes from server and storage systems. This is five times faster growth than the IT sector average. The company attributed this impressive growth to “continued record demand for AI systems at rack scale.”

Owing to its IT Rack Solutions for efficiently scaling data centers, the company expects to reach $25 billion in annual revenue in the future. It is also notable that Super Micro increased its operating margin from the prior quarter from 10.8% to 11.3%, demonstrating greater effectiveness in generating profit from revenue dollars.

Based on eight analyst inputs pulled by Nasdaq, SMCI stock is a “strong buy.” The average SMCI price target is $496.83 vs the current $514. The high estimate is $691, while the low forecast is $160 per share.

2. The Ensign Group

Around 17.3% of the US population is older than 60. The number of people over 65 has sharply increased from 35 million in 2000 to 54.1 million in 2019. Per the Administration for Community Living (ACL) report, 40% have reported difficulty with mobility, 9% with self-care, and 27% with cognition.

This translates to a large market for post-acute care services, focusing on nursing, senior living, healthcare, and rehabilitative services. Ensign Groups (NASDAQ:ENSG) diversified across all these needs, including non-emergency transportation services, long-term care pharmacy, and real estate acquisitions.

The Ensign Group is scheduled to release its year-end 2023 results on February 1st. In the previous Q3 quarter, the company reported a $69 million adjusted net income, a 16.6% increase from the comparable quarter in the previous year. Accordingly, they have raised their annual revenue guidance to $3.72B – $3.73B, ranging from the previous $3.69B – $3.73B.

The Ensign Group has spread out to 112 real estate assets, hosting 296 healthcare operations. This means the company is also in the leasing and real estate acquisition business. In terms of total operational bed occupancy, it increased from 75% from a year-ago quarter to 78.3%.

Based on six analyst inputs pulled by Nasdaq, ENSG stock is a “strong buy.” The average ENSG price target is $121.33 vs the current $116. The high estimate is $127, while the low forecast is $112 per share.

3. Chord Energy Corporation

Known for its largest hydrocarbon acreage in the prolific Williston Basin, this oil and gas exploration company is down 7% year-to-date. Following the merger between Oasis Petroleum (NASDAQ:CHRD) and Whiting in 2022, the new company has reported a 50% reinvestment rate in Q3 2023 earnings.

For the quarter, Chord’s cash flow was $265 million vs $400 million debt with 2026 maturity. Compared to Q4 ‘22, Chord’s total operating costs increased by nearly 8% while its total oil and gas revenue decreased by 5.6%.

Since the merger, Chord returned $1.45 billion to shareholders via dividends ($647M), share buybacks ($250M), and special dividend and cash considerations ($553M).

Presently, Chord pays a 3.5% dividend yield at a $5.44 annual payout per share. Given Chord’s strong oil presence in the Williston Basin and balance sheet, 11 analyst inputs pulled by Nasdaq positioned CHRD stock as a “strong buy. “

The average CHRD price target is $188.89 vs. the current $156. The high estimate is $228, while the low forecast is above the present price at $165 per share.

Disclaimer: The author does not hold or have a position in any securities discussed in the article. Neither the author, Tim Fries, nor this website, The Tokenist, provide financial advice. Please consult our website policy prior to making financial decisions.

This article was originally published on The Tokenist. Check out The Tokenist’s free newsletter, Five Minute Finance, for weekly analysis of the biggest trends in finance and technology.