- Semiconductor manufacturer Qorvo has seen its stock drop more than 13% so far this year.

- Despite the recent strong quarterly Q3 metrics, Qorvo stock has come under further pressure.

- Long-term investors could consider buying QRVO shares in February.

- SPDR® S&P Semiconductor ETF (NYSE:XSD)

- SPDR S&P Kensho Intelligent Structures (NYSE:SIMS)

- VictoryShares Nasdaq Next 50 ETF (NASDAQ:QQQN)

- Invesco PHLX Semiconductor ETF (NASDAQ:SOXQ)

Qorvo (NASDAQ:QRVO), which designs radio-frequency chips, lost 19.1% in the past 12 months and more than 13% so far in 2022. By comparison, the Philadelphia Semiconductor Index is up 18.1% in the past year, but down 8.2% year-to-date.

In late April 2021, QRVO shares hit a record high of $201.68. Then, between May and August, the stock traded in a range, mainly between $180 and $200. Afterwards came the drop in price, which led to a 52-week low of $123.92 on Jan. 28. The current market capitalization of Qorvo stands at $14.8 billion.

The North Carolina-based chip group is well-known for its radio-frequency (RF) technologies for mobile and broadband communications. It also offers products for the aerospace and defense industry.

Analysts expect the chip-maker to benefit from growth in 5G smartphone sales as many smartphone manufacturers rely on its RF chips. In fact, Apple (NASDAQ:AAPL) is one of its most important customers, accounting for over a quarter of sales in FY 2021. Samsung (OTC:SSNLF) is also a key client.

Among Qorvo’s peers are Broadcom (NASDAQ:AVGO), Qualcomm (NASDAQ:QCOM) and Skyworks (NASDAQ:SWKS). Readers might be interested to know that so far in 2022, these three stocks are down 9.1%, 0.5% and 7.7%, respectively.

On Feb. 2, Qorvo announced robust FY 2022 Q3 financials. Its top line was $1.11 billion, up 19.2% year-over-year. Diluted earnings per share came in at $2.98.

On the results, CEO Bob Bruggeworth said:

“Sustained year-over-year revenue growth was supported by multi-year secular growth drivers in 5G, IoT connectivity, defense and power.”

Furthermore, CFO Mark Murphy added:

“We expect to deliver sequential growth in the March quarter on smartphone launch timing…. At the midpoint of our March guidance, we project our full fiscal year revenue growth to exceed 15%, operating margin to expand to over 33%, and earnings per share to grow 25%.”

Prior to the release of the quarterly results, Qorvo stock was around $143. Then, on Feb. 4. it went below $126. Now, it is trading around $134.60.

What To Expect From Qorvo Stock

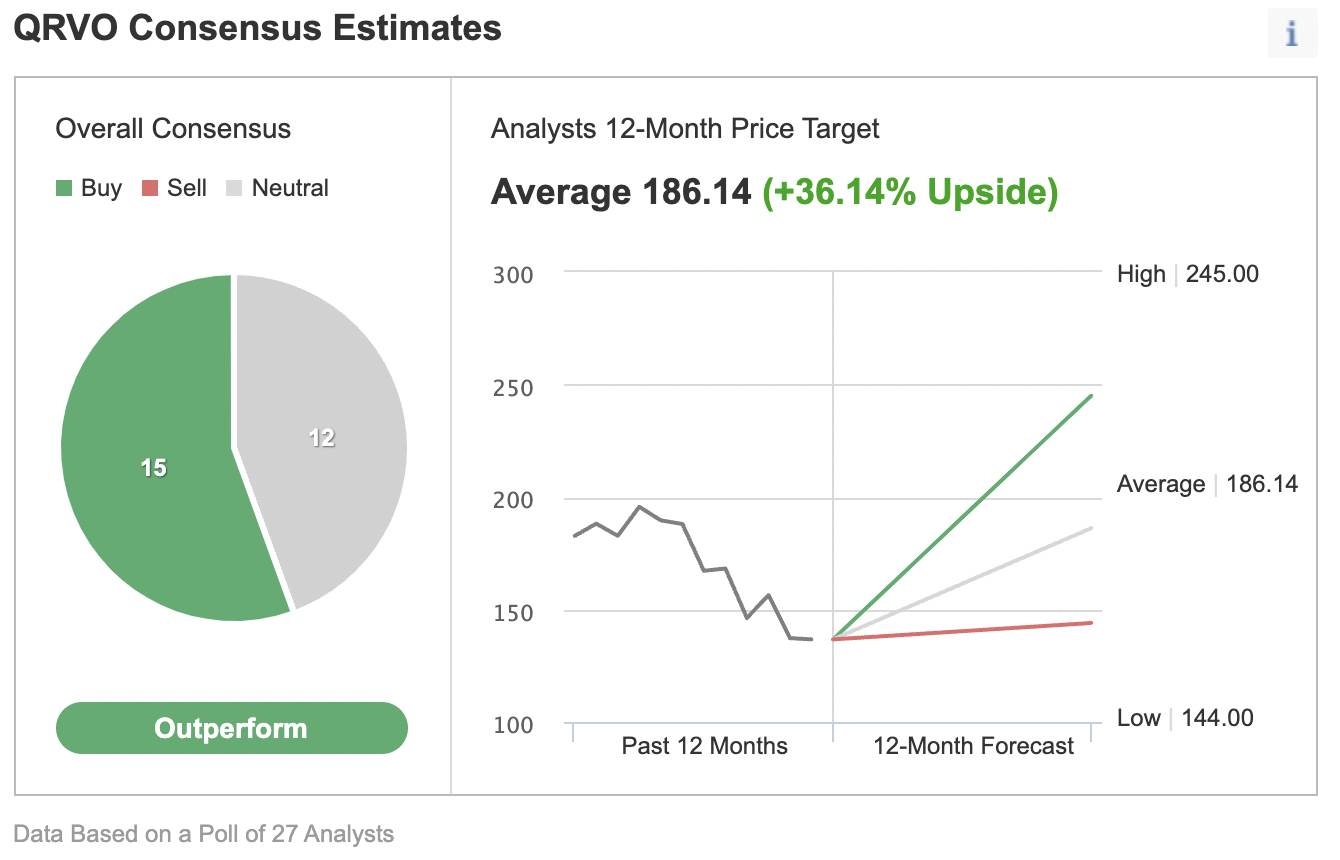

Among 27 analysts polled via Investing.com, QRVO stock has an "outperform" rating.

Source: Investing.com

Wall Street also has a 12-month median price target of $186.14 for the stock, implying an increase of more than 38% from current levels. The 12-month price range currently stands between $144 and $245.

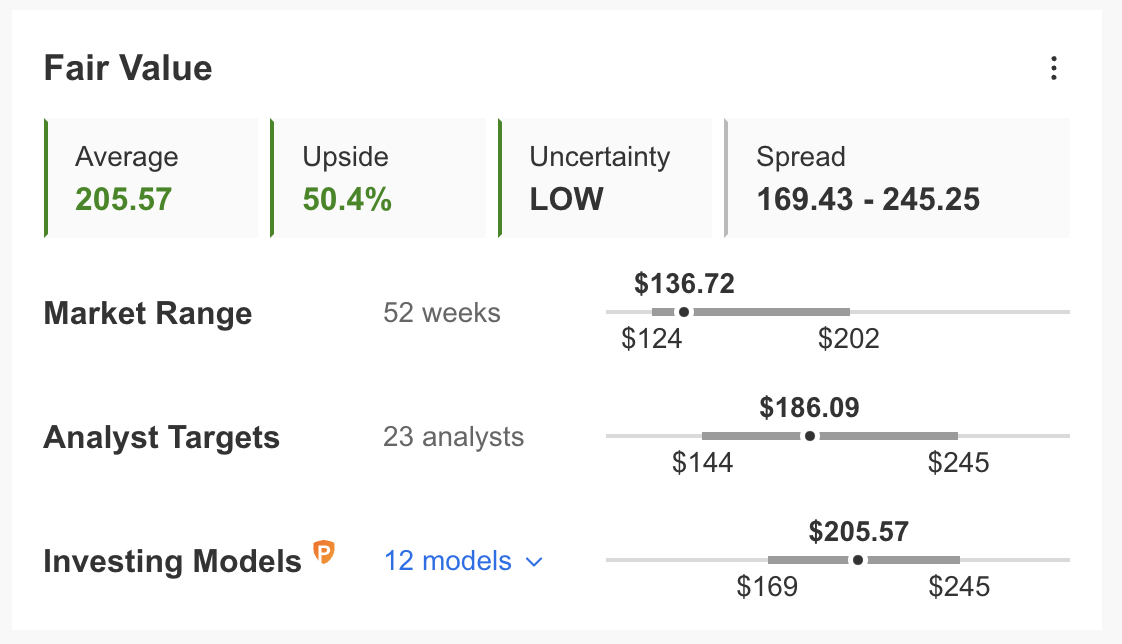

Similarly, according to a number of valuation models, like those that might consider P/E or P/S multiples or terminal values, the average fair value for Qorvo stock via InvestingPro stands at $205.57.

Source: InvestingPro

In other words, fundamental valuation suggests shares could increase around 50%.

We can also look at Qorvo’s financial health as determined by ranking more than 100 factors against peers in the information technology sector.

For instance, in terms of growth and profit, it scores 4 out of 5. Its overall score of 4 points to a great performance ranking.

At present, Qorvo stock’s P/E, P/B and P/S ratios are 13.0x, 3.1x and 3.2x. For comparison, those metrics for its peers stand at 27.3x, 8.3x and 8.8x. This illustrates how Qorvo offers better value than its peers.

Our expectation is for QRVO stock to build a base between $130 and $140. Afterwards, shares could start a new leg up.

Adding QRVO Stock To Portfolios

Qorvo bulls who are not concerned about short-term volatility could consider investing now. Their target price would be analysts’ estimate of $186.14.

Alternatively, investors could consider buying an exchange-traded fund (ETF) that has QRVO stock as a holding. Examples would include:

Finally, investors who expect QRVO stock to bounce back in the weeks ahead could consider setting up a bull call spread.

However, most option strategies are not suitable for all retail investors. Therefore, the following discussion on Qorvo stock is offered for educational purposes and not as an actual strategy to be followed by the average retail investor.

Bull Call Spread On Qorvo Stock

Price At Time Of Writing: $134.60

In a bull call spread, a trader has a long call with a lower strike price and a short call with a higher strike price. Both legs of the trade have the same underlying stock (i.e. Qorvo) and the same expiration date.

The trader wants QRVO stock to increase in price. In a bull call spread both the potential profit and the potential loss levels are limited. The trade is established for a net cost (or net debit), which represents the maximum loss.

Today’s bull call spread trade involves buying the May 20 expiry 140 strike call for $8.40 and selling the 150 strike call for $4.90.

Buying this call spread costs the investor around $3.50, or $350 per contract, which is also the maximum risk for this trade.

We should note that the trader could easily lose this amount if the position is held to expiry and both legs expire worthless, i.e., if the QRVO stock price at expiration is below the strike price of the long call (or $140 in our example).

To calculate the maximum potential gain by subtracting the premium paid from the spread between the two strikes, and multiplying the result by 100. In other words: ($10 – $3.50) x 100 = $650.

The trader will realize this maximum profit if the Qorvo stock price is at or above the strike price of the short call (higher strike) at expiration, or $150 in our example.

Bottom Line

Since August, Qorvo stock has come under significant pressure. Yet, the decline has improved the margin of safety for buy-and-hold investors, who could consider investing in February. Alternatively, experienced traders could also set up an options trade to benefit from a potential run-up in the price of QRVO stock.

Which stock should you buy in your very next trade?

AI computing powers are changing the stock market. Investing.com's ProPicks AI includes 6 winning stock portfolios chosen by our advanced AI. In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. Which stock will be the next to soar?

Unlock ProPicks AI