- The Q2 earnings season draws to a close with some final reports from retail and enterprise tech companies.

- Despite some economic uncertainties, market optimism persists.

- In this piece, we'll take a look at the three key takeaways from the latest earnings season.

- For less than $8 a month, InvestingPro's Fair Value tool helps you find which stocks to hold and which to dump at the click of a button.

As the Q2 earnings season winds down, it's a good time to take stock and assess the overall picture. Most companies reported growth in both revenue and earnings per share, with S&P 500 EPS rising by 10.9% overall.

Despite the market's fluctuations in early August, the S&P 500 remains in the positive territory, showing a nearly 3% return over the past two months.

From a macroeconomic standpoint, optimism remains despite some weakening in the labor market, especially after the recent big revision lower by the BLS.

Currently, the probability of a recession sits at 20% according to Goldman Sachs, which is relatively low for this stage of the cycle.

With these points in mind, let’s explore three key takeaways from this earnings season.

1. Earnings Season Favoured the Bulls

For the second quarter of 2024, the outlook remains positive. FactSet reports that 79% of companies have exceeded earnings per share (EPS) forecasts and 60% have surpassed revenue expectations.

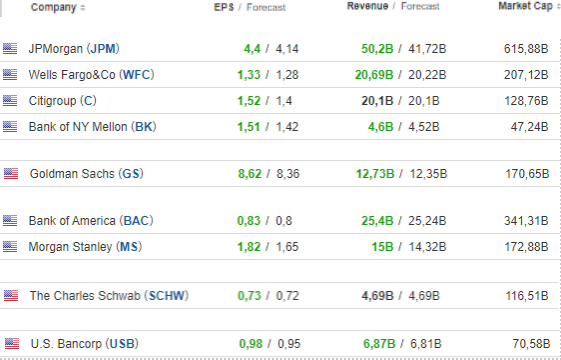

Both figures are higher than the 5-year and 10-year averages, which stand at 77% and 74%, respectively. Notably, companies have outperformed averages by 0.8 percentage points in revenue and 3.9 percentage points in EPS. Financial institutions and the utilities sector (NYSE:XLU), in particular, have shown impressive results.

In the U.S., the consumer remains strong, with reports from major retailers like Walmart (NYSE:WMT) indicating robust spending across nearly all income groups. However, companies such as McDonald’s (NYSE:MCD) and PepsiCo (NASDAQ:PEP) suggest that consumers are becoming more cautious with their spending. This caution stems from months of high inflation and uncertainty about the economic outlook for the coming quarters.

2. Rate Cuts Could Boost the Financial Sector

During the interest rate hike cycle, the financial sector (NYSE:XLF) enjoyed rising interest income, largely from increased lending.

However, as the cost of maintaining deposits has started to catch up with earnings, financial sector representatives eagerly anticipate rate cuts, possibly starting at the September meeting.

The finance industry saw a 17.6% year-on-year profit growth, ranking third in profit growth across sectors.

With banks generally passing recent stress tests without major issues, a broad-based Fed pivot could help the industry maintain its positive performance in the upcoming quarters.

3. Is Big Tech Overspending on AI?

Big Tech's heavy investment in AI is raising concerns. As the intelligence revolution heats up, companies are pouring more and more capital into the arms race. Take Alphabet (NASDAQ:GOOG), for example. Despite reporting earnings that beat forecasts, its stock fell by nearly 5% on the day of the announcement.

The drop stemmed largely from the hefty $13 billion spent on upgrades. Google’s capital spending surged by 91% year-on-year in the second quarter.

Source: InvestingPro

Next week, all eyes will be on Nvidia’s quarterly results, set for release on Wednesday. The market remains optimistic, as shown by the numerous upward revisions in its forecasts.

***

Disclaimer: This article is written for informational purposes only. It is not intended to encourage the purchase of assets in any way, nor does it constitute a solicitation, offer, recommendation or suggestion to invest. I would like to remind you that all assets are evaluated from multiple perspectives and are highly risky, so any investment decision and the associated risk is at the investor's own risk. We also do not provide any investment advisory services. We will never contact you to offer investment or advisory services.