Stocks started flat and turned sharply, only to rise sharply following a confusing CPI report. By day’s end, it seemed clear that the only thing the CPI report seemed to confirm was that the Fed was unlikely to cut rates by 50 bps in September.

The S&P 500 started the day a bit higher as implied volatility fell. Then the selling came in, which was pretty big, with the S&P 500 dropping until roughly 10:45.

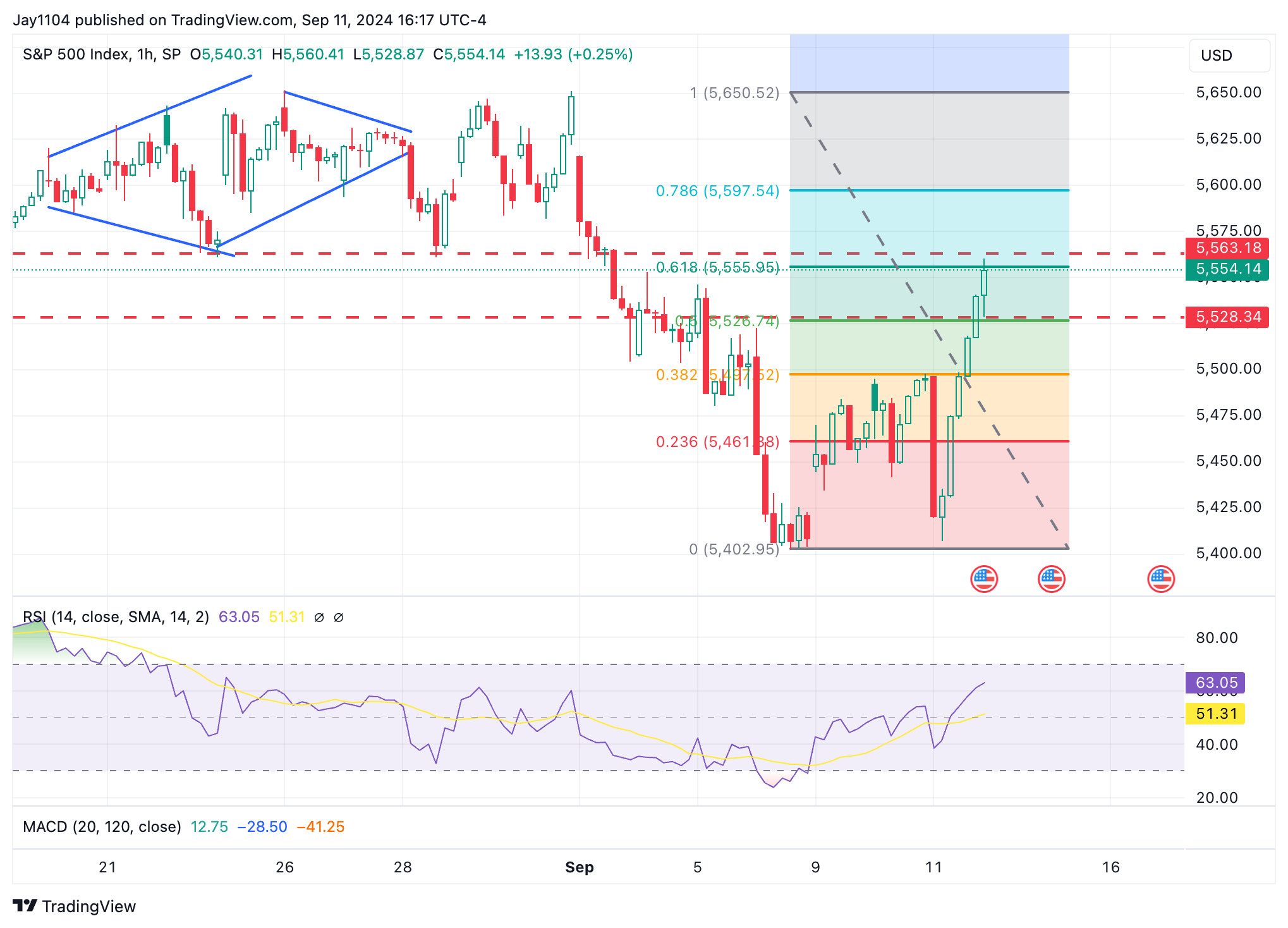

The index hit the put wall at 5,400, where it bounced. That is probably the point where the put holders started selling their puts, pushing IV down, and creating the move higher.

Despite the core CPI coming in at 0.3% month-over-month (higher than the estimated 0.2%), the 10-year rate only rose by two basis points, which is insignificant, while the 2-year rate increased by five basis points.

This caused the 10/2 yield curve to narrow to 1 basis point. Ultimately, the yield curve will need to keep steepening, and I don’t see that trend for a steeper curve changing anytime soon.

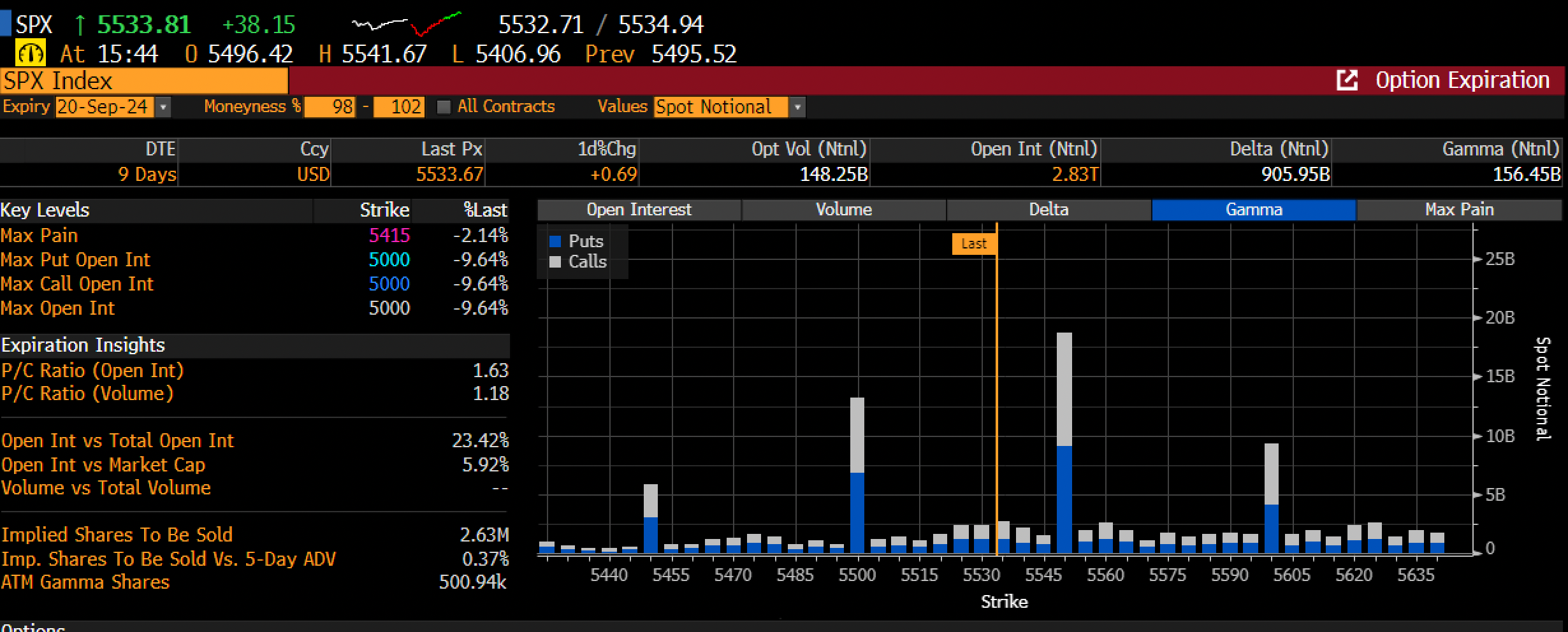

Most of the afternoon felt like a negative gamma-induced short-squeeze type behavior. The problem is that a significant resistance level for the S&P 500 lies at 5,550, making it challenging for the index to break through.

Additionally, the S&P 500 returns to positive gamma terrory likely based on where the market is trading at 5,554 at the close.

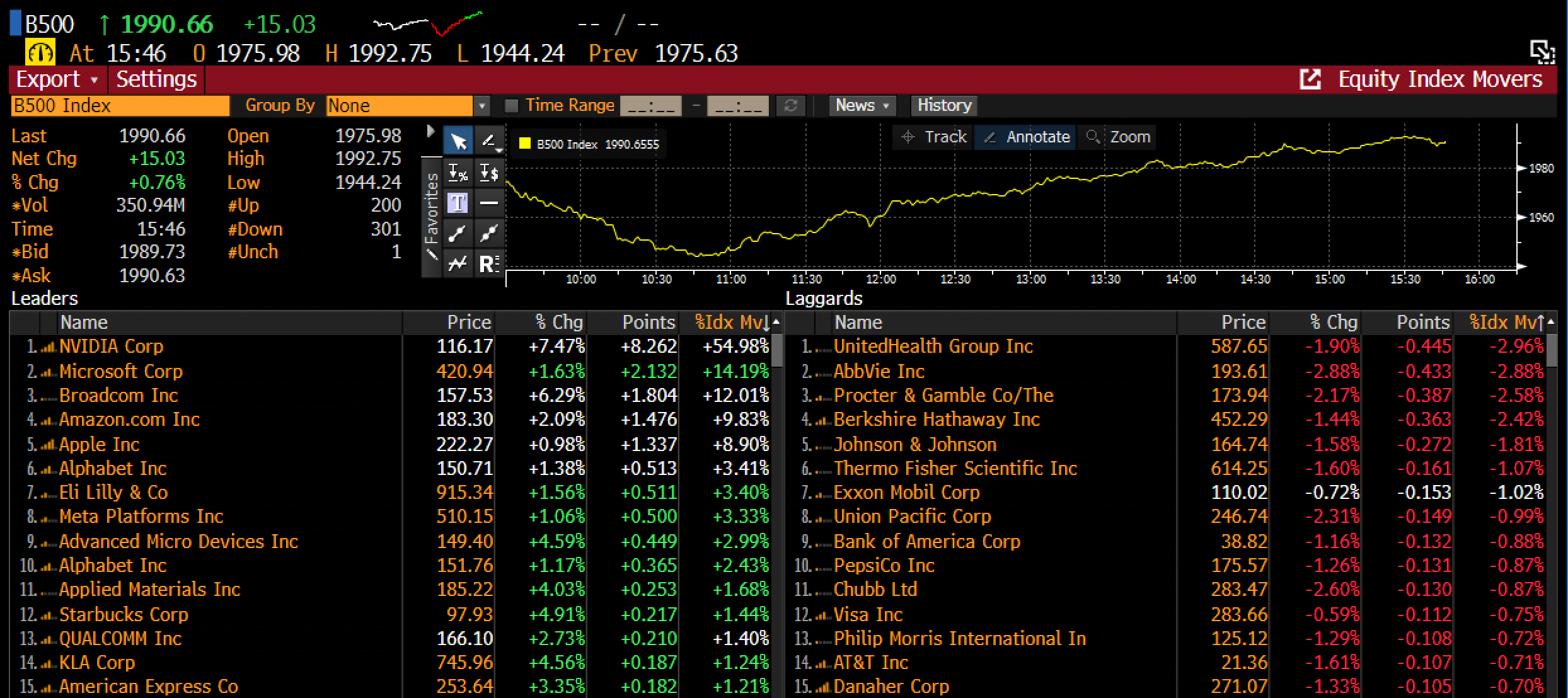

Another issue is that most of yesterday’s gains came from Nvidia (NASDAQ:NVDA), contributing about half of the overall increase in a market with more losers than winners as of 3:45 PM ET.

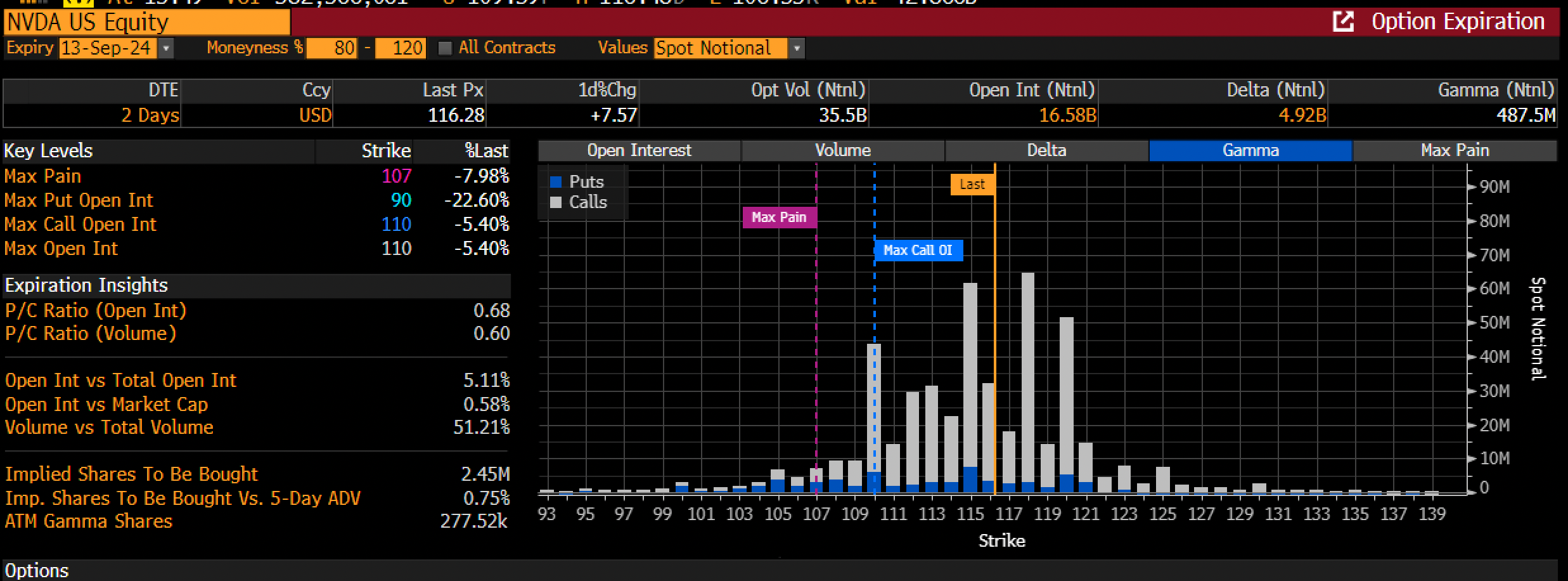

And just like the S&P 500, there is a lot of Nvidia option gamma layered between $118 and $120, which could very well keep a lid on the stock from traveling all that much higher from here.

But there is still the potential for the stock to fill the gap at $120 following its earnings report.

Otherwise, yesterday felt like a really confusing day, with the market not sure at first, and just getting caught on the wrong side of things, as Nvidia started to move following the CEO talk at a Goldman Sachs (NYSE:GS) Conference.

So right now, the S&P 500 finds itself at the 61.8% retracement of the decline last week, which makes things to this point, fairly normal following last week’s big declines.