- US indexes have fallen recently, and analysts are predicting more declines in the future.

- As the stock market heads lower, you should consider defensive additions to your portfolio.

- These three ETFs can be great choices if the market downturn continues.

Last month was characterized by moderate declines in the US indexes. The major indexes have fallen by 1% or 2%, but many analysts see this as a prelude to larger declines. Concerns about a possible continuation of the declines are mainly based on the unfavorable labor market and CPI data, which came in above forecasts in January.

In addition, expectations for the US interest rate target have risen and are currently at 5.25-5.5%. Selecting a suitable ETF is one way to prepare for a possible negative scenario. It is worth looking at typical defensive funds now, along with some exposure to more aggressive ETFs targeting declines in the S&P 500.

Here are 3 such funds:

1. iShares S&P 500 Value ETF - Investing in Value

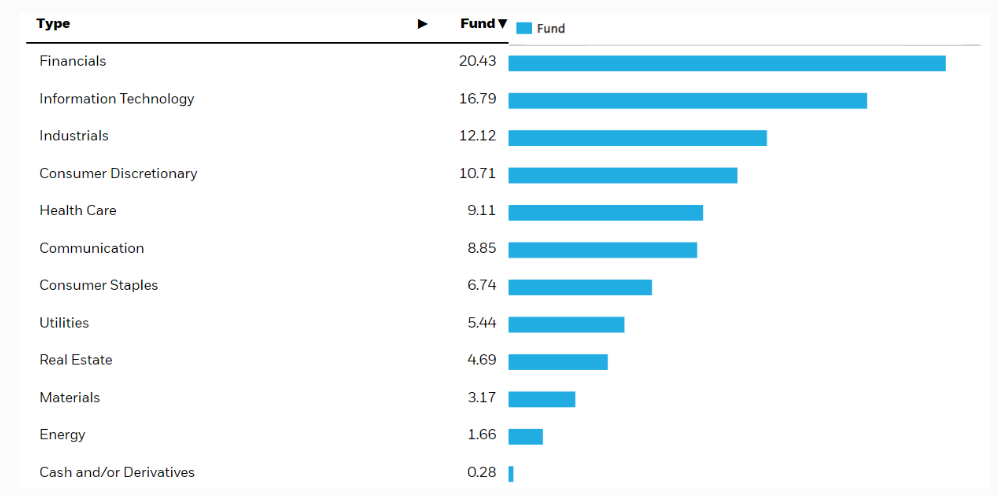

One of the basic divisions in the stock market is between growth and value companies. Value stocks are more resilient to market downturns and pay higher dividends on average. iShares S&P 500 Value ETF (NYSE:IVE) is a classic ETF that provides exposure to large-cap US stocks.

Source: www.ishares.com

The ETF is backed by companies in the financial sector, including Warren Buffet's Berkshire Hathaway (NYSE:BRKa). The Oracle of Omaha's investments are primarily value-oriented. At 3.5%, it is the second largest holding on the list after Microsoft (NASDAQ:MSFT).

2. Invesco S&P 500 Equal Weight Utilities - Exposure to Utility Stocks

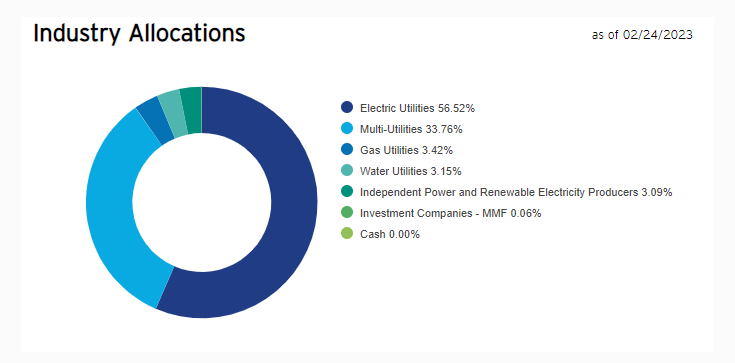

The utilities sector is one of the most frequently cited segments for well-defended portfolios. This is because companies that provide services such as gas or electricity tend to have a stable market position and customer base.

The Invesco S&P 500® Equal Weight Utilities ETF (NYSE:RYU) fund holds mainly large US companies that are experienced in providing essential public services.

Source: www.invesco.com

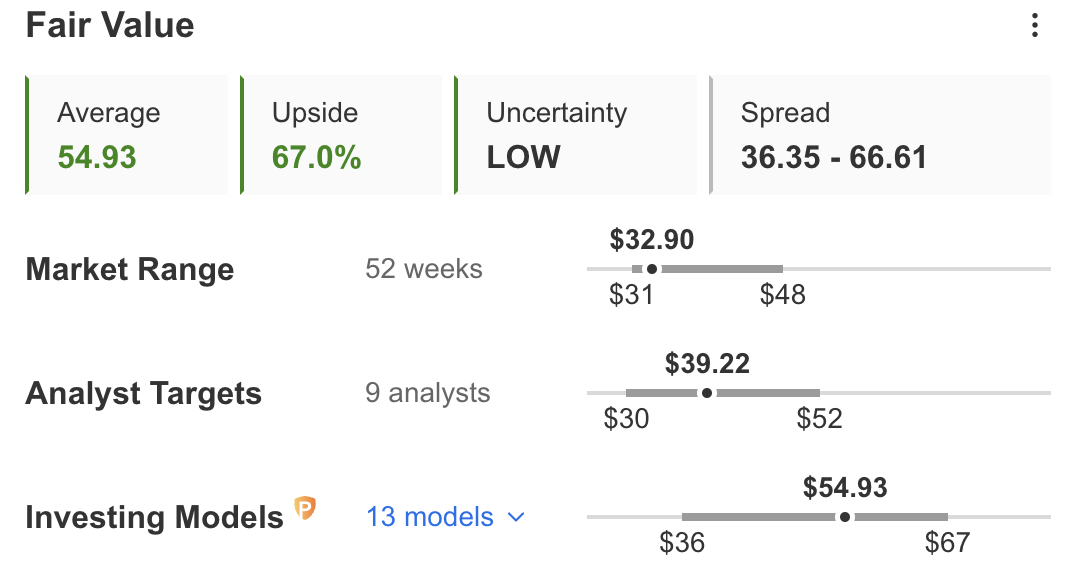

In terms of portfolio structure, the focus is on utilities. Among individual companies, NRG Energy (NYSE:NRG), which has an upside potential of 67.0%, according to the Fair Value Index, may attract attention.

Source: InvestingPro

The listed company is the second largest holding in the Invesco S&P 500 Equal Weight Utilities ETF, with a weighting of 3.62%.

3. ProShares Short S&P500

You can also benefit from ProShares Short S&P500 ETF (NYSE:SH), a fund designed to profit when the S&P 500 falls. The fund's characteristics are evident when you look at the price action. There has been a clear upward momentum since the beginning of February.

Like the main benchmark, the ETF has the technical potential to move south. The next target for buyers appears to be a strong resistance level in the 16.30 area.

It is important to remember the adage that bulls take the stairs up and bears take the lift down, so we should consider a somewhat shorter timeframe when deciding on a bearish exposure.

Disclosure: The author does not own any of the securities mentioned.