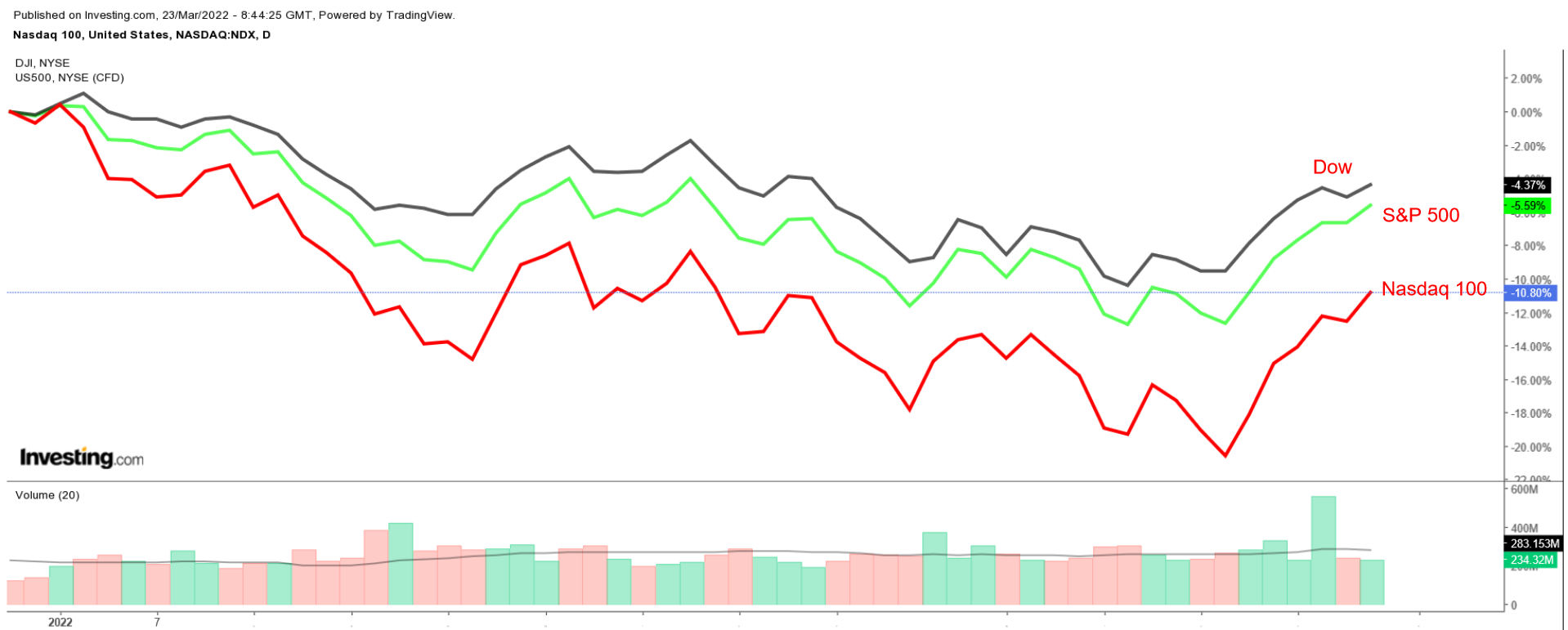

High-growth technology stocks have endured a rough start in 2022. Amid rising Treasury yields, accompanied by talk of, and now the start of, interest rate hikes from an increasingly hawkish Fed, formerly frothy tech shares have been sold off sharply.

In general, higher yields and expectations of more aggressive Fed monetary policy tend to weigh heavily on high-growth tech stocks with lofty valuations, as it threatens to erode the value of their longer-term cash flows. The NASDAQ 100, which tracks the 100 largest companies listed on the tech-heavy NASDAQ Composite, is down 10.2% year-to-date, trailing the comparable returns of both the Dow Jones Industrial Average and the S&P 500.

That said, last week saw the three major averages notch their best week since November 2020, boosted largely by growth stocks.

Below, we highlight three beaten-down tech companies to consider as investors rotate back into the sector. All three still have plenty of room to grow their respective businesses, making them solid long-term investments.

1. Snowflake

- Year-To-Date Performance: -33.6%

- Percentage From ATH: -47.5%

- Market Cap: $68.9 Billion

Snowflake Inc. (NYSE:SNOW)—whose data warehouse software helps companies manage and store vast amounts of information—has endured some turbulence lately as worries over the Federal Reserve’s plans to tighten monetary policy sparked a rout in many top-rated technology stocks.

Shares of the cloud-based data storage and analytics provider, which sank to an all-time low of $164.29 on Mar. 15, are down 33.6% year-to-date due to the broad-based selloff in the tech sector. SNOW ended Tuesday’s session at $224.96, about 47.5% away from its record peak of $428.68 reached in December 2020. At current levels, the San Mateo, California-based cloud data warehousing specialist has a market cap of $68.9 billion.

Despite recent volatility, we expect shares of the software-as-a-service (SaaS) company to bounce back in the weeks ahead, given the robust demand from large enterprises for its data analytics and management tools as the work-from-home environment continues.

Snowflake, which counts nearly half of the Fortune 500 companies as clients, reported fourth quarter financial results which blew past Wall Street estimates on Mar. 2. Revenue soared 101.5% year-over-year to $383.7 million, marking the highest quarterly sales total in its history.

The SaaS company said it had 5,944 customers as of the end of Q4, rising 44% from the year-ago period. Even more impressive, Snowflake said it had 184 customers with annual recurring revenue (ARR) of $1 million or more, up a whopping 139% from 77 customers reported in the same quarter last year.

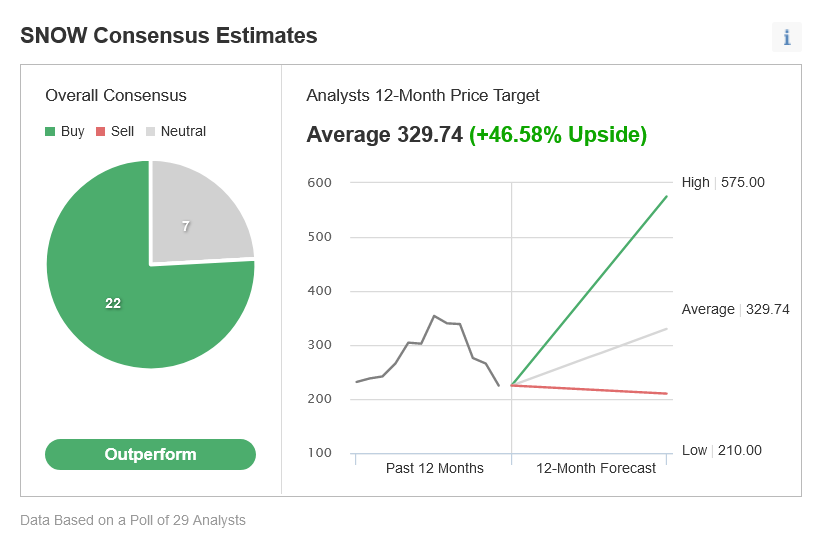

Not surprisingly, 22 out of 29 analysts surveyed by Investing.com rate SNOW stock as "Outperform," implying an almost 47% upside from current levels to $329.74/share.

Source: Investing.com

2. Etsy

- Year-To-Date Performance: -32.3%

- Percentage From ATH: -51.8%

- Market Cap: $18.8 Billion

With investors increasingly turning away from high-growth tech stocks that are most sensitive to rising interest rates due to their frothy valuations, Etsy (NASDAQ:ETSY) has struggled mightily in recent months.

After scoring sizable gains of 301% and 23%, respectively, during the COVID outbreak in 2020 and 2021, Etsy—which provides an online e-commerce platform for handmade and vintage goods—has seen its stock decline about 32% year-to-date as fears over rising rates triggered an exodus from the tech sector.

ETSY closed at $148.25 last night, nearly 52% below its record peak of $307.75 touched in November 2021. At current valuations, the Brooklyn, New York-based internet retail company has a market cap of $18.8 billion.

In our view, Etsy shares seem poised to recover from their recent selloff and resume their march higher in the near term as people around the world flock to its online marketplace platform amid the current inflationary environment.

In a sign of how well Etsy’s business has performed in recent months, the company reported fourth quarter financial results that easily beat Wall Street’s profit and revenue estimates on Feb. 24.

Among highlights in the quarter, Etsy’s number of active buyers rose 17.6% year-over-year to 96.3 million. It also saw a spike in the number of merchants on its platform, with active sellers jumping 72% from a year earlier to 7.5 million.

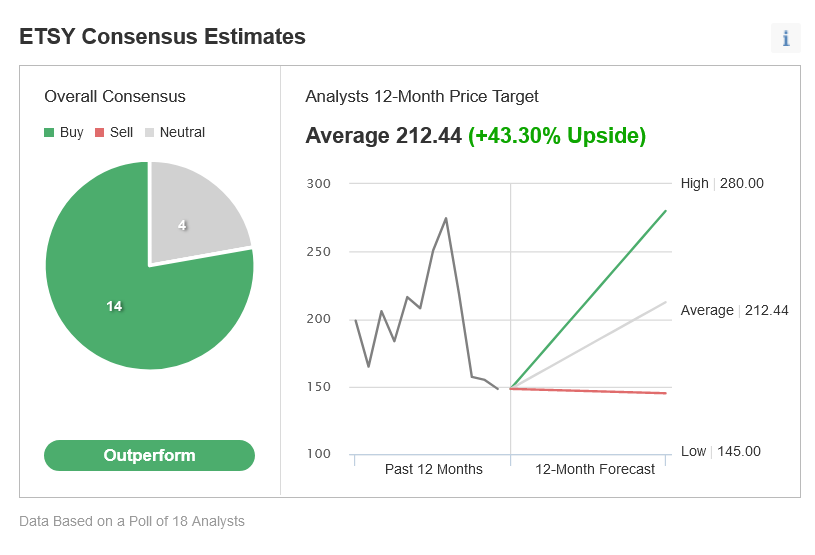

Additionally, gross merchandise sales (GMS) per active seller, which is a key metric used in the e-commerce sector to measure transaction values, increased 16% to reach an all-time high of $136. Indeed, 14 out of the 18 analysts surveyed by Investing.com are optimistic on ETSY stock, forecasting a gain of around 43% over the next 12 months to $212.44/share.

Source: Investing.com

3. Unity Software

- Year-To-Date Performance: -31.9%

- Percentage From ATH: -53.6%

- Market Cap: $28.6 Billion

Unity Software Inc. (NYSE:U) provides a cross-platform game engine used to create video games for desktop, mobile, console, and virtual reality (VR) devices. It, too, has suffered a challenging start to 2022 as the former market darling fell out of favor with investors.

Shares of the San Francisco, California-based tech company, which recently plunged to their lowest level since making their trading debut in September 2020, have lost roughly 32% so far this year as a result of the aggressive reset in valuations across the frothy tech space.

Shares of U—which settled at $97.40 yesterday—are currently trading about 54% below the all-time peak of $198.71 reached in November 2021, earning the video game design and animation software developer a market cap of $28.6 billion.

Despite the recent pullback, we believe that Unity still looks like a good bet going forward, thanks in large part to the strong demand it has seen for its video game and digital content creation platform. It is also set to benefit from its growing involvement in the emerging metaverse, which is viewed as the next-generation version of the internet.

Unity delivered blowout financial results in its sixth quarterly report as a public company on Feb. 3, prompting it to raise its full-year sales guidance. The company reported an adjusted loss of $0.05 per share, narrowing substantially from a loss of $0.10 per share in the year-ago period. Revenue of $315.8 million was up 43% year-over-year, topping expectations for sales of $295.5 million.

The number of customers spending $100,000 or more on Unity’s platform rose to 1,052 in Q4, up 33% from 793 a year ago. For full-year 2022, Unity forecast revenue of about $1.5 billion, which would represent annualized growth of 35%. It expects to break even during 2023.

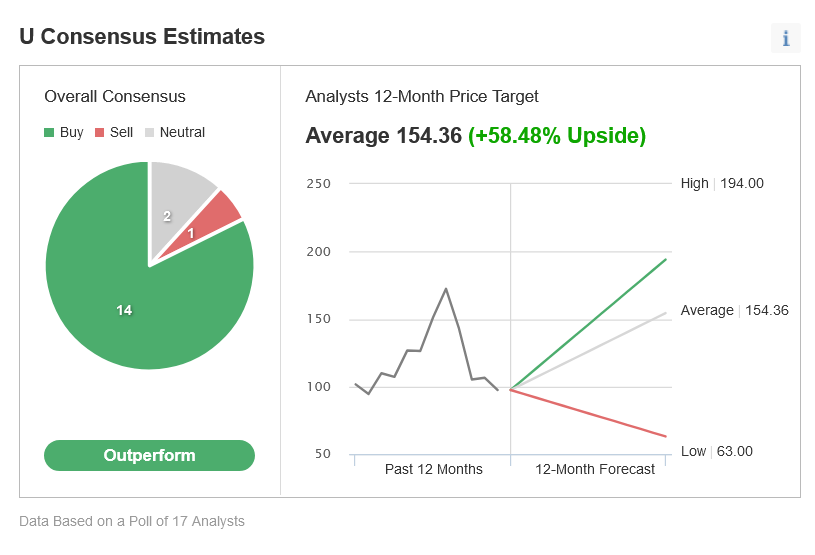

According to Investing.com, among 17 analysts polled, 14 rated U stock 'outperform'. The average analyst price target for shares is around $154, representing an upside of approximately 58% from current levels over the next 12 months.

Source: Investing.com