- The recent rally on Wall Street is taking a breather amid uncertainty over the Federal Reserve’s outlook for interest rates

- As such, I used the InvestingPro stock screener to search for undervalued stocks that have potential ‘Fair Value’ upside of at least 25%

- Don't miss out on the InvestingPro Summer Sale: Explore incredible discounts on our subscription plans!

- CVS Health (NYSE:CVS): InvestingPro Fair Value Upside: +54.7%

- Marathon Petroleum (NYSE:MPC): InvestingPro Fair Value Upside: +54.4%

- LyondellBasell Industries (NYSE:LYB): InvestingPro Fair Value Upside: +48.8%

- Cigna (NYSE:CI): InvestingPro Fair Value Upside: +43%

- Phillips 66 (NYSE:PSX): InvestingPro Fair Value Upside: +41.8%

- Hartford Financial (NYSE:HIG): InvestingPro Fair Value Upside: +39.7%

- Pfizer (NYSE:PFE): InvestingPro Fair Value Upside: +39.3%

- Kroger (NYSE:KR): InvestingPro Fair Value Upside: +38.7%

- Altria (NYSE:MO): InvestingPro Fair Value Upside: +33.7%

- Cognizant (NASDAQ:CTSH): InvestingPro Fair Value Upside: +32%

- Centene (NYSE:CNC): InvestingPro Fair Value Upside: +31.1%

- Lennar (NYSE:LEN): InvestingPro Fair Value Upside: +31%

- Elevance Health (NYSE:ELV): InvestingPro Fair Value Upside: +30.4%

- Valero Energy (NYSE:VLO): InvestingPro Fair Value Upside: +29.7%

- American International Group (NYSE:AIG): InvestingPro Fair Value Upside: +29.6%

- McKesson (NYSE:MCK): InvestingPro Fair Value Upside: +28.9%

- PNC Financial (NYSE:PNC) Services: InvestingPro Fair Value Upside: +28.8%

- Albemarle (NYSE:ALB): InvestingPro Fair Value Upside: +27.8%

- Devon Energy (NYSE:DVN): InvestingPro Fair Value Upside: +26.4%

- Exxon Mobil (NYSE:XOM): InvestingPro Fair Value Upside: +26.2%

- Monthly: Save 20% and gain the flexibility to invest on a month-to-month basis.

- Yearly: Save a jaw-dropping 50% and secure your financial future with a full year of InvestingPro at an unbeatable price.

- Bi-Yearly: Save an astonishing 52% and maximize your returns with our exclusive web offer.

The rally in U.S. stocks has appeared to falter, with the S&P 500 and the Nasdaq falling from recent highs amid growing uncertainty over the Federal Reserve’s outlook for interest rates.

After raising rates by 500 basis points since March 2022, the Fed left borrowing costs unchanged earlier this month, but signaled that rate hikes could resume in July.

Financial markets now look to Fed Chair Jerome Powell's two-day testimony before Congress, starting with the U.S. House Financial Services Committee on Wednesday, which will be scrutinized for clues regarding how the central bank views inflation and monetary policy.

As we grapple with fresh uncertainty surrounding the Fed's rate plans, identifying undervalued stocks becomes paramount as investors find themselves seeking stability and potential opportunities.

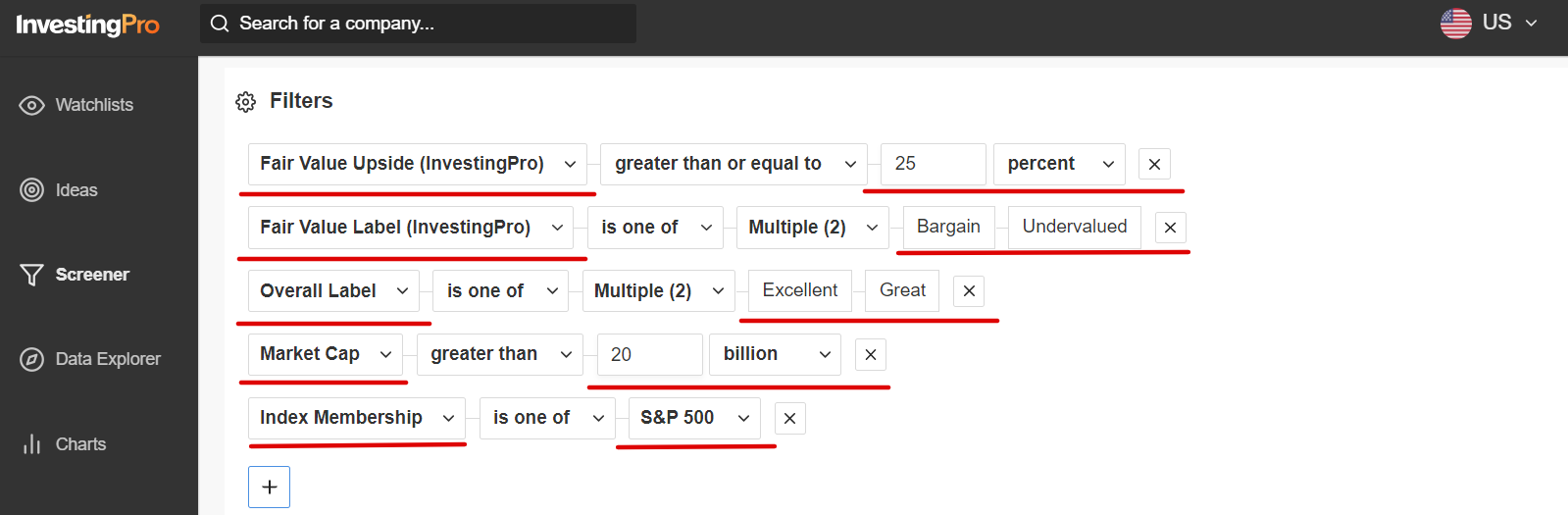

Amid the current backdrop, I used the InvestingPro stock screener to identify the best undervalued stocks that have the potential to weather market turbulence and provide attractive investment returns.

InvestingPro's stock screener is a powerful tool that can assist investors in identifying cheap stocks with strong potential upside. By utilizing this tool, investors can filter through a vast universe of stocks based on specific criteria and parameters.

To identify undervalued stocks, I first filtered for names with an InvestingPro ‘Fair Value’ upside greater than or equal to 25%. The Fair Value estimate is determined according to several valuation models, including price-to-earnings (P/E) ratios, price-to-sales (P/S) ratios, and price-to-book (P/B) multiples.

I then scanned for stocks with an InvestingPro ‘Fair Value’ Label of either ‘Bargain’, or ‘Undervalued’ and an InvestingPro ‘Health’ Label of ‘Excellent’, or ‘Great’.

Source: InvestingPro

And those companies with a market cap of $20 billion and above made my watchlist.

Once the criteria were applied, I was left with a total of 20 companies. These stocks all offer compelling valuations, strong fundamentals, and the potential for long-term growth, providing investors with a diversified selection to consider during uncertain times.

These 20 Stocks Have At Least 25% Upside Potential According to InvestingPro:

Among the S&P 500, here are the top 20 stocks that are expected to rise the most over the next 12 months, based on InvestingPro ‘Fair Value’ price targets.

Source: InvestingPro

Source: InvestingPro

The InvestingPro stock screener empowers investors to make informed decisions by providing a comprehensive analysis of undervalued stocks with the potential for significant upside in the market, saving you substantial time and effort.

As part of the InvestingPro Summer Sale, you can now enjoy incredible discounts on our subscription plans for a limited time:

Don't miss out on this limited-time opportunity to access cutting-edge tools, real-time market analysis, and expert insights. Join InvestingPro today and unlock your investing potential. Hurry, the Summer Sale won't last forever!

Disclosure: At the time of writing, I am short on the Dow, S&P 500, and Russell 2000 via the ProShares UltraPro Short Dow 30 ETF (SDOW), ProShares Short S&P 500 ETF (SH) and ProShares Short Russell 2000 ETF (RWM). I also have a position in the ProShares UltraShort 20+ Year Treasury ETF (NYSE:TBT).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials. The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.