Wall Street's first quarter earnings season kicks off this week, with banking behemoths JPMorgan Chase (NYSE:JPM), Bank of America (NYSE:BAC), Wells Fargo (NYSE:WFC), Citigroup (NYSE:C), Morgan Stanley (NYSE:MS), and Goldman Sachs (NYSE:GS) all set to report their latest financial results.

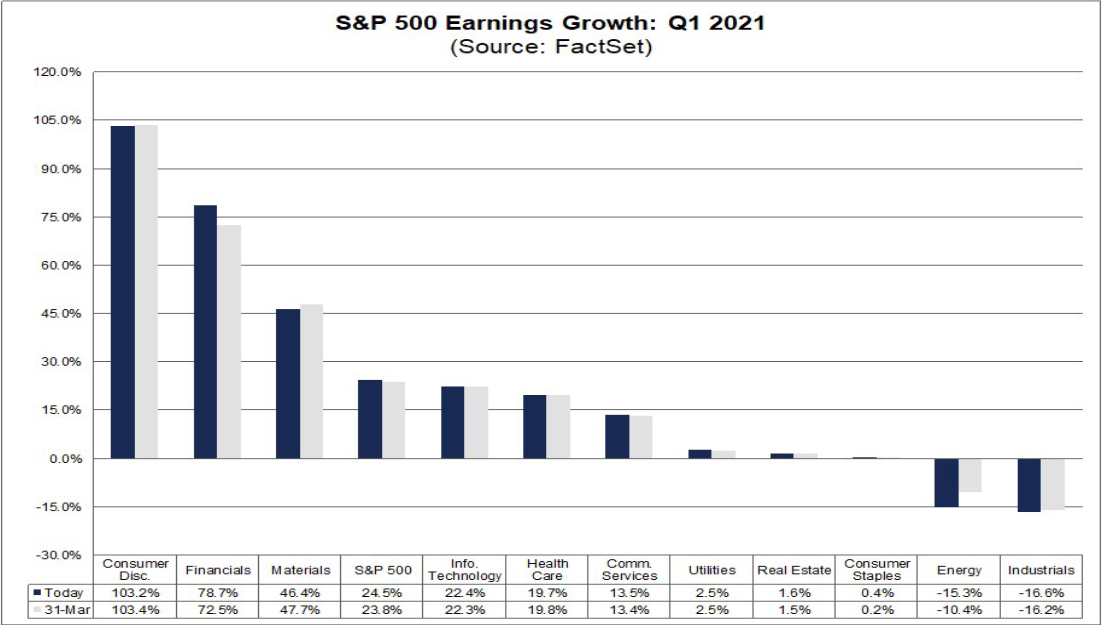

FactSet data shows analysts anticipate Q1 S&P 500 earnings will surge by 24.5% when compared to the same period last year, mainly due to the receding impact of the COVID-19 health crisis on several industries.

If confirmed, Q1 2021 would mark the highest year-over-year (Y-o-Y) growth in earnings reported by the index since Q3 2018, when tax cuts under former President Donald Trump drove a surge in profit growth.

At the sector level, nine are projected to report Y-o-Y earnings growth, led by the Consumer Discretionary, Financials, and Materials sectors. On the other hand, two are predicted to report a decline in earnings from the year-ago period, led by the Industrial and Energy sectors.

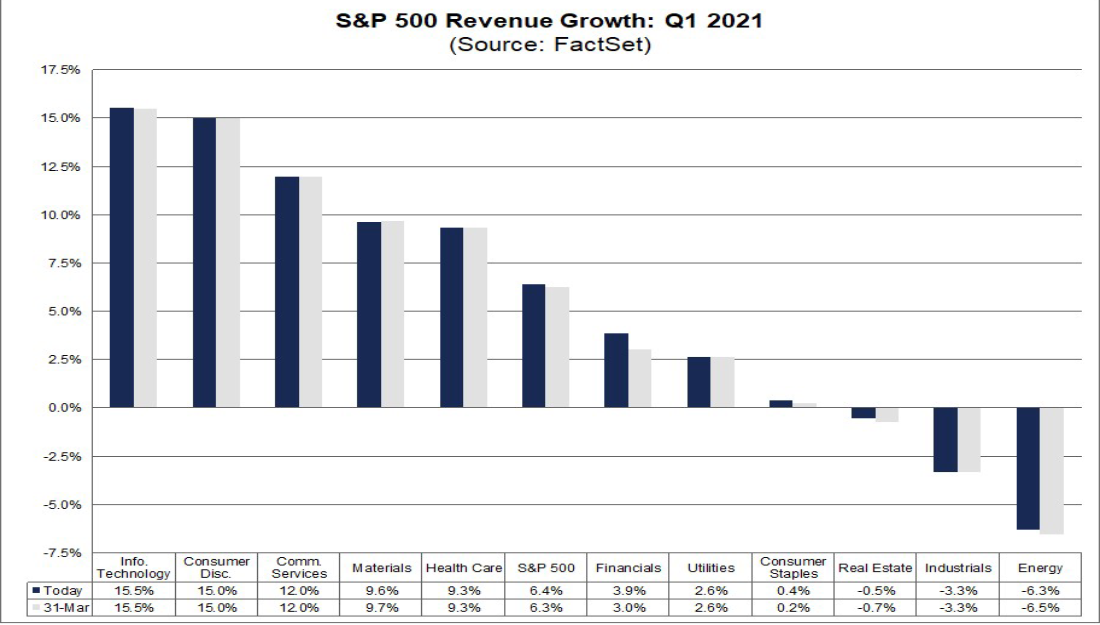

Revenue expectations are also encouraging, with sales growth predicted to rise 6.4% from the same period a year earlier. If confirmed, it will mark the highest Y-o-Y revenue growth reported by the index since Q4 2018.

Eight sectors are anticipated to report Y-o-Y revenue growth, led by the Information Technology, Consumer Discretionary, and Communication Services sectors. In contrast, three are predicted to report an annualized drop in sales growth, led once again by the Energy and Industrials sectors.

Below we break down two sectors whose financial results are projected to show significant improvement from the year-ago period and one sector whose earnings are expected to take the deepest dive amid the current market conditions.

2 Sectors To Buy

1. Consumer Discretionary: Reopening Enthusiasm Set To Boost Results

- Projected Q1 EPS Growth: +103.2% YoY

- Projected Q1 Revenue Growth: +15.0% YoY

The Consumer Discretionary sector—which was hit hard by COVID-related shutdowns a year ago—is expected to report the biggest Y-o-Y gain in earnings of all 11 sectors, with an impressive 103.2% surge in first quarter EPS, according to FactSet.

Nine of the 10 sub-industries in the sector are forecast to post double-digit earnings growth, led by automakers and luxury goods retailers, which are forecast to see their collective EPS surge 1,116% and 484% respectively from a year ago.

The sector, which is perhaps the most sensitive to economic conditions and consumer spending, is also expected to report the second largest Y-o-Y revenue growth of all 11 sectors, with Q1 sales set to rise 15.0%.

Six of the 10 industries in the sector are projected to enjoy double-digit gains, led by Internet and Direct Marketing Retail stocks, which are expected to see their collective EPS jump 38% from a year ago.

Indeed, the Consumer Discretionary Select Sector SPDR® Fund (NYSE:XLY)—which tracks a market-cap-weighted index of consumer-discretionary stocks drawn from the S&P 500—is up roughly 11% since the start of the year, reaching a series of record highs in recent sessions.

Its ten biggest holdings include Amazon (NASDAQ:AMZN), Tesla (NASDAQ:TSLA), Home Depot (NYSE:HD), McDonald’s (NYSE:MCD), Nike (NYSE:NKE), Starbucks (NASDAQ:SBUX), Lowe’s (NYSE:LOW), Booking Holdings (NASDAQ:BKNG), Target (NYSE:TGT), and TJX Companies (NYSE:TJX).

2. Materials: Higher Commodity Prices Set to Drive Profit, Sales Growth

- Projected Q1 EPS Growth: +46.4% YoY

- Projected Q1 Revenue Growth: +9.6% YoY

The Materials sector is forecast to print the third largest Y-o-Y earnings jump of all 11 sectors, with first quarter EPS anticipated to rise 46.4% from the year-ago period, according to FactSet.

With stronger prices of metals such as gold, silver, and copper, benefitting the sector, it is also expected to report the fourth biggest Y-o-Y increase in revenue, with sales expected to grow almost 10%.

Not surprisingly, all four industries in this sector are predicted to report explosive Q1 revenue growth, with the SPDR® S&P Metals and Mining ETF (NYSE:XME) group set to see a Y-o-Y sales spike of 501%.

Two companies from the group stand out for their potential to record impressive results. The first is Nucor (NYSE:NUE), which is expected to report earnings per share of $3.07, compared to EPS of $0.99 in the year-ago period. The second is CF Industries (NYSE:CF), which is projected to report EPS of $0.58, compared to EPS of $0.33 in the same period a year earlier.

The Materials Select Sector SPDR® Fund (NYSE:XLB)—which tracks a market-cap-weighted index of U.S. basic materials companies in the S&P 500—witnessed the fourth-largest increase in price of all 11 sectors during the first three months of 2021, climbing 8.8%.

Its 10 largest stock holdings include Linde (NYSE:LIN), Air Products & Chemicals (NYSE:APD), Sherwin-Williams (NYSE:SHW), Ecolab (NYSE:ECL), Freeport-McMoRan (NYSE:FCX), Newmont Mining (NYSE:NEM), Dow Chemical (NYSE:DOW), DuPont de Nemours (NYSE:DD), International Flavors & Fragrances (NYSE:IFF), and Corteva (NYSE:CTVA).

1 Sector To Avoid

Industrials: Airlines Expected to Lead Y-o-Y Drop

- Projected Q1 EPS Decline: -16.6% YoY

- Projected Q4 Revenue Decline: -3.3% YoY

Industrials are projected to report the highest Y-o-Y earnings slump of all 11 sectors, with EPS for the group set to tumble 16.6%, per FactSet. Of the 12 industries in the sector, four are expected to report a decline in earnings, led by airlines.

The Industrials sector is also anticipated to report the second largest Y-o-Y decline in revenue, with a projected decrease of 3.3%. The airline industry is once again forecast to be the largest contributor to the annualized decline in revenue for the sector, with a drop of 54%, as it continues to deal with the negative impact of the ongoing coronavirus health crisis.

At the company level, Delta Air Lines (NYSE:DAL), American Airlines (NASDAQ:AAL) and United Airlines (NASDAQ:UAL) are predicted to be the largest contributors to the decline in earnings for the group. Losses anticipated are from -$0.51 to -$2.84 for Delta, from -$2.65 to -$3.89 for American, and from -$2.57 to -$6.82 for United.

Despite the expected slump in earnings and revenue, this sector has enjoyed an increase in price of 11% during the quarter, the third best performance of all 11 sectors.

In fact, the sector’s main exchange traded fund—the Industrial Select Sector SPDR® Fund (NYSE:XLI)—is trading near its highest level on record, climbing above the $100 level for the first time in history earlier this week.

Its top 10 holdings include Honeywell International (NYSE:HON), Union Pacific (NYSE:UNP), Caterpillar (NYSE:CAT), United Parcel Service (NYSE:UPS), Boeing (NYSE:BA), General Electric (NYSE:GE), Deere (NYSE:DE), Raytheon (NYSE:RTN), 3M (NYSE:MMM), and Lockheed Martin (NYSE:LMT).

Which stock should you buy in your very next trade?

With valuations skyrocketing in 2024, many investors are uneasy putting more money into stocks. Unsure where to invest next? Get access to our proven portfolios and discover high-potential opportunities.

In 2024 alone, ProPicks AI identified 2 stocks that surged over 150%, 4 additional stocks that leaped over 30%, and 3 more that climbed over 25%. That's an impressive track record.

With portfolios tailored for Dow stocks, S&P stocks, Tech stocks, and Mid Cap stocks, you can explore various wealth-building strategies.