- Growth stocks have made a remarkable comeback this year.

- The S&P 500 Growth ETF is up +12% YTD, outperforming the broader S&P 500 index.

- Using the InvestingPro stock screener, we'll identify two potential growth stocks that could rally soon.

As we already know, stocks are classified into two main categories: value and growth.

While value stocks often embody well-established enterprises with stable financials, growth stocks are young, dynamic companies. Unlike their value counterparts, growth stocks allocate their profits towards reinvestment to grow rapidly rather than distributing dividends or conducting share buybacks.

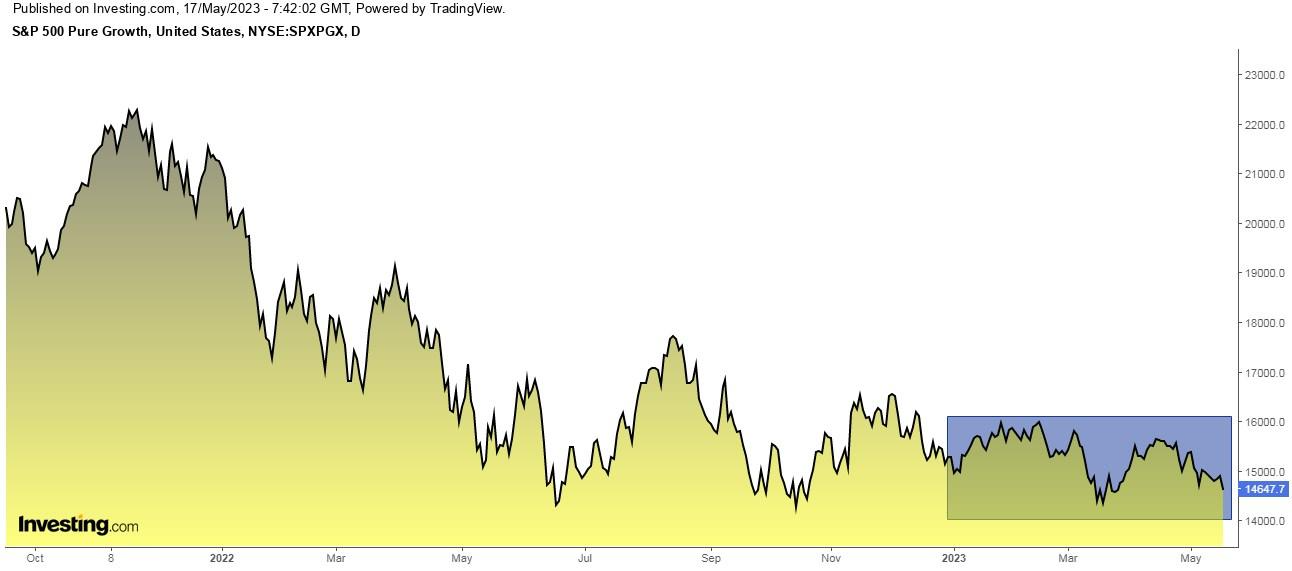

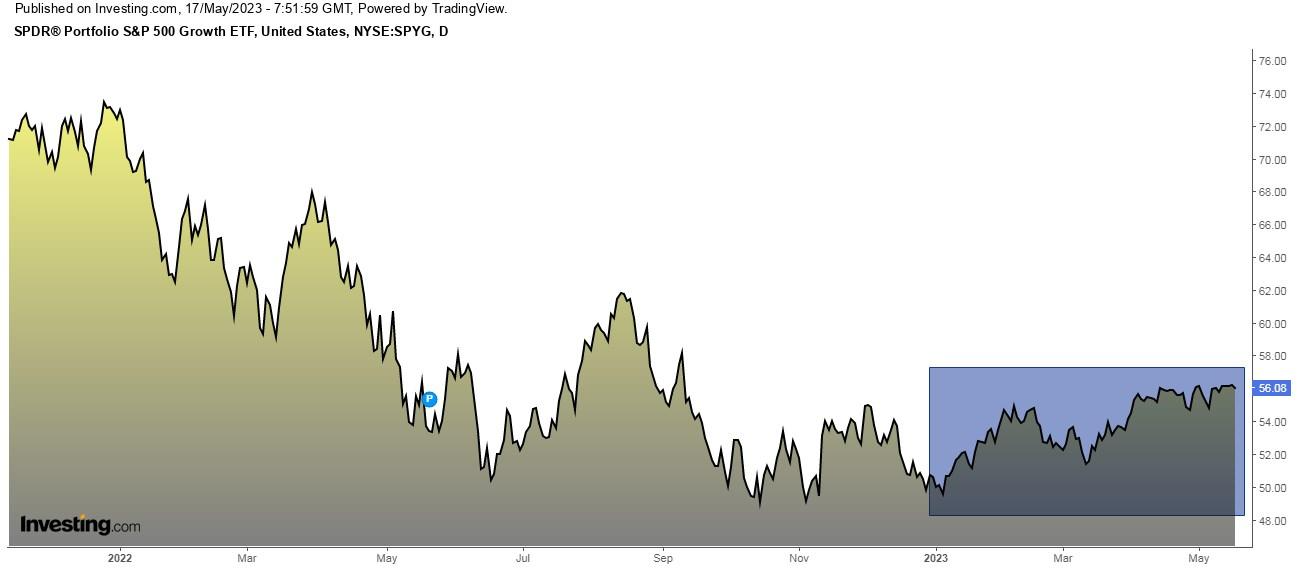

The S&P 500 Pure Growth index — which represents the performance of growth stocks — is beating the S&P 500 index by a hefty margin so far this year. Likewise, the SPDR® Portfolio S&P 500 Growth ETF (NYSE:SPYG), up 12% this year already, has also been rallying.

Likewise, the SPDR® Portfolio S&P 500 Growth ETF (NYSE:SPYG), up 12% this year already, has also been rallying.

In this article, we will leverage InvestingPro's advanced stock screener to identify two growth stocks poised to rally this year.

In this article, we will leverage InvestingPro's advanced stock screener to identify two growth stocks poised to rally this year.

1. Axon

Axon (NASDAQ:AXON) is a technology solutions provider. The company develops devices and services that help law enforcement officers de-escalate situations, prevent or minimize the use of force, and assist consumers.

These tools include TASER devices and virtual reality training. The company is headquartered in Seattle, Washington.

The company will report second quarter results on August 8.

Source: InvestingPro

As the InvestingPro tool indicates, its earnings per share are expected to increase by 16.9% to $0.63.

Source: InvestingPro

In addition, you can view the 2023/2024/2025 revenue and earnings projections on the InvestingPro tool.

Source: InvestingPro

The first quarter results, announced on May 9, revealed intriguing figures. Notably, the company's EPS (Earnings Per Share) exceeded expectations by 64.4%.

This metric measures the company's profitability by determining the portion of net income attributed to each share of its stock.

In the first quarter, EPS was 64.4% higher than expected. Revenues were 7.3% higher than expected.

Source: InvestingPro

The InvestingPro tool's news section provides the latest company updates.

Source: InvestingPro

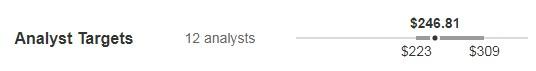

There are 13 buy ratings and 0 sell ratings for Axon. The latest to weigh in was JP Morgan, which upgraded the company to Overweight and reiterated a 12-month price target of $236.

InvestingPro, for its part, gives the stock a potential of $246.81 based on various metrics.

Source: InvestingPro

It has an Altman Z-score of 6.8 on InvestingPro. This is positive, as a score above 2.99 means that the company is healthy, solid, and unlikely to go bankrupt.

Source: InvestingPro

Its shares are up +21.26% in 2023.

From a technical perspective, a golden crossover (upward crossover of the 50 and 200 averages) occurred last November, indicating an uptrend pattern.

However, the stock has encountered resistance at $227.90 and has made multiple unsuccessful attempts to surpass it this year in March, April, and May.

2. ON Semiconductor

ON Semiconductor (NASDAQ:ON) is an American company based in Phoenix, Arizona, specializing in the design, manufacture, and marketing of semiconductor electronic components.

It presents its second quarter results on July 31.

Source: InvestingPro

According to InvestingPro, it is expected to report earnings per share of $1.21.

Source: InvestingPro

Here, we have the revenue and profit forecasts for 2023, 2024, and 2025 provided by InvestingPro.

Source: InvestingPro

The company's latest first quarter results, reported on May 1st, were interesting. Earnings per share beat analyst expectations by 9.7%, while revenue beat estimates by 1.8%.

Source: InvestingPro

In the news section, you can find the latest updates and evaluations regarding the company.

Source: InvestingPro

ON Semiconductor had 20 buy, 9 hold, and 0 sell valuations. Deutsche Bank gives it a target of $95.

Source: InvestingPro

InvestingPro gives it a potential of $92.38 based on many metrics.

It has an Altman Z-score of 6.4. This is above 2.99, meaning it is a solvent and reliable company.

Source: InvestingPro

Its shares are up +33.14% in 2023.

From a technical point of view, it has maintained its uptrend, moving within an ascending trend channel. It is very close to the resistance at $86.88.

As you saw in this article, with InvestingPro, you can conveniently access comprehensive information and outlook on a company in one place, eliminating the need to gather data from multiple sources such as SEC filings, company websites, and market reports.

In addition to analyst targets, InvestingPro provides a single-page view of complete information, saving you time and effort.

Start your InvestingPro free 7-day trial now!

***

Disclaimer: This article is written for informational purposes only; it does not constitute a solicitation, offer, advice, counseling, or investment recommendation. As such, it is not intended to incentivize the purchase of assets in any way. I want to remind you that any type of asset is evaluated from multiple points of view and is highly risky; therefore, any investment decision and the associated risk remain with the investor.