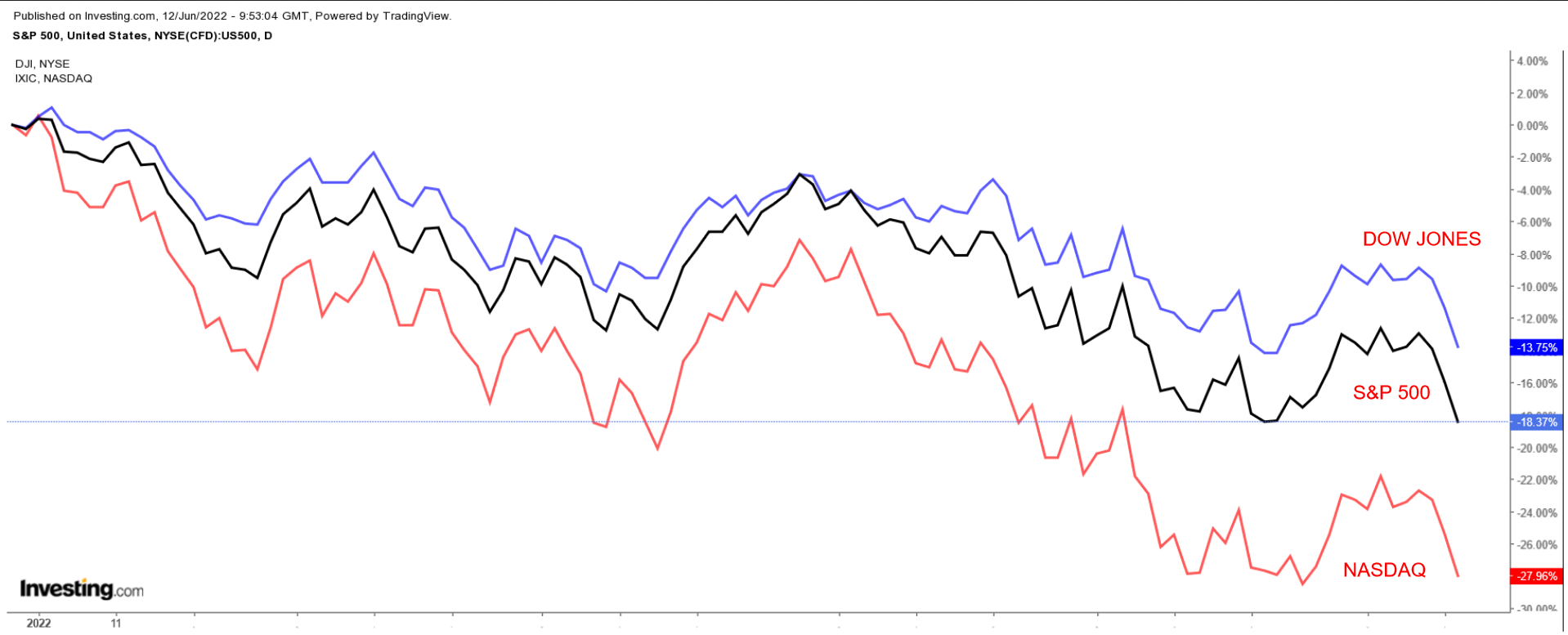

Stocks on Wall Street tumbled on Friday, with the major averages on the Dow, S&P 500, and NASDAQ suffering their biggest weekly losses since January, after scorching hot inflation data fueled fears of more aggressive interest rate hikes by the Federal Reserve, raising the risks of recession.

Year-on-year, U.S. consumer prices surged 8.6% in May, the biggest increase since 1981.

The week ahead is expected to be another eventful one as the Federal Reserve prepares to make its widely anticipated monetary policy announcement on Wednesday.

While most market participants forecast a 50-basis-point rate hike, the odds for a larger 75-point move jumped following Friday’s hot CPI report.

Besides the Fed, this week’s economic calendar consists of important producer price inflation data, as well as the latest reports on retail sales and housing starts.

Meanwhile, on the earnings docket, there are just a handful of corporate results due, including Oracle (NYSE:ORCL), Adobe (NASDAQ:ADBE), and Kroger (NYSE:KR).

Regardless of which direction the market goes, below we highlight one stock likely to be in demand and another which could see further downside.

Remember though, our timeframe is just for the upcoming week.

Stock To Buy: Exxon Mobil

Oil and gas supermajor Exxon Mobil (NYSE:XOM), which saw its shares reach a new all-time high last week, could see further gains in the days ahead as investors continue to pile into the thriving energy sector amid the furious rally in oil and gas prices.

Crude futures enjoyed their seventh straight weekly gain last week, with U.S. WTI and the global Brent benchmark both climbing above $120 a barrel, on the back of lingering fears of a potential disruption in supplies in Europe and the Middle East.

Shares of XOM have gotten off to one of their best starts to a year in history, surging to a fresh record peak of $105.57 on Wednesday; they ended Friday’s session at $100.46.

At current levels, the Irving, Texas-based oil-and-gas behemoth has a market cap of roughly $423.2 billion, making it one of the world’s largest energy companies.

Year-to-date, Exxon shares have soared 64.2%, easily outperforming the S&P 500’s roughly 18% decline over the same timeframe, as the energy giant benefits from strong commodity prices, improving global demand, and streamlined operations.

Investors have also been encouraged by Exxon’s continuous efforts to return more cash to shareholders in the form of increased stock buybacks and higher dividend payouts. Exxon currently pays a quarterly dividend of $0.88 a share, providing an annual yield of about 3.50%.

U.S. President Joe Biden on Friday blamed the U.S. oil industry, and Exxon Mobil specifically, for exploiting the current supply shortage to boost profits.

Speaking after a report showed inflation accelerating to a new 40-year high in May, Biden said Exxon has “made more money than God” this year and accused it of using higher profits to buy back its stock instead of increasing output.

"Why aren't they drilling? Because they make more money not producing more oil. Exxon, start investing and start paying your taxes."

Exxon pushed back at the President’s comments, noting that it paid $40.6 billion in taxes in 2021, an increase of $17.8 billion from 2020, when it suffered massive losses of more than $20 billion amid falling oil prices and weak worldwide demand.

Stock To Dump: Robinhood Markets

There's another challenging week ahead for retail trading platform Robinhood Markets (NASDAQ:HOOD), whose stock—which sank to its lowest level on record on Friday—faces investors' fretting over the negative impact of several factors plaguing the struggling retail brokerage firm.

The latest negative news came after Securities and Exchange Commission (SEC) chair Gary Gensler unveiled plans last week aimed at making the U.S. stock market more transparent.

In what would be one of the most substantial changes, Gensler floated the idea of creating an order-by-order auction mechanism intended to help retail investors obtain the best pricing for their orders.

If enacted, Gensler’s sweeping measures to overhaul the current market structure could directly impact how brokerage firms earn revenue when processing retail trade orders.

Robinhood previously warned that any potential SEC intervention in a payment arrangement between brokerages and trading firms—known as ‘payment-for-order-flow’ (PFOF)—could pose key risks to its business model.

The practice, in which brokerage firms receive compensation for directing customers’ stock orders to different market makers for trade execution, accounts for a significant stream of Robinhood’s revenue.

HOOD closed at a new all-time low of $7.81 on Friday. At current levels, the Menlo Park, California-based fintech company has a market cap of $6.8 billion.

Year-to-date, Robinhood stock has lost approximately 56% as the Fed’s plans to aggressively tighten monetary policy triggered a months-long selloff in shares of unprofitable technology companies with sky-high valuations.

Even more alarming, shares of the online trading platform are a whopping 90% below their record peak of $84.12 touched in August 2021.

In general, expectations of more hawkish Fed policy tend to weigh heavily on high-growth tech stocks with lofty valuations, as it threatens to erode the value of their longer-term cash flows.

Taking that into account, shares of the beleaguered stock-and-crypto trading app will likely remain vulnerable to sharp swings in the days ahead.