- Fed speakers and Nvidia earnings will be in focus this week.

- Nvidia is a buy with another huge beat-and-raise quarter on deck.

- Target is a sell amid declining sales, downbeat outlook expected.

- Looking for actionable trade ideas to navigate the current market volatility? Join InvestingPro for just 60 cents a day!

- Fair Value: Instantly find out if a stock is underpriced or overvalued.

- ProPicks: AI-selected stock winners with proven track record.

- ProTips: Digestible, bite-sized insight to simplify complex financial data.

- Stock Screener: Search for the best stocks based on hundreds of selected filters, and criteria.

- Top Ideas: See what stocks billionaire investors such as Warren Buffett, Ray Dalio, Michael Burry, and George Soros are buying.

U.S. stocks finished mostly higher on Friday, with the Dow Jones Industrial Average ending above the key 40,000 level for the first time in history on growing expectations of Fed rate cuts this year.

All three indices were up for the week, with the blue-chip Dow climbing 1.2% to notch its fifth straight weekly gain. The S&P 500 and tech-heavy Nasdaq rose 1.5% and 2.1%, clinching their fourth weekly advance in a row.

Source: Investing.com

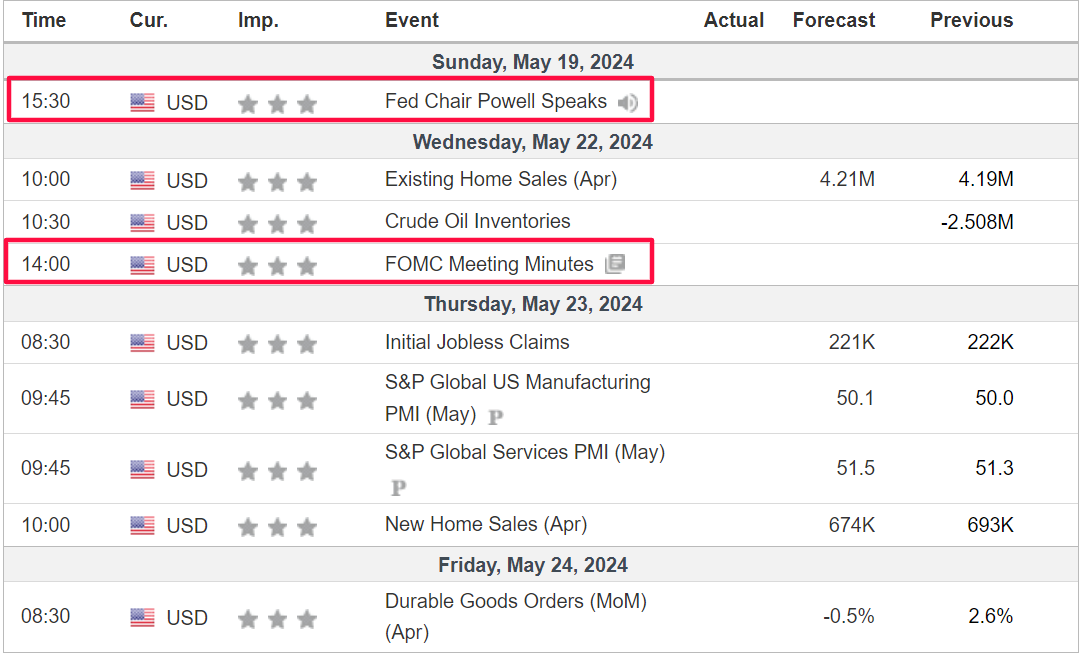

The week ahead is expected to be another eventful one as investors continue to look for more cues on the prospects for potential rate cuts.

On the economic calendar, most important will be the minutes of the Federal Reserve’s latest FOMC policy meeting, due on Wednesday.

That will be accompanied by a heavy slate of Fed speakers, with the likes of district governors Raphael Bostic, Christopher Waller, Loretta Mester, Thomas Barkin, and John Williams all set to make public appearances.

Meanwhile, Fed Chair Jerome Powell is due to deliver a commencement speech at the Georgetown Law Commencement ceremony on Sunday afternoon.

Source: Investing.com

Financial markets currently see a 65% chance of the first interest-rate cut happening in September, according to the Investing.com Fed Monitor Tool.

Elsewhere, in corporate earnings, Nvidia (NASDAQ:NVDA)'s results will be the key update of the week as the Q1 reporting season quiets down. Other notable names lined up to report earnings include Palo Alto Networks (NASDAQ:PANW), Zoom Video (NASDAQ:ZM), Target (NYSE:TGT), TJX Companies (NYSE:TJX), Macy’s (NYSE:M), Ross Stores (NASDAQ:ROST), Lowe’s (NYSE:LOW), Deckers Outdoor (NYSE:DECK), and Toll Brothers (NYSE:TOL).

Regardless of which direction the market goes, below I highlight one stock likely to be in demand and another which could see fresh downside. Remember though, my timeframe is just for the week ahead, Monday, May 20 - Friday, May 24.

Stock to Buy: Nvidia

I expect Nvidia to outperform this week, possibly culminating in a breakout and a push towards new record highs, as the tech darling prepares to deliver another beat-and-raise quarterly earnings report amid surging demand for its AI chips.

The Santa Clara, California-based chip giant is scheduled to release its Q1 update after the closing bell on Wednesday at 4:20PM ET, and it is expected to shatter its sales record once again as growth prospects in artificial intelligence remain strong. A call with CEO Jensen Huang is set for 5:00PM ET.

Market participants expect a sizable swing in NVDA shares following the print, as per the options market, with a possible implied move of around 9% in either direction. Notably, shares soared 13% after its last earnings report in February.

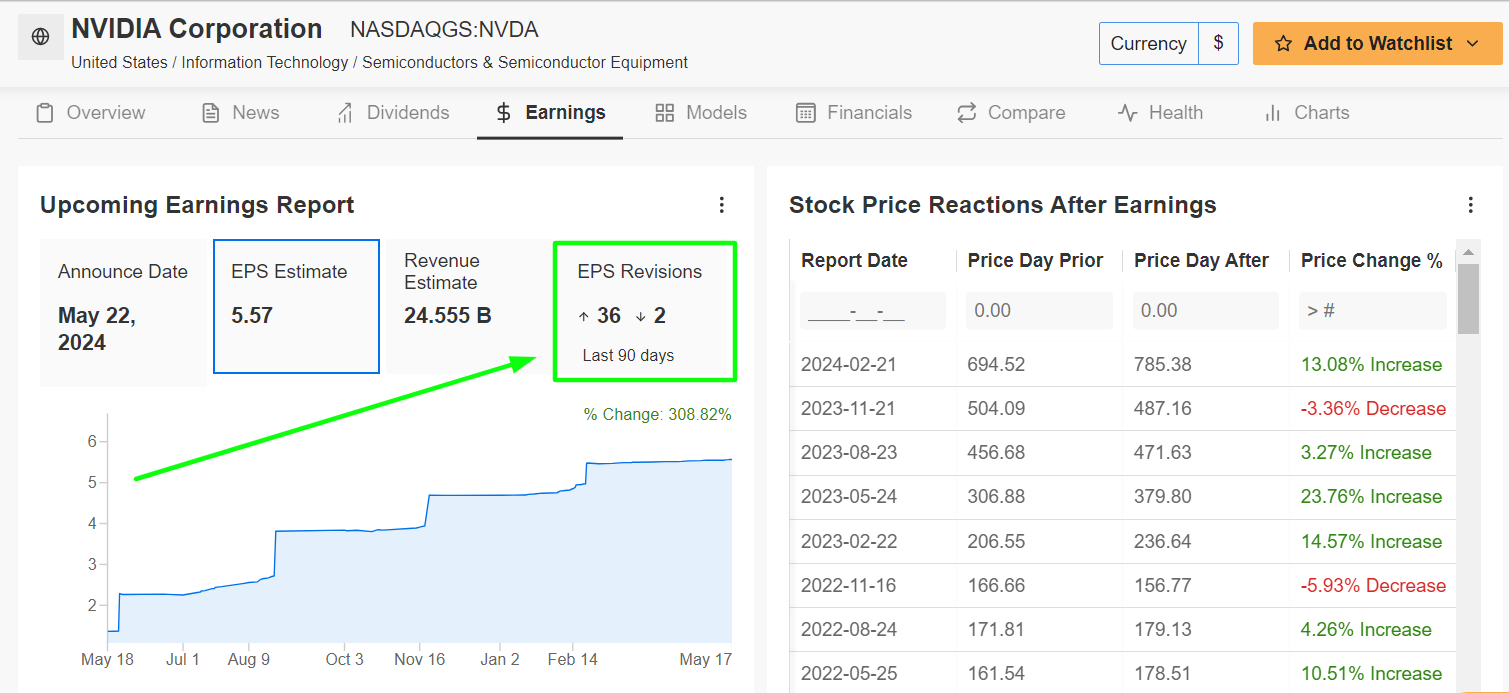

As could be expected, an InvestingPro survey of analyst earnings revisions points to surging optimism ahead of the print amid the rapid shift into accelerated computing and generative AI. Profit estimates have been revised upward 36 times in the last 90 days, compared to just two downward revisions.

Source: InvestingPro

Consensus expectations call for Nvidia to post earnings per share of $5.57 for the first quarter, jumping 412% from EPS of $1.09 in the year-ago period. If that is in fact reality, it would mark Nvidia’s most profitable quarter in its history.

Meanwhile, revenue is forecast to skyrocket 241% year-over-year to $24.55 billion, as the tech leader benefits from soaring demand for its A100 and H100 AI chips, which have become a standard in AI development.

If that is in fact confirmed, it would mark Nvidia’s fourth straight quarter of triple-digit percentage growth in sales and earnings.

But as is usually the case, investors will key in on its outlook for the current quarter and beyond. As such, I believe chief executive Jensen Huang will provide better than expected profit and sales guidance thanks to strong demand for its graphics processors used to run AI applications.

NVDA stock ended Friday’s session at $924.79, just below its record high of $974 reached on March 8. At current levels, Nvidia has a market cap of $2.3 trillion, making it the third most valuable company trading on the U.S. stock exchange.

Source: Investing.com

Shares are up a whopping 86.7% in 2024, making Nvidia one of the top-performing S&P 500 stocks of the year, thanks to ongoing AI-related buzz.

It is worth mentioning that Nvidia’s ‘Financial Health Score’, as assessed by InvestingPro's AI-backed models, reflects its excellent financial position and promising growth trajectory. Pro also underscores Nvidia's anticipated substantial surge in free cash flow due to its high operating margins.

Stock to Sell: Target

I believe Target will suffer a difficult week ahead, as the big-box retailer’s latest earnings and guidance will underwhelm investors due to a difficult operating environment, competitive landscape, and ongoing discounting activity.

Target’s financial results for the first quarter are due ahead of the opening bell on Wednesday at 6:30AM ET and are likely to take a hit from slowing consumer demand for discretionary items, such as home furnishings, apparel, and accessories.

The Minneapolis, Minnesota-based company - which is the seventh largest brick-and-mortar retailer in the U.S. - has also been struggling with higher costs pressures and decreasing operating margins amid the current backdrop.

According to the options market, traders are pricing in a swing of about 7% in either direction for TGT stock following the print.

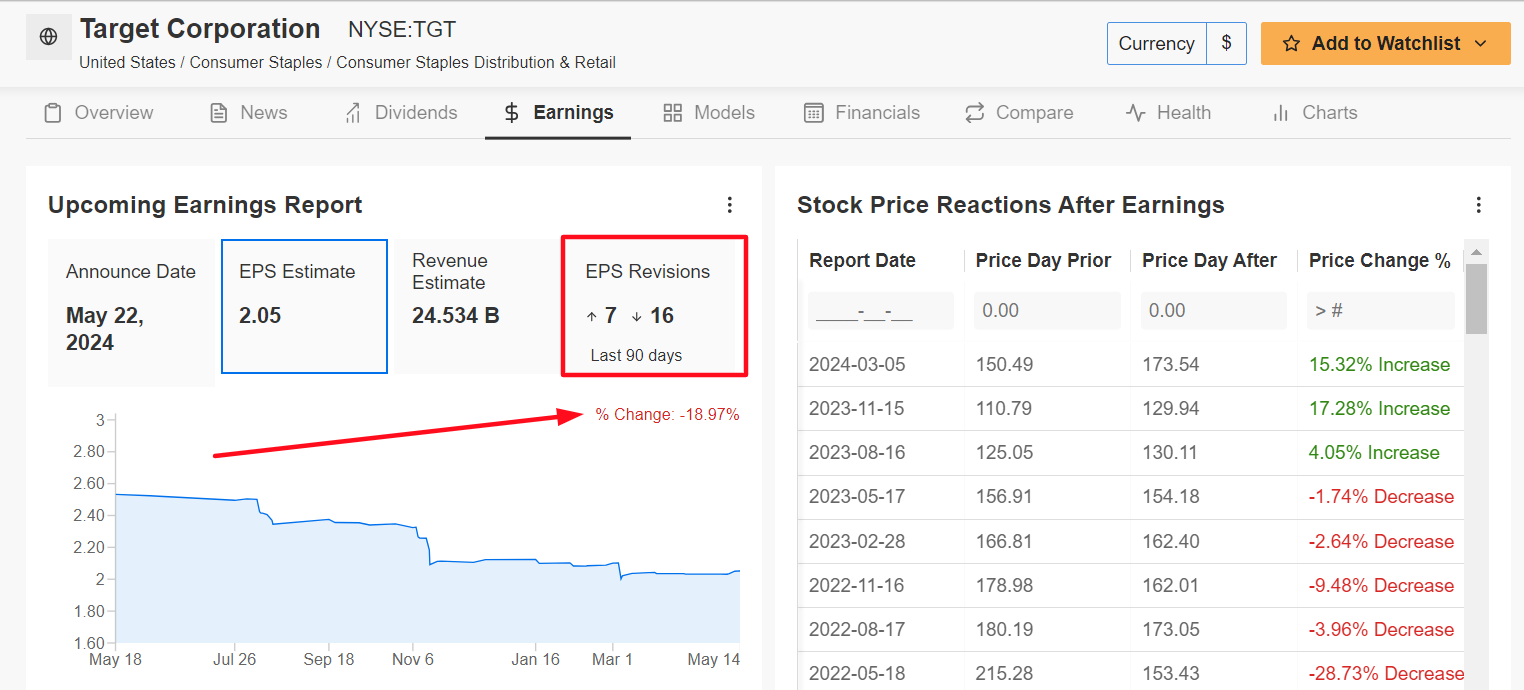

Underscoring several near-term challenges Target is facing, 16 out of the 23 analysts surveyed by InvestingPro slashed their profit estimates ahead of the print to reflect a drop of approximately 19% from their initial expectations.

Source: InvestingPro

Consensus expectations call for Target to report earnings of $2.05 per share for the April quarter, the same as in the year-ago period.

Meanwhile, revenue is forecast to decline 3.1% annually to $24.53 billion, driven by weak traffic trends and soft consumer spending on discretionary goods.

Therefore, I believe CEO Brian Cornell will strike a cautious tone in his outlook for the current quarter to reflect concerns about a slowing economy, as well as worries over lingering inflationary pressures and high interest rates.

TGT stock closed at $160.16 on Friday, pulling back from a 2024 peak of $181.74 reached on April 1. At current valuations, Target has a market cap of $74 billion.

Source: Investing.com

The stock has racked up a year-to-date gain of about 12.5%.

It should be noted that Target currently has a below average InvestingPro ‘Overall Score’ of 2.6 out of 5.0 due to lingering concerns over weakening profit margins and spotty sales growth.

Be sure to check out InvestingPro to stay in sync with the market trend and what it means for your trading.

Readers of this article enjoy a 40% discount on the yearly and bi-yearly plans with the coupon codes PROTIPS2024 (yearly) and PROTIPS20242 (bi-yearly).

Whether you're a novice investor or a seasoned trader, leveraging InvestingPro can unlock a world of investment opportunities while minimizing risks amid the challenging backdrop of elevated inflation, high interest rates, and mounting geopolitical turmoil.

Subscribe here and unlock access to:

Disclosure: At the time of writing, I am long on the S&P 500, and the Nasdaq 100 via the SPDR S&P 500 ETF (SPY (NYSE:SPY)), and the Invesco QQQ Trust ETF (QQQ).

I regularly rebalance my portfolio of individual stocks and ETFs based on ongoing risk assessment of both the macroeconomic environment and companies' financials.

The views discussed in this article are solely the opinion of the author and should not be taken as investment advice.

Follow Jesse Cohen on X/Twitter @JesseCohenInv for more stock market analysis and insight.