By Yimou Lee and Paul Carsten

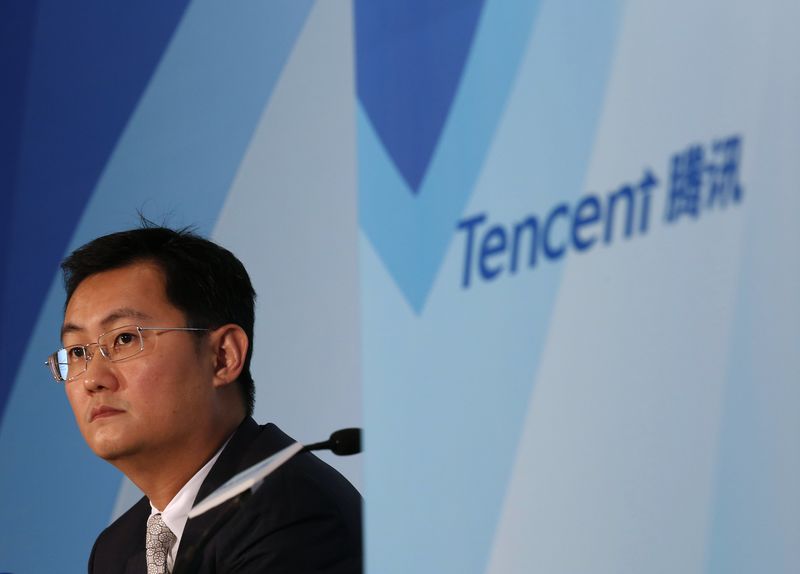

HONG KONG/BEIJING (Reuters) - Tencent Holdings Ltd, China's biggest social network and online media firm, is taking inspiration from Facebook Inc (NASDAQ:FB) in growing advertising revenue, executives said on Wednesday, after posting its slowest revenue growth in seven years.

Tencent has long depended on online gaming to generate revenue, but the company which competes on several fronts with Alibaba (NYSE:BABA) Group Holding Ltd and Baidu Inc (NASDAQ:BIDU), also wants to emulate Facebook's success in making money from mobile advertising, as well as its online video platform.

At the same time, Tencent said it would continue to look at investments in Chinese and in foreign companies, particularly entertainment content providers.

The Shenzhen-based company plans to increase spending on video content in 2015, executives told a conference call, after fourth-quarter earnings showed net income had missed forecasts while sharing and content costs ate into sales.

Tencent, which rules the roost for Chinese social networks with its ubiquitous WeChat and QQ messaging services, wants to expand social advertising in China, gunning for the same kind of domination enjoyed by Facebook in the United States, said Martin Lau, Tencent's president.

"Given what Facebook has achieved in the U.S., we see promising long-term potential," Lau said on a conference call.

Tencent also flagged its 2014 shopping spree should continue in 2015. The company shelled out more than $2 billion on acquisitions last year, a splurge unlikely to end as it grapples with rival internet firms Alibaba and Baidu to gain the upper hand on mobile devices in China, the world's largest smartphone market.

That excludes doling out large sums for video content, the extent of which Tencent declines to disclose. But it saw a ramp-up this year. It has recently inked licensing deals for television, film, sport and music, including with U.S. cable broadcaster HBO and the NBA.

Tencent's revenue grew 24 percent to 20.98 billion yuan (2.3 billion pounds) in the three months through December, slightly above forecasts of 20.5 billion, on the back of strong sales from online gaming on PCs and smartphones linked to its social networks.

Net income rose 51 percent to 5.95 billion yuan, below estimates of 6.26 billion, according to a Thomson Reuters SmartEstimate poll of 11 analysts.

Tencent said in 2015 it would focus on two other areas besides entertainment and advertising: enabling offline business transactions with their mobile internet services; and building up its online payment system.