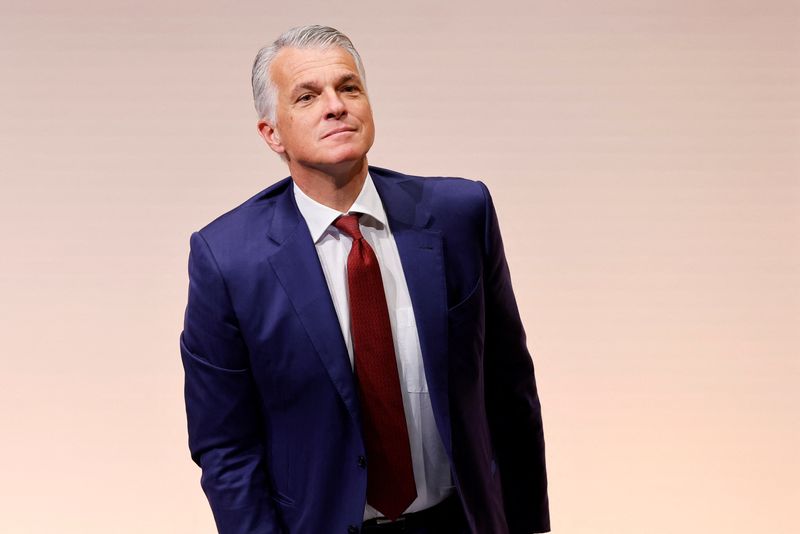

LUCERNE, Switzerland (Reuters) -UBS Chief Executive Sergio Ermotti said on Friday that the situation at Credit Suisse (SIX:CSGN) has stabilized and he did not think outflows at the embattled bank were continuing.

Addressing the Swiss Media Forum in Lucerne, Ermotti also said he hoped there would be an investigation into the circumstances that pushed Credit Suisse Group to the brink of collapse and led to its takeover by UBS as part of a rescue orchestrated by the Swiss authorities.

Commenting on his decision to include in his new leadership team Ulrich Koerner, a former UBS executive who has led Credit Suisse since last year, Ermotti said the bank's problems were rooted well in the past.

"In my opinion it is crystal clear, this situation did not develop in the last six weeks or six months but over the course of the last six, seven years," he said.

"I hope that, when there will be an investigation, it should be long enough to properly understand everything that happened," Ermotti said, addressing the conference from the MS Diamant boat moored on the Lake of Lucerne.

Switzerland's attorney general said last month the country's federal prosecutor had opened an investigation into the takeover, looking into potential breaches of Swiss criminal law by government officials, regulators and executives at the two banks.

He also said UBS was on track to close the transaction within three months from its March 19 announcement.

Earlier this week, UBS said that following the legal closing of the transaction it would manage two separate parent companies – UBS AG and Credit Suisse AG - throughout the integration process, which it has said could take three to four years.

During that time, each institution will continue to have its own subsidiaries and branches, serve its clients and deal with counterparties.