Benzinga - by Piero Cingari, Benzinga Staff Writer.

Friday is shaping up to be one of the strongest days for metal commodities in recent years. Gold climbed over 1.7% toward a record-high close above $2,400 per ounce, silver surged more than 6% to its highest level since February 2013, and copper hit an all-time high.

What Happened: In a week marked by diminishing inflation fears, the case for Federal Reserve rate cuts strengthened. Additionally, news of a broad-based Chinese stimulus to support the struggling real estate sector sent metal commodities skyrocketing. Beijing announced measures such as reducing down payments for homebuyers and a state-financed package to convert unsold properties into social housing.

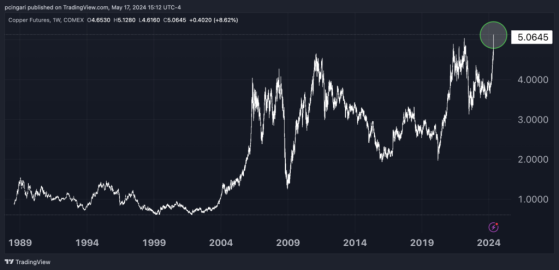

Copper, extremely sensitive to China’s economic health as the country is the top purchaser of the red metal, rallied 4% to above $5 a pound. This surge marked a fresh weekly all-time high and its strongest day since November 2022.

Precious metals like silver and gold positively reacted to both interest-rate and Chinese-related developments. Silver spiked above $30, breaking out of a triple-top resistance pattern.

Chart: Copper Hits All-Time High

Expert Insights on Metal Commodities According to Otavio Costa, macro strategist at Crescat Capital, central banks are “acquiring gold to enhance the quality of their international reserves and thereby strengthen the credibility of their monetary systems.”

He highlighted that unlike many investors and traders, central banks have a long-term perspective, meaning that “the accumulation of gold by these institutions is just beginning.”

According to analysts at Goldman Sachs, copper remains a focus amid an ongoing short squeeze that has sent futures to record highs. The investment bank maintains a positive outlook on copper, citing the market’s structural deficit and forecasting a 20% increase from current levels.

Jeff Currie, former Goldman Sachs commodities strategist and now chief strategy officer of energy pathways at Carlyle Group, stated in a Bloomberg interview that the red mental still has more room to run, emphasizing copper’s importance in powering electric vehicles, updated grids and AI data centers.

Chart: Silver Notches Best-Performing Week Since August 2020

Mining Stocks Surge The rally in metal commodities fueled broad-based gains on mining stocks.

- The SPDR S&P Metals & Mining ETF (NYSE:XME) rose 1.8% reaching April 2022 highs. Coeur Mining, Inc. (NYSE:CDE) and Hecla Mining Company (NYSE:HL) were the top gainers among miners, both up by 11%.

- The Global X Copper Miners ETF (NYSE:COPX) skyrocketed 4.3%, hitting a record high since the fund’s inception in 2010. Taseko Mines Limited (NYSE:TGB), Ero Copper Corp. (NYSE:ERO), and First Quantum Minerals Ltd. (NYSE:FM) were the fund’s top performers, up 7.3%, 6.8% and 6.6%, respectively

- The Global X Silver Miners ETF (NYSE:SIL) rose 5%, reaching April 2022 highs. Besides Coeur Mining and Hecla Mining Company, Endeavour Silver Corp. (NYSE:EXK) also performed strongly, up 10%.

- The VanEck Gold Miners ETF (NYSE:GDX) surged 3%, also reaching April 2022 highs, with New Gold Inc. (NYSE:NGD) topping the performance among gold miners, up nearly 12%.

Photo: Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga