Benzinga - by Zaheer Anwari, Benzinga Contributor.

- Over 10,500 black-cab drivers in London have initiated a £250 million lawsuit against Uber earlier this month.

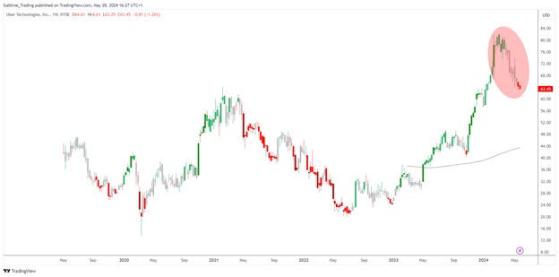

- Amidst these legal challenges, Uber's financial performance remains volatile, with its stock price recently dropping 21% over two months.

The drivers argue that Uber allowed direct bookings, bypassing the required centralized dispatch systems for minicabs. This, they claim, gave Uber an unfair advantage and caused substantial financial losses for traditional cabbies.

The drivers want to recover financial damages and ensure fairness and proper regulation in London's competitive taxi market. Uber, however, denies these claims, insisting that its practices follow London's regulations and that it has a valid license from Transport for London (TfL).

This defense comes in the context of previous legal issues, including a recent A$272 million settlement in Australia, where Uber resolved claims from taxi and hire-car drivers who experienced financial losses due to Uber’s market strategies.

This ongoing legal case in London revives the long-standing debate over Uber's compliance with private hire rules, a topic that has been in discussion for more than five years.

At the same time, Uber's financial performance has shown volatility, as reflected in its recent stock movements. After hitting a record high of $82.14 in March, Uber's stock has dropped 21% over the past two months, currently sitting at $64.

This level is significant as it was formed from the high of February 2021, marking a crucial level. The level was first tested on May 8th and revisited several times since this price level could indicate a turning point.

If the support holds, it might spark a recovery, pushing the stock back towards its all-time high. However, a drop below this threshold could lead to further declines, highlighting the uncertainties in the stock's future.

After the closing bell on Friday, May 24, the stock closed at $64.26, trading up by 0.97%.

This article is from an unpaid external contributor. It does not represent Benzinga's reporting and has not been edited for content or accuracy.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga