Benzinga - by Zacks, Benzinga Contributor.

Jack in the Box Inc. (NASDAQ: JACK) announced an ambitious plan to open 15 new locations in Georgia. This significant development agreement marks the company's first foray into the Peach State, underscoring its strategic expansion in the Southeastern United States.

Tim Linderman, JACK's chief development officer, highlighted that this franchise commitment represents a substantial advancement in the company's growth strategy. Jack in the Box's 24/7 menu is set to attract Georgia's thriving business environment and robust consumer base, making it an ideal market for expansion. This move is in sync with the company's broader goal of dynamic growth, following 30 recently announced commitments in Florida.

The locations for the new Georgia restaurants are yet to be finalized. However, Jack in the Box plans to focus on key markets such as Macon, Augusta and Savannah. These growing areas are expected to provide ample opportunities to engage with new customers and communities.

Linderman expressed enthusiasm about partnering with an experienced multi-unit franchisee for this venture. This franchisee's entrepreneurial spirit and dedication to excellence are well-aligned with the values of Jack in the Box. Its deep understanding of the local community is anticipated to be a significant asset to the brand, ensuring that the new restaurants integrate seamlessly into Georgia's market.

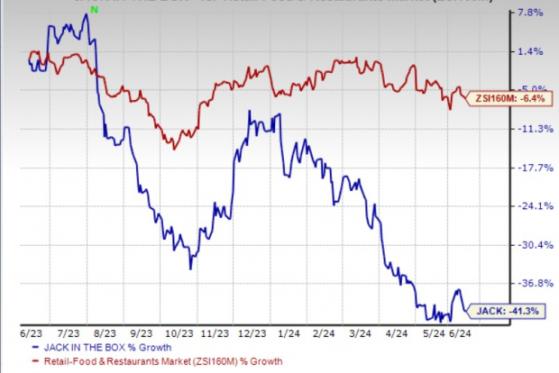

Image Source: Zacks Investment Research

Expansion Efforts Bode Well This expansion is not just about increasing the number of locations but also about enhancing the overall customer experience. Jack in the Box aims to bring its craveable offerings to more people, leveraging the strong economic and demographic trends in Georgia. The strategic placement of these new outlets is expected to maximize market penetration and brand visibility.

Jack in the Box's entry into Georgia is a promising development for the company and the local market. With a solid growth strategy and a focus on key markets, JACK is well-positioned to achieve substantial success in the Southeastern United States. This expansion signifies not just an increase in physical presence but also a commitment to delivering quality and convenience to more communities.

The company anticipates approximately 25 to 35 restaurant openings in fiscal 2024. Given the substantial progress in terms of the franchise development program, JACK anticipates achieving a long-term net unit growth goal of 4% by 2025. Also, it expects to have Jack in the Box restaurants in 40 states by 2030.

Shares of the company have lost 41.3% in the past year compared with the industry's decline of 6.4%.

JACK currently carries a Zacks Rank #3 (Hold).

Stocks to Consider Some better-ranked stocks in the Zacks Retail-Wholesale sector are discussed below.

Wingstop Inc. (NASDAQ: WING) sports a Zacks Rank #1 (Strong Buy) at present.

It has a trailing four-quarter negative earnings surprise of 21.4%, on average. The stock has surged 110.9% in the past year. The Zacks Consensus Estimate for WING's 2024 sales and EPS implies a rise of 27.5% and 36.7%, respectively, from the year-ago levels.

Brinker International, Inc. (NYSE: EAT) carries a Zacks Rank #2 (Buy) at present. It has a trailing four-quarter earnings surprise of 213.4%, on average. EAT's shares have risen 78.8% in the past year.

The Zacks Consensus Estimate for EAT's 2024 sales and EPS indicates 5% and 41.3% growth, respectively, from the year-earlier actuals.

El Pollo Loco Holdings, Inc. (NASDAQ: LOCO) carries a Zacks Rank #2 at present. It has a trailing four-quarter earnings surprise of 19.4%, on average. LOCO's shares have risen 6.7% in the past year.

The Zacks Consensus Estimate for LOCO's 2025 sales and EPS indicates 3.8% and 9.9% growth, respectively, from the prior-year figures.

To read this article on Zacks.com click here.

Read the original article on Benzinga