Proactive Investors - Mark Carney, the former Bank of England governor, said interest rates will remain high for years to come, meaning more misery for homeowners and ramping up the pressure on government finances.

The UK is “going to be paying higher rates of interest for their debt for the foreseeable future,” he said in an interview with Robert Peston on ITV (LON:ITV) last night.

The higher borrowing costs, he said, represent “big tectonic shifts in the global economy” and “mean that we are likely to have higher longer term interest rates for a period of time”.

“One of the things that governments in the UK, and Canada, elsewhere have to get used to, now, is that they are going to be paying higher rates of interest for their debt for the foreseeable future,” he said.

Markets are now pricing in interest rates peaking at 5.75%, a big jump from only a month ago, when they thought rates might peak under 5%.

????BlimeyUK money markets now pricing in @bankofengland interest rates of 5.75% by early next year.

That’s a massive change from only a month ago, when they thought rates might peak under 5%.

Things looking increasingly grisly for mortgage payers/the housing market pic.twitter.com/7S9OCon9uu

— Ed Conway (@EdConwaySky) June 14, 2023

Higher than expected inflation figures and stubborn wage growth have sparked fears that the BoE will need to keep raising interest rates as it seeks to bring inflation back down to its 2% target.

Laith Khalaf at AJ Bell reckons it won't take much for forecasts to hit 6%. "A few hawkish comments from the Bank of England, or some more ugly inflation data, could easily tip those expectations up to 6%," he said.

Earlier this week, current BoE Governor Andrew Bailey accepted inflation was falling a lot slower than he had hoped and said mistakes had been made.

Sushil Wadhwani, a former member of the BoE’s monetary policy committee said failing to fight inflation now risks making the situation worse.

“If we delay raising rates then we might find the disease gets worse and we might then find that we have to do even more and experience even worse side effects,” Wadhwani said.

The fast moving picture in money markets has caused chaos in the mortgage market. HSBC (LON:HSBA) has been forced to pull mortgage deals twice within a week while Santander (BME:SAN) also pulled products and other providers have increased rates.

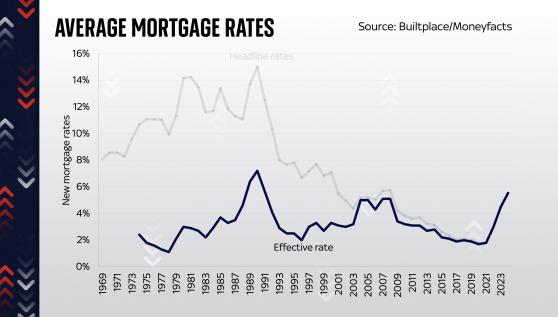

Moneyfacts shows the average two year fixed rate deal is now 5.9% with the average 5 year deal 5.54%, the highest since 2008.

Adjusting for the fact that these days people have bigger mortgages and lower incomes versus their monthly payments the mortgage burden is much higher – similar to levels seen in the 1990s.

This led to a housing market crash and while most commentators do not expect this now, a house price correction is expected.