Proactive Investors -

- FTSE 100 storms ahead, up 155 points

- Rolls-Royce (LON:RR) jumps as Jefferies upgrades to buy

- UK manufacturing ends 2022 on weak footing - PMI

11.01am: Weak PMI data points to lower interest rate peak

Another factor in the decline in sterling today is that economists think the weak PMI data will prompt the Bank of England’s Monetary Policy Committee (MPC) to not raise interest rates as high as had been feared.

Gabriella Dickens, senior UK economist at Pantheon Macroeconomics forecast “that the recession ahead will crush domestically-generated inflation, ensuring that the MPC does not need to raise Bank Rate above 4% this year.”

She said the further step down in the manufacturing PMI in December all but confirms the sector now is in recession.

The EY ITEM Club agreed. It said the weak data should ease some of the MPC’s concerns that high inflation and a tight labour market could create the conditions for a wage-price spiral to develop.

“The EY ITEM Club thinks the Bank of England is close to the end of its rate rising cycle, with Bank Rate likely to peak at 4%” it said.

10.42am: Sterling dips on concerns about UK economy

Sterling dipped after the release of the PMI figures which showed UK manufacturing remained in the doldrums in December.

The S&P Global/CIPS UK manufacturing Purchasing Managers' Index (PMI) sank to 45.3 in December from 46.5 in November, its lowest since May 2009 apart from two months at the start of the pandemic in 2020.

The reading was stronger than an initial estimate of 44.7 released last month, but well below the 47.8 reported in the equivalent euro zone survey on Monday. S&P director Rob Dobson said:

It came on the back of a FT report which predicted the UK will experience one of the worst recessions and poorest recoveries among the G7 countries in the upcoming year and sent the pound into reverse on concerns over the financial strength of the UK’s economy.

As a result, the pound fell 1.1% against the US dollar to US$1.1913.

10.17am: Power generators in focus at Jefferies

UK power generators were in focus at Jefferies today with the broker raising its price target for Drax Group (LSE:LON:DRX) but downgrading its rating on SSE PLC (LSE:LON:SSE) to hold on valuation grounds.

On Drax the broker upped its price target for the FTSE 250 listed group to 800p from 650p and reiterated a 'buy' recommendation.

They said Drax's strong balance sheet and cash flow generation, combined with a discounted valuation, make it an attractive risk-reward relative to its peers.

But on SSE PLC (LON:SSE) was downgraded by the same broker to hold from buy.

It pointed out the group had outperformed the European utility sector by c.15% over 2022 thanks to power/gas prices-driven EPS upgrades, deleveraging and clarity on UK windfall tax for electricity generators.

“However, these positive factors now appear to be well-reflected within consensus, with sources of further earnings upgrades less clear to us” it suggested.

“We see some valuation upside on the stock, but it's not big enough to retain a Buy”analysts wrote.

The stock was moved to hold from buy with a reduced price target of 1,830p, down by 12%.

Shares in Drax were a bright feature, up 2.8%, while SSE recovered some early weakness to trade little changed.

9.43am: UK manufacturing remains in the doldrums

The UK manufacturing sector ended 2022 on a weak footing, with output, new orders and employment all falling at faster rates according to the latest reading from the S&P Global / CIPS UK Manufacturing Purchasing Managers’ Index (PMI).

Domestic and overseas demand remained lacklustre, as clients faced rising costs, increased market volatility and (in the case of EU-based clients) Brexit-related complications, the report found.

???????? UK manufacturing conditions declined at a steeper rate at the end of 2022 (#PMI at 45.3; Nov: 44.7) as domestic and overseas demand remained weak and rising costs deterred spending. Read more: https://t.co/z0hwJBzDco pic.twitter.com/svYt2Gci9r— S&P Global PMI™ (@SPGlobalPMI) January 3, 2023

But although the seasonally adjusted PMI fell to a 31-month low of 45.3 in December, down from 46.5 in November it was above the earlier flash estimate of 44.7.

The PMI has remained below the neutral 50.0 mark for five successive months and excluding the series lows registered during the first pandemic lockdown, the current PMI reading is one of the weakest since mid-2009.

All five of the PMI sub-indices signalled a weaker operating environment for the UK manufacturing economy.

Output, new orders, employment and stocks of purchases all fell at accelerated rates, while vendor delivery times (an indicator of supply chain stress) lengthened to the least marked extent since January 2020.

Rob Dobson, director at S&P Global Market Intelligence, said: “The decline in new business was worryingly steep, as weak domestic demand was accompanied by a further marked drop in new orders from overseas.”

But he said there was some brighter news on the inflation front as the “rates of increase in input prices and factory selling prices both slowed further in December.”

9.05am: Equities in favour as 2023 kicks off

Equities remained in favour in the first trading session of the year following gains in Hong Kong and despite gloomy forecasts for the global economy from amongst others, the IMF.

Craig Erlam, senior market analyst, UK & EMEA, at OANDA, noted the “IMF is among those warning of a tough year, more so than the one we've just left, as the simultaneous slowing down of the US, EU, and China takes its toll.”

But for now, markets are taking heart from hopes that the reopening in China will give a boost to economic growth in 2023 and help defy some of the gloomier expectations.

Today’s Caixin manufacturing PMI in China although weak, painted a less pessimistic picture than the official PMI number over the weekend, and this supported a rally in the Hang Seng today which rose 1.8%.

This helped boost Asian-focused stocks which were amongst those on the rise in London with Rolls Royce Holdings Plc topping the risers, up 5.25% on hopes the reopening would boost international travel. This also gave a lift to International Consolidated Airlines Group (LON:ICAG) SA (LSE:IAG), up 4.4%.

A rise in the oil price supported index heavyweights, BP PLC (LON:BP) and Shell PLC (LON:RDSa), while housebuilders were another firm feature with Barratt Developments PLC (LON:BDEV),

Persimmon PLC (LON:PSN), Taylor Wimpey PLC (LON:TW) and Berkeley Group Holdings PLC (LON:BKGH) all on a sound footing today.

On the downside, SSE PLC (LON:SSE) fell 0.7% as Jefferies downgraded to hold while GSK (LON:GSK) was another on a small list of fallers, down 0.4%, as JP Morgan lowered the pharma giant to underperform with a 1,350p price target.

8.40am: Rolls-Royce boosted by upgrade by Jefferies

Rolls-Royce Holdings PLC (LON:RR) received an early boost to the year as Jefferies put the company on its buy list with an increased price target of 125p, up from 90p.

“As we look to 2023, we are more risk-on, and warm to aftermarket momentum” the broker said.

It sees a number of positive catalysts for the FTSE 100 listed engineer in 2023 including potential credit upgrades and further flight hours recovery which should build confidence in the group's mid-term potential.

The broker lifted its 2022 estimated EBIT by 16% on better mix (spare engines) and 2022/23/24 free cash flow forecasts by 22%/9%2% respectively.

Despite cuts to near-term EPS forecasts reflecting higher non-cash taxes the broker has shifted its focus to mid-term potential.

“We now value new market opportunities within our 2024-SOTP and roll our FCF yield valuation to 2024, boosting our price target to 125p (vs. 90p)” it said.

8.15am: FTSE makes strong start to 2023

Trading in London has got off to a bright and breezy start in the first session of 2023 with the FTSE 100 posting gains of over 1% reflecting advances in European markets yesterday when UK equity markets were closed.

The advances came despite a report in the Financial Times which predicted the UK will experience one of the worst recessions and poorest recoveries among the G7 countries in the upcoming year.

At 8.15am the lead index was 92 points to the good at 7,544 while the more domestically focused FTSE 250 soared 224 points to 19,077.

“In the UK, the premier index opened the year on the front foot in early exchanges, driven by mark-ups across various sectors, such as oils and banks.”

“In addition, the possibility of increased Asian travel also boosted the likes of International Consolidated Airlines and Rolls-Royce, while the initial risk-on approach came at the slight expensive of the more defensive sectors” commented Richard Hunter, head of markets at interactive investor.

Rolls-Royce Holdings PLC was also supported by an upgrade by Jefferies to buy with the share price up 4%.

But the New Year cheer was not extended to ailing cinema chain, Cineworld Holdings PLC, which warned of a “very significant dilution” to existing shareholders as it continued to explore its options to exit Chapter 11 bankruptcy.

It also said there had been no talks with AMC Entertainment Holdings (NYSE:AMC) Inc and shares slumped 9% in reaction.

7.45am: EUR loses ground against the greenback, Cable maintains a sideways trade

The forex markets kicked off the new year in a muted fashion.

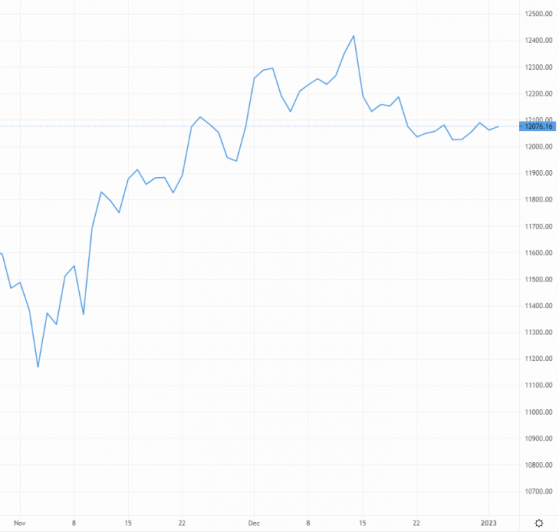

Cable continued to trade sideways on Monday as we entered the first trading session of 2023, having opened at 1.208 and closed 28 pips down at 1.206, where it has stayed in this morning’s Asia hours.

Cable kicks off 2022 in muted fashion – Source: capital.com

Commencing trade on Tuesday, the US Dollar Index (DXY) remains on the weaker side at 103.36; a fair way below the 20-day moving average.

Yet the euro lost ground against the greenback too, with the EUR/USD pair dipping 0.3% on Monday and continuing to fall another 0.25% this morning, where it currently changes hands at 106.53.

Eurozone manufacturing data released yesterday indicated somewhat of an easing of the industry’s downturn, although output for the entire fourth quarter is likely to have been on the negative side.

Things were worse for manufacturing output in the UK, with today’s reading showing the weakest output since May 2020 for the month of December, spurred by lukewarm new business volumes and exports.

EUR/GBP fell a quarter of a percent to 88.29p in Tuesday’s Asia window, but the pair is still substantially above the 20-day moving average owing to a bullish December.

Things are quiet on the economic calendar today, but tomorrow will give us mortgage data on both sides of the Atlantic. Mortgage approvals in the UK are expected to gain slightly, with net lending expected to come in at £3.7bn.

7.35am: Cineworld warns of “very significant dilution of existing equity interests”

Cineworld Group PLC (LON:CINE), has said it has not held talks with AMC Entertainment Holdings (NYSE:AMC) Inc. regarding the sale of its cinema assets, as it warned that any transaction would result in a “very significant dilution of existing equity interests.”

The beleaguered cinema chain which filed for chapter 11 bankruptcy protection in September was responding to recent claims by AMC that it had held talks with its lenders with a view to buy some of Cineworld’s cinema assets.

Cineworld said talks continue with key stakeholders to develop a proposed plan that seeks to maximise value for the benefit of moviegoers and all other stakeholders and these discussions are ongoing.

Proposals are set to be made to potential suitors in January 2023, the group said.

But it warned any restructuring or sale transaction agreed with stakeholders will result in a “very significant dilution of existing equity interests in Cineworld and there is no guarantee of any recovery for holders of Cineworld's existing equity interests.”

7.00am: Bright start to 2023 in London forecast

London is set to start the year on the front foot after the extended New Year holiday after European markets made progress yesterday and the Hang Seng advanced strongly today.

Spread betting companies are calling the lead index up by around 20 points.

However, corporate news is likely to be thin on the ground but there will be a number of PMI releases for investors to digest after releases in the past couple of days showed further falls in manufacturing activity in China in Germany.

But as Ipek Ozkardeskaya, senior analyst at Swissquote Bank said “We will have more PMI data today, but don’t expect to see anything brilliant.”

Otherwise, investors will have one eye on the latest FOMC minutes and non-farm payrolls due for release later in the week.

Read more on Proactive Investors UK