Proactive Investors -

Rival approach for Network International

A battle for Network International Holdings PLC (LON:NETW) has broken after the payments company revealed a second bid approach.

The company confirmed it has received a “highly preliminary” 400p a share cash offer from Canada's Brookfield Asset Management (TSX:BN_pfj).

The offer for the FTSE 250 firm trumps a proposal from a consortium comprising CVC Advisers and Francisco Partners Management worth 387p per share announced on Monday.

“The board of Network is currently evaluating the Brookfield Proposal with its financial advisers and a further statement will be made in due course,” the company said in a statement.

Retail sales fall more than expected

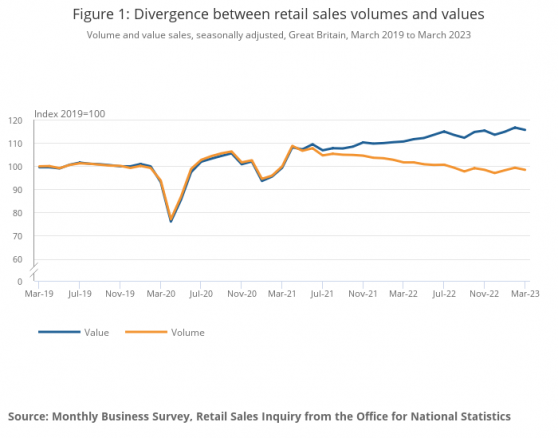

Retail sales fell in March by more than City commentators expected after the bounce back in February, according to the Office for National Statistics.

The fall of 0.9% in March, compared to consensus expectations of a 0.5% decline, and followed February’s rise of 1.1% (revised from a rise of 1.2%).

More encouragingly, sales volumes rose by 0.6% in the three months to March when compared with the previous three months; the first three-month on three-month rise since August 2021.

Non-food stores sales volumes fell by 1.3% in March following a rise of 2.4% in February, with feedback from retailers that poor weather conditions throughout most of March affected sales.

Food store sales volumes fell by 0.7% in March following a rise of 0.6% in February.

Non-store retailing (predominantly online retailers) sales volumes fell by 0.8% in March, following a rise of 0.3% in February.

Automotive fuel sales volumes rose by 0.2% in March, following a fall of 1.2% in February; sales remain 8.5% below their pre-coronavirus (COVID-19) February 2020 levels.

Subdued start seen in London

FTSE 100 is expected to open flat ahead of retail sales figures which will give a further indicator as to the confidence levels of UK consumers.

Spread betting companies are calling London’s lead index down by around 2 points.

On Wall Street, stocks ended lower as disappointing earnings from AT&T (NYSE:T) and heavy falls in Tesla (NASDAQ:TSLA) weighed on equities.

The Dow Jones Industrial Average closed down 110.46 points, or 0.3%, at 33,786.55. The S&P 500 declined 24.71 points, or 0.6%, at 4,129.81, while the Nasdaq Composite slipped 97.67 points, or 0.8%, to 12,059.56.

In Asia, markets fell. The Nikkei 225 index was down 0.3%. the Shanghai Composite was down 1.4%, while the Hang Seng index in Hong Kong was down 1.2%.

Back in London, the early focus will be retail sales figures while a slew of PMI prints is due later today in the UK, EU, and US.

Read more on Proactive Investors UK