Proactive Investors - Grocery price inflation has risen again to 17.1% in the four weeks to 19 February 2023, the highest level ever recorded by Kantar, with households facing an £811 increase to their average annual bill if they buy the same items.

Fraser McKevitt at Kantar said: “Shoppers have been facing sustained price rises for some time now and this February marks a full year since monthly grocery inflation climbed above 4%. This is having a big impact on people’s lives.”

“Our latest research shows that grocery price inflation is the second most important financial issue for the public behind energy costs, with two-thirds of people concerned by food and drink prices, above public sector strikes and climate change.”

Aldi pushed its market share to a new record this period hitting 9.4%.

It remains the fastest growing grocer, with sales up by 26.7%, closely followed by Lidl which increased sales by 25.4% taking its market share to 7.1%.

Frozen food specialist Iceland also won share, taking 2.4% of market sales, up from 2.3% last year as spending through its tills increased by 10.8%.

Ocado put in a strong performance, bucking the overall trend in online sales. While online fell by 0.9% over the 12 weeks, the digital specialist grew sales by 11.3% to achieve its largest ever market share of 1.9%.

Tesco edged slightly ahead in the battle between Britain’s biggest retailers, with sales up by 6.6%. Sainsbury’s and Asda were just behind with sales rising by 6.2% and 5.9% respectively. Morrisons’ sales decline of 0.9% was its best performance since May 2021.

Waitrose returned to growth, nudging up sales by 0.7%. It has a market share of 4.7%. Convenience retailer Co-op increased sales by 3.4% while independents and symbols were up by 1.8%.

Footsie dips at the open

London’s blue chips fell back on Tuesday conceding some of yesterday’s strong gains as investors digested a raft of trading updates and the implications of the deal between the UK and the EU over post-Brexit trading arrangements for Northern Ireland.

At 8.15am London's blue chip index was at 7,908.59, down 26.52 points, or 0.33% while the FTSE 250 stands at 19,826.23, down 59.87 points, or 0.30%.

Ocado Group PLC fell 4.4% to 597.44p after reporting losses widened in 2022.

The firm said revenue was broadly flat at £2.5bn in the 12 months to 31 December 2022, up 0.6%, with strong growth in Solutions revenue offset by a decline at Ocado Retail. Ocado Retail's revenue fell 3.8% to £2.2bn, with robust customer growth offset by lower value baskets.

But pre-tax losses at the online food retailer widened to £501mln compared to £176.7mln in 2021 due to rising costs and investments made at Ocado Retail and £349mln depreciation and amortisation.

Ocado Retail, a joint venture between Ocado Group and Marks and Spencer Group PLC, posted an EBITDA loss of £4mln compared to a profit of £150.4mln in 2021.

Shore Capital described the results as “awful”, that “record, as expected, material losses; half-a-billion of them.”

“One day in a distant time zone the Ocado Group may be surrounded by the words, meaningful sequential pre-tax profits, who knows, it may even pay Corporation Tax, but one cannot yet see the rainbow, never mind any pot of gold. Further notable losses are guided for FY23,” the broker said.

But heading the other way was AO World PLC which soared 8.5% after raising guidance for the second time in as many months due to higher retail margins than previously forecast.

The electrical retailer now expects adjusted EBITDA in a range of £37.5m to £45m for the full year compared to the £30mln to £40mln guidance given in January.

“The steps we have taken to simplify the business and become more efficient have outperformed expectations and been delivered quicker than expected,” AO said in a statement.

Croda International PLC slipped 5.8% despite record results on Tuesday as it posted a rise in full-year sales and profit following a strong performance in Asia, Western Europe and Latin America, with growth across consumer care and life sciences.

In the year to the end of December 2022, statutory pre-tax profit rose 89.6% to £780m, including a gain on the PTIC business disposal of £356.0m. Adjusted pre-tax profit was 11% higher at £496.1m and sales pushed up 10.6% to £2.1bn.

But Travis Perkins PLC tumbled 8.2% after reporting a 16% fall in adjusted operating profit to £295mln impacted principally by lower year-on-year property profits and a £15mln charge related to restructuring activities in the fourth quarter.

The building materials firm is targeting cost savings of around £25mln in 2023.

Home sellers accepting bigger discounts

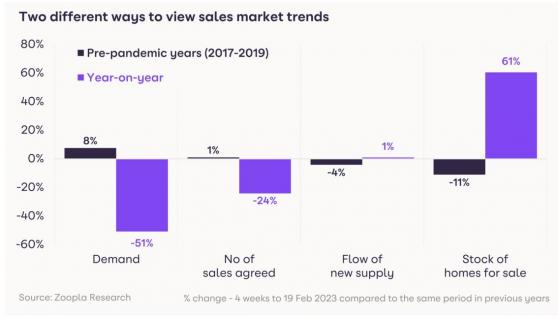

Home sellers are accepting an average discount of 4.5% off their asking prices to find a buyer, according to property website Zoopla.

The average property price in the UK is now £260,800, Zoopla said, which means sellers are taking a cut of £14,100, the highest gap between asking and selling prices for five years.

Richard Donnell, executive director at Zoopla, explained: “Greater realism on the part of sellers is supporting housing market activity in the face of higher borrowing costs.”

“Many homeowners are sitting on sizable house price gains made over recent years and have more room to be flexible accepting offers below the asking price.”

“Discounts to asking price have widened and while 4-5% discounts are manageable, if these were to widen further then this would point to a greater likelihood of larger house price falls.”

“We believe the market remains on track for a soft landing in 2023 with modest price falls of up to 5% and one million housing sales.”