Proactive Investors - The FTSE 100 tumbled as inflation fell, but far less than the City had hoped, prompting concerns of further interest rates increases.

At 8.15am London’s lead index was down 77.42 points at 7,685.53, down 1.0%, while the FTSE 250 slipped to 19,013.22, down 195.09 points, or 1.02%.

Susannah Streeter at Hargreaves Lansdown (LON:HRGV) said: “Inflation has soared up like an eagle and taken a ferocious bite out of our standard of living, but it’s coming down at a snail’s pace and leaving a sticky trail of prices in its wake.”

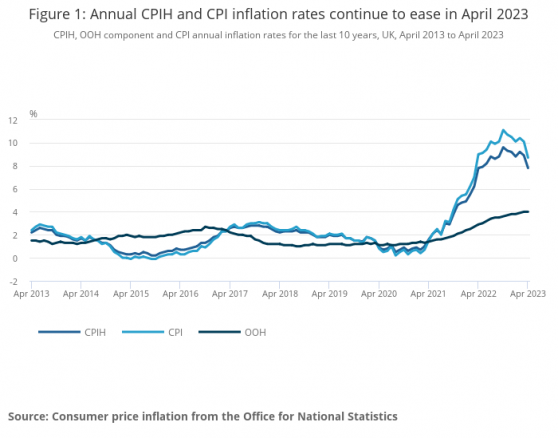

Consumer price inflation eased to 8.7% in April from 10.1% in March but below expectations for a fall to 8.2%.

Energy prices dropped but food prices remained close to record highs.

Streeter pointed out “more worryingly, core inflation, which strips out volatile food and energy prices crept back upwards to 6.8%.”

“It shows that the price spiral is still proving to be a stubborn beast to conquer for the Bank of England.”

“A further increase in Bank Rate to 4.75% at the MPC’s next meeting on June 22, from 4.50%, now is firmly on the table,” said Samuel Tombs at Pantheon Macroeconomics.

Talk of further rate hikes saw the pound rise 0.2% to $1.2438 against the US dollar.

Marks and Spencer Group PLC (LON:MKS) soared 6.7% after announcing plans to restore its dividend alongside profit growth in the year April 1.

Pre-tax profits in the year jumped 21% to £475mln, while revenues grew 9.9% to £11.9bn, the retailer said in a statement.

"One year in, our strategy to reshape M&S for growth has driven sustained trading momentum, with both businesses continuing to grow sales and market share,” said M&S chief executive Stuart Machin.

Richard Hunter, head of markets at interactive investor, said: “M&S continues with its transformation apace, boosted not only by its traditionally strong Food business but also by strengthening signs of a revitalised Clothing & Home unit.”

SSE PLC (LON:SSE) firmed 2% in early exchanges as it announced increased investment plans alongside soaring profits.

In the year to March 31 the FTSE 100-listed generator reported pre-tax profit of £2.18bn, up 89% from £1.16bn the year prior while EPS of 166p, jumped 75% from 94.8p a year ago.

The company has increased its investment plans as part of the "NZAP Plus" five-year strategic plan to 2027 with £18.0bn of capital investment planned, an increase of more than 40% on the previous plan.

Aviva PLC (LON:AV) slipped 1.8% despite what it called an “encouraging” start to the year.

Amanda Blanc, group chief executive officer, said: “We have delivered an encouraging start to 2023 and continue to build clear trading momentum.

“New business volumes are good, despite persistent economic uncertainty, and we delivered another quarter of strong growth across our diversified business.”

But the insurer did report wealth net flows of £2.3bn were 15% lower year-on-year due to the impact of the challenging market volatility on Platform.

SSE beefs up investment plans, profit soars

SSE PLC beefed up investment plans as it reported soaring profits but geared shareholders to lower dividends going forward.

In the year to March 31 the FTSE 100-listed generator reported pre-tax profit of £2.18bn, up 89% from £1.16bn the year prior while EPS of 166p, jumped 75% from 94.8p a year ago.

The company has increased its investment plans as of the "NZAP Plus" five-year strategic plan to 2027 with £18.0bn of capital investment planned, an increase of more than 40% on the previous plan.

Alistair Phillips-Davies, Chief Executive, said: "Action, not just ambition, is what is needed to provide lasting solutions to the problems of climate change, energy affordability and security - and, with a record-breaking investment programme, that is what we are delivering.”

“The "NZAP Plus" raises the bar on our ambitions to 2027, and provides a solid platform for growth that could see us invest up to £40bn over the next decade,” he added.

Looking ahead, the company guided investors to lower earnings and dividends in the year ahead.

SSE forecast adjusted EPS of more than 150p for 2023/24, with capital expenditure and investment of more than £2.8bn in 2023/24, exceeding the record investment in 2022/23.

A rebased 60p pence dividend for 2023/24, enabling growth with annual dividend increases of between 5-10% is now targeted to 2026/27.

This compares to the 96.7p total dividend SSE announced today.