Proactive Investors -

- FTSE 100 down just 4 points

- Mining shares under pressure

- GSK ahead on US court news

11.45am: US markets set for downbeat start

Wall Street is expected to open lower as concern about a US recession adds to worries that the Federal Reserve will continue on its path of hiking interest rates by 75 basis points when its rate-setting committee meets next week.

Futures for the Dow Jones Industrial Average fell 0.1% in Wednesday pre-market trading, while those for the broader S&P 500 index dropped 0.2% and the Nasdaq shed 0.3%.

Stocks declined on Tuesday as the chief executives of major Wall Street banks including Bank of America Corp (NYSE:NYSE:BAC) (Bank of America Corp (NYSE:BAC)) and Goldman Sachs (NYSE:NYSE:GS) (Goldman Sachs (NYSE:GS)) predicted a recession in the US in 2023, while JP Morgan also warned about the impact of inflation on consumer spending.

The S&P closed 1.4% lower at 3,941, while the Dow slipped 1% to 33,596 and the Nasdaq sank 2% to 11,015.

“Having seen another lacklustre and negative session for European and US markets yesterday there appears very little interest to drive markets higher in the short term, as we look ahead to next week’s central bank meetings from the Federal Reserve, as well as the European Central Bank and Bank of England,” said Michael Hewson, chief market analyst at CMC Markets UK.

Markets are also shrugging off reports that China is taking measures to reopen its economy following strict COVID lockdowns, added James Hughes, chief market analyst at Scope Markets.

“With the Fed set to persist with the policy tightening agenda and this fuelling concerns that the US economy could be tipped into recession, even the idea of China easing those draconian COVID lockdown restrictions doesn’t seem to be offering up much support,” Hughes said.

“Economic data remains thin on the ground, although weekly mortgage application numbers could offer up some interest, depending just how sharp any contraction is here. Earnings news is also rather limited but GameStop (NYSE:GME), one of the so-called meme-stocks, has third quarter numbers after the bell tonight,” he said.

Back in the UK, the FTSE 100 is now virtually flat, down just 4.41 points at 7516.98.

11.10am: Moonpig warns of challenging times

Moonpig Group PLC (LSE:MOON) is one of the day's big fallers after the online greetings card firm warned that trading had become “more challenging” through October and November.

It reported flat sales at £142.8mln and underlying earnings of £34.6mln for the first half of the year, but said it now expects sales for the full year to be around £320mln compared to previous guidance of £350mln.

Its shares have lost 14.68%.

Sophie Lund-Yates, lead equity analyst at Hargreaves Lansdown (LON:HRGV), said: “There are multiple headwinds blowing against Moonpig as the macro environment has scuppered any plans the group had of shooting for the stars. Arguably the most pressing is the effect of Royal Mail (LON:IDSI) strikes, which has badly affected UK orders.

"Much like retailers, Moonpig will have been relying on the festive season to supercharge the top and bottom lines, and operational disruption has resulted in a disappointing downgrade which has sent shares tumbling...

"The other disappointing development is that customers are reducing the amount they spend on gifts. These lucrative add-ons are an important pillar for margin growth, but the sad truth is that while the cost-of-living crisis cruises on, people are simply not inclined to throw chocolates and flowers into their virtual baskets. Sadly, this is also a trend likely to persist at least into the first quarter of next year and massively limits margin potential.

"Ultimately, the market is nervous about Moonpig. There is a question mark over where meaningful growth comes from. Recovery in revenue is one thing, and this may well come through the pipes in time, but real, sustained growth is another consideration entirely. It’s something the market isn’t sure we’ll see any time soon.”

10.37am: Oil firms slide as crude falls

The fall in oil has helped push the FTSE 100 into negative territory.

The leading index is now down 16.95 points or 0.23% at 7504.44 having earlier climbed as high as 7567.

Worries about global recession continue to grow, as evidence by the latest Chinese trade figures showing a plunge in imports and exports.

With Brent heading for the year's low, oil companies are among the big fallers.

Harbour Energy PLC is down 2.91%, BP PLC (LON:BP.) has lost 2.02% and Shell (LON:RDSa) PLC is 2.01% lower.

With China a major consumer of commodities, mining sectors are falling on concerns about a downturn in the country.

Glencore PLC (LON:GLEN) is off 2.41% - not helped by four analyst teams cutting their price targets - and Anglo American PLC (LON:AAL) has dropped 1.47%.

10.26am Oil on the slide

After an intial move higher, oil is now on the slide again and approaching the year's low.

WIth the disappointing trade data out of China outweighing news of the country's plan to ease its zero-COVID policy further, Brent crude is down 1.81% at US$77.91 a barrel.

West Texas Intermediate, the US benchmark, is off 1.83% at US$72.89.

OIL MARKET: Brent crude falling further, quickly approaching the 2022 low point (set on the firsts trading day of the year -- Jan 3rd -- at $77.04 a barrel). Brent is down nearly 10% so far this week | #OOTT— Javier Blas (@JavierBlas) December 7, 2022

Neil Wilson at Markets.com said: "The market is going to be even tighter next year and it’s hard to fathom why it’s dropping so much."

10.09am: Eurozone GDP growth beats forecasts but still slows

The Eurozone economy grew slightly more than expected in the third quarter, ahead of next week's interest rate decision from the European Central Bank.

On a seasonally adjusted basis, Eurozone GDP grew by 2.3% year on year, better than the forecast 2.1%.

However this was down from 4.2% growth in the previous quarter, and the economy is also expected to contract in the final three months of the year.

Eurozone GDP SA (Q/Q) Q3 F: 0.3% (est 0.2%; prev 0.2%)- Eurozone GDP SA (Y/Y) Q3 F: 2.3% (est 2.1 prev 2.1%)

— LiveSquawk (@LiveSquawk) December 7, 2022

In the wider European Union, GDP grew by 2.5% year on year, down from 4.3% in the prior quarter.

9.30am: Footsie higher but Santa rally may be too much to hope for

Leading shares continue to head in the right direction, despite worries about a global slowdown and a fall in UK house prices.

The FTSE 100 is currently up 15.87 points or 0.21% at 7537.26, but market watchers believe a Santa rally this year may be difficult to sustain.

“The FTSE 100 shrugged off losses on Wall Street overnight to trade higher on Wednesday morning as China showed genuine signs of easing up on Covid restrictions,” said AJ Bell investment director Russ Mould.

“Warnings from big American investment banks of a US recession in 2023 are setting less than happy mood music heading into the end of 2022 and the prospects of a Santa rally are fading by the day.

“The Federal Reserve meets next week to decide its latest rate increase and it still has plenty to think about as economic data delivers conflicting messages about the future trajectory of inflation and growth.

“Further evidence of a slowdown in UK house prices is unsurprising, but it underlines how tough the property market is right now as mortgage rates remain elevated and people don’t feel in a position to make such a big commitment thanks to uncertainty and cost of living pressures.

“The turmoil could become self-fulfilling as messages about double-digit falls in house prices moving forward lead potential purchasers to sit on their hands.”

8.54am: GSK and Haleon lead Footsie risers but commodity companies weigh

GSK PLC continues to lead the way in the UK blue chip index.

Its shares are up 12.67% after a favourable US court ruling relating to a case claiming the Zantac heartburn drug caused cancer.

Victoria Scholar, head of investment at interactive investor said: “Shares in GSK are trading sharply higher after a US ruling spared the drugmaker of thousands of lawsuits alleging that heartburn drug Zantac was carcinogenic. GSK said it will continue to defend itself vigorously and said the scientific consensus is that there is no consistent or reliable evidence that ranitidine increases the risk of any cancer...

"The Zantac litigation has been a major overhang on the stock for some time with GSK shares set for their biggest one-day gain since 1998."

Haleon PLC, the consumer healthcare business spun out of GlaxoSmithKline, is also higher.

It has repeatedly said it has no liabilities in any Zantac legal claim, but the US news has helped push its shares up 6.03% to 313p.

It is also being supported by positive comments from analysts at Barclays (LON:BARC), who have moved their recommendation from equal weight to overweight and raised their price target from 298p to 360p.

Elsewhere Smurfit Kappa Group plc is up 2.15% after it announced the start of a buyback of up to 1.2mln shares.

But commodity companies are proving a drag.

The poor Chinese trade data has upset mining shares, with Glencore PLC (LSE:GLEN) down 3.35% and Antofagasta PLC (LSE:LON:ANTO) falling 1.92%.

Meanwhile the recent falls in the oil price have left Shell PLC (LSE:SHEL, NYSE:SHEL) 1.51% lower.

And Persimmon PLC (LON:PSN) is down 1.61% after a downgrade from Investec and the fall in house prices reported by the Halifax.

Overall the FTSE 100 is off its best levels, up 8.79 points or 0.12% at 7530.18.

8.30am: North East only region to show house price growth

Back with the UK housing market, and the only region of the UK which saw any growth in annual house price inflation according to the Halifax was the North East.

There the rate of annual growth edged up slightly to +10.5% (from +10.4%). It’s also now the only area of the UK with annual house price inflation in double figures, with an average property price of £173,587.

Wales (+7.9%, average price of £220,689) and the South West (+8.4%, average price of £307,750) have seen the sharpest slowdown of annual growth (from +11.5% and +10.7% respectively).

This is notable given both were key hotspots of house price inflation during the pandemic, suggesting that previous drivers of the market such as the race for space and heightened demand for rural living are now receding, said Halifax.

Scotland also saw its pace of annual house price inflation continue to slow, now at +6.5% (from +7.4%) with a typical property now costing £203,132.

House prices in Northern Ireland are up +9.1% year-on-year, easing back from +9.7% last month, with an average property price of £185,097.

The pace of annual property price inflation also slowed in London, which continues to lag the other UK regions and nations. House prices have risen +5.2% over the last 12 months, down from +6.6%. The average property price in the capital remains well above the UK average at £549,160.

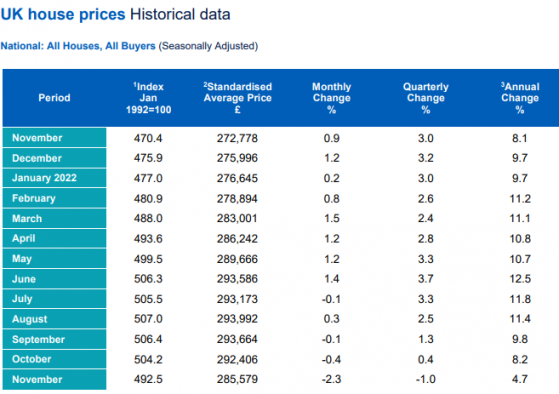

Here are the overall figures going back a year:

8.19am: Investors positive - for now

Leading shares have opened higher, with investors deciding to accentuate the positive for now and helped by a jump in GSK PLC (LSE:GSK, NYSE:GSK) shares.

The latest moves by China to ease its pandemic restrictions have been welcomed but they have been countered by growing concerns about a global recession amid rising interest rates.

China's trade data showing a 8.7% plunge in exports and a 10.6% slump in imports is not helping sentiment, but does show why the country's government has been forced to change tack on its zero-COVID policy.

Despite the drop in UK house prices in November adding to the worries about a downturn, the FTSE 100 is up 19.85 points or 0.26% at 7541.24.

The index is being supported by a 13% rise in GSK shares after a favourable US court ruling in a case that had claimed the Zantac heartburn drug caused cancer.

But overall, economic concerns continue.

Susannah Streeter, senior investment and markets analyst, Hargreaves Lansdown:

‘’Fears are growing that economies are in for a rough time ahead as feverish inflation and the bitter interest rate medicine being used to bring it down take effect.

"Worries deepened amid warnings from US banking and media sectors that navigating through the storm would not be easy, while the latest data has shown China’s trade has been sideswiped by a drop in global demand and zero-COVID policies. Despite today’s easing of restrictions it’s clear China’s COVID nightmare is not at an end."

Concerns about an economic slowdown had push crude to its lowest level for a year, with Brent hitting a low of US$79 a barrel.

But China's move to loosen restrictions has helped oil recover a little this morning, with Brent up 0.26% at US$79.56.

8.06am: US dollar surprisingly strong against the pound and euro

Traders are anticipating the Bank of Canada’s interest rate decision later today.

A 50 bps hike is generally expected, which would mark the seventh consecutive increase by the bank, though 25 bps is also on the cards.

USD/CAD has rallied hard over the past two days in anticipation of the announcement, bringing the pair to a three-week high of 1.356, although the pair has been somewhat indecisive in this morning’s Asia trading window.

With the US Dollar Index (DXY) performing surprisingly well, Cable has continued to retreat from those five-month highs achieved towards the end of last week. The pair is currently changing hands at 1.213, having closed 0.5% lower on Tuesday.

It is debatable how long the US dollar can sustain its surprise momentum, considering broader market acknowledgement that the dollar top has been reached.

GBP/USD pares back, but dollar rally may be short lived – Source: tradingview.com

Somewhat indicatively, average UK house prices fell -2.3% month on month according to Halifax data released this morning, marking the biggest monthly drop since October 2008.

The greenback is showing strength against the euro, with the EUR/USD pair dipping another 15 pips to 1.045 this morning.

Eurozone GDP figures are due later today. The European Commission revised its forecasts up recently – from 2.7% to 3.2% – though a considerable slowdown in 2023 is all but a given.

EUR/GBP is currently trading at 86.21p, having inched back around 10 pips from the morning high.

7.43am: House prices fall for third consecutive month - Halifax

UK house prices dropped in November at their fastest monthly rate since 2008, falling for the third consecutive time with potential buyers put off by rising mortgage rates and the cost of living crisis.

According to the latest Halifax survey, prices fell by 2.3% last month, compared to a 0.4% decline in October.

The typical UK property now costs £285,579, down from £292,406 last month.

The annual rate slowed from 8.2% to 4.7%.

Kim Kinnaird, director of Halifax Mortgages, said: “The monthly drop of 2.3% is the largest seen since October 2008 and the third consecutive fall.

“While a market slowdown was expected given the known economic headwinds – and following such extensive house price inflation over the last few years (+19% since March 2020) – this month’s fall reflects the worst of the market volatility over recent months.

“Some potential home moves have been paused as homebuyers feel increased pressure on affordability and industry data continues to suggest that many buyers and sellers are taking stock while the market continues to stabilise.

“When thinking about the future for house prices, it is important to remember the context of the last few years, when we witnessed some of the biggest house price increases the market has ever seen. Property prices are up more than £12,000 compared to this time last year, and well above pre-pandemic levels (+£46,403 vs March 2020)

“The market may now be going through a process of normalisation. While some important factors like the limited supply of properties for sale will remain, the trajectory of mortgage rates, the robustness of household finances in the face of the rising cost of living, and how the economy – and more specifically the labour market – performs will be key in determining house prices changes in 2023.”

Jonathan Hopper, chief executive of Garrington Property Finders, said: “The speed with which the market has turned has left many people playing catch-up.

“Plenty of sellers still seem to think it’s 2021, not realising that to buyers it feels more like 2008.

“The post-pandemic days of soaring prices and the ‘race for space’ as professionals snapped up homes in the middle of nowhere are over.

“Demand from buyers has throttled back, with many taking the time to reflect and negotiate aggressively on price. As supply starts to exceed demand, homes that are less than perfect are struggling to get a look in."

7.00am: Footsie to shrug off heavy US losses

FTSE 100 expected to open higher today shrugging aside hefty losses in the US as China announced a nationwide loosening of its strict zero-Covid measures.

China will now allow people with asymptomatic COVID-19 or mild symptoms to quarantine at home in another relaxation of its rules.

In London, spread betting companies are calling the lead index up by around 20 points.

In the US markets fell again as uncertainty around the pace and direction of Federal Reserve rate hikes and further talk of a looming recession dented sentiment.

The S&P fell for a fourth day in a row, closing 58 points lower, or 1.44%, to 3,941, the Dow Jones Industrial Average slipped 351 points, or 1.03%, to 33,596 and the Nasdaq Composite dipped 225 points, or 2%, to 11,015.

In Asia markets have been mixed with the latest China trade data pointing to the damage the country’s zero-Covid strategy is doing to its economy.

China's imports and exports plunged in November to levels not seen since early 2020, according to official figures.

Back in London and results are due from Mitchells and Butler PLC and Moonpig Group PLC while Halifax house price data is also expected.

Read more on Proactive Investors UK