Welcome to the Investing.com UK weekly FTSE 100 latest update, designed to keep investors informed on the newest UK stock market movements and key developments. In this weekly report, you'll find a summary of the last week's significant news, and trends affecting the FTSE 100 index, helping you stay ahead with timely insights for your investment decisions.

We update every Friday during London Stock Exchange (LSE) market opening times between 8:00am-4:30pm UK local time (GMT+1).

FTSE 100 Share Price Opening 23rd September 2024

The closing share price for the start of this week, Monday 23rd September, was 8,259.71, which sat +0.36% higher than at close on Friday 20th September, suggesting a modestly positive start in an attempt to make up for the previous week’s losses.

Investor Sentiment This Week For FTSE 100 Predictions

The FTSE 100 started the week with a +0.36% boost on Monday and, apart from Wednesday, has seen more positive movements day on day. Does this suggest that the ‘September Scaries’ that the global stock markets usually suffer from lack teeth this year?

UK Growth Reflects a Return to Normalcy

Analysts are reassuring investors that the UK's private sector growth is experiencing a return to normal trends, not a severe downturn. According to EY ITEM Club, both services and manufacturing sectors are still expanding at a healthy pace. Recent data from S&P Global showed the UK purchasing managers index (PMI) declined slightly to 52.9 in September from 53.8 in August. While any figure above 50 indicates growth, this dip has sparked some concerns. However, it seems driven by uncertainties surrounding October’s Autumn Budget and potential higher taxes, indicating a shift back to sustainable growth levels rather than a major slowdown. Analysts, including Kyle Chapman from Ballinger Group, believe the UK is on course for a "soft landing" as the Bank of England looks to gradually taper interest rates.

Health and Beauty Spending Shines

Figures from Barclays (LON:BARC) PLC revealed that spending on health and beauty products significantly outpaced the broader retail sector last month. Spending on beauty products jumped by 7.3% year-on-year, marking the fastest growth since January 2023. In contrast, overall retail spending rose only slightly by 0.1%, with non-essential purchases inching up by 0.7%.

Bank of England and Interest Rates

Bank of England Governor Andrew Bailey expressed optimism about the direction of interest rates. After the initial 0.25% cut in August, Bailey told the Kent Messenger that he expects rates to gradually decrease as inflation falls. Inflation, which peaked at 11.1% in 2022, had reduced to 2.2% by August 2023. Despite the base rate holding steady this month, Bailey acknowledged the need to maintain sustainable inflation levels, noting the complexity of its current composition.

Competitive Mortgage Markets Benefit Buyers

Mortgage rates have continued to decline, fuelled by competitive offers from lenders, including the Nationwide Building Society (LON:NBS). As of Tuesday, average two-year fixed rates dropped slightly to 5.43%, and five-year rates declined to 5.09%. Nationwide further intensified the competition by increasing its lending limit to six times the borrower's salary, a first for a major UK bank. This move aims to attract new buyers amidst the Bank of England's recent decision to keep the base interest rate unchanged.

September is historically a volatile month for stocks but, as always, long-term investors are keeping an eye on the index and snapping up value buys wherever they can.

Want to know whether specific FTSE 100 stocks fit your investment strategy? Use InvestingPro and win on your decisions. Sign up TODAY for less than £9 per month and get up to an additional 10% off your 1-year plan!

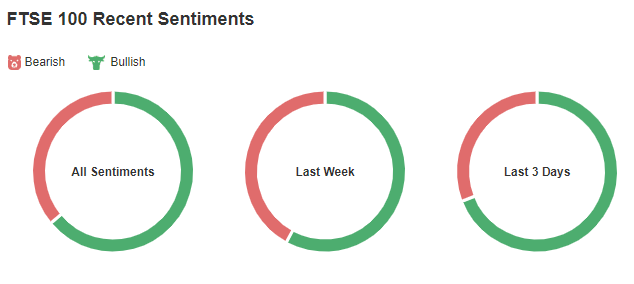

We can see that the Investing.com UK community’s sentiment towards the FTSE 100 index has again reversed its bearish momentum and has swung to a 31-69 Bearish-Bullish split, compared to last week’s 38-62.

Notable FTSE 100 Movements & Stock Market News

Here are some of the top stories from the footsie 100 constituents over the past 5 days.

Vodafone Italia Sale Progresses

The European Commission has given the green light to Vodafone Group PLC (LON:VOD) Italia’s takeover by Swisscom. Although still subject to regulatory clearance, including from Italy’s competition authority, this EU nod is a big step forward. The deal, initially unveiled in March, is valued at €8 billion (£6.7 billion) as part of Vodafone's strategy to streamline its European operations. Swisscom expects the acquisition to finalize early next year. Vodafone’s shares inched up by 0.3% on Tuesday.

Raspberry Pi’s Impressive Debut Financial Report

Raspberry Pi Holdings PLC (LON:RPI) wowed investors with stronger-than-expected profits in its first financial results since going public. Underlying profits jumped to $20.9 million, a 55% increase from last year, with revenues climbing 61% to $144 million.

While sales volumes were slightly below expectations, a shift towards higher-margin products bolstered the results. The previous year was hampered by supply constraints, which Raspberry Pi has since addressed.

Smiths Group Stumbles

Smiths Group PLC (LON:SMIN) struggled this week, falling to the bottom of the FTSE 100 after reporting disappointing earnings. Despite a 5% rise in operating profit to £526 million and a 3% revenue boost to £3.1 billion, the results fell short of market expectations of £535 million profit. To address these issues, Smiths Group is launching a cost-cutting plan aiming to save £35 million annually and will review its operational footprint and research priorities.

The company is also expanding with acquisitions of US-based Modular Metal Fabricators and Canada’s Wattco for £110 million to enhance its international heating business.

Rolls-Royce Ambition Goes Nuclear

Rolls-Royce Holdings PLC (LON:RR) is on the brink of securing deals to build mini nuclear reactors (SMRs) in Sweden and The Netherlands. Already selected as the favoured SMR supplier in the Czech Republic, Rolls-Royce is now close to similar agreements with other countries.

Swiss energy firm Vattenfall has shortlisted Rolls-Royce for potential SMR deployment, and an exclusive agreement with Dutch company ULC-Energy has been signed, pending government approvals.

AstraZeneca Disheartening Cancer Trial Results

AstraZeneca PLC (LON:AZN) experienced a significant drop in shares, hitting a five-month low after another disappointing phase III cancer drug trial. The trial for their drug Dato-DXd, aimed at treating late-stage breast cancer, did not show a significant survival benefit compared to standard chemotherapy.

Despite this, AstraZeneca noted the drug had shown promise in earlier phases and blamed the trial outcome partly on the approval of other treatments like its own Enhertu during the trial period. These factors could have impacted overall survival results.

Susan Galbraith, head of oncology research at AstraZeneca, reaffirmed the drug's potential and ongoing discussions with regulatory authorities. Ken Takeshita from Daiichi Sankyo, AstraZeneca’s partner, reiterated the drug's past success in improving progression-free survival.

Since early September, AstraZeneca's shares have fallen around 13%, with recent failures in other cancer trials, including one for non-small-cell lung cancer, contributing to the decline.

Despite these hurdles, AstraZeneca remains focused on advancing its oncology research and achieving better outcomes for cancer patients.

Rightmove Snubs Right-Wing-Owned Takeover Bid

Rightmove PLC (LON:RMV) has rejected a £6.1 billion acquisition bid from right-wing media mogul Rupert Murdoch’s REA Group, deeming the offer as undervaluing the company and its future prospects. This marks the fourth proposal turned down by Rightmove, which has left REA Group expressing frustration over the lack of meaningful negotiations.

Financial advisory firm Panmure Liberum described the latest bid as complicated and suggested that a successful deal is unlikely without a more creative and higher valuation from REA. Rightmove remains a dominant player in the UK online property market, generating significant revenue from advertising and premium listings.

Investors will be watching closely to see if REA amends its offer to better reflect Rightmove’s strong market position and growth potential.

Co-op Turns its Fortunes Around

The Co-operative has reported a promising swing back to profitability in the first half of the year. Pre-tax profit stood at £58 million, a significant recovery from a £33 million loss in 2023. This turnaround was driven by a 1.5% revenue increase to £5.6 billion, with food sales and life services performing particularly well.

Despite a challenging external environment, Co-op's chief executive praised the company's resilience and market outperformance. Food revenue alone climbed by 3.2%, and growth was seen across its funeral, legal, and insurance segments.

Today's FTSE 100 Close

The above investor sentiment and factors driving this week's ‘Footsie’ volatility meant that today the FTSE 100 is likely to close at a price which sits comfortably higher than the weekly FTSE 100 opening price of 8,229.99.

Best FTSE 100 Shares To Buy

Investors can also use our free stock screener to filter top FTSE 100 companies according to their investment strategy, and add them to a watchlist today.