Proactive Investors -

- FTSE 100 higher, up 24 points

- Retail sales in surprising fall, down 1% in December

- Google to cut 12,000 jobs

10.54am: Google to axe 12,000 jobs, 6% of workforce

Google's parent company Alphabet (NASDAQ:GOOGL) Inc. has announced it will cut about 12,000 jobs, becoming the latest tech giant to slash its workforce after years of growth.

The cuts represent more than 6% of the company's global workforce.

The reductions will cut across Alphabet units and geographies, the company said, though some areas, including recruiting and projects outside of the company’s core businesses, would be more heavily affected.

“Over the past two years we’ve seen periods of dramatic growth. To match and fuel that growth, we hired for a different economic reality than the one we face today,” Alphabet chief executive Sundar Pichai wrote in a message to employees according to The Wall Street Journal.

10.04am: Footsie holds firm, Deutsche downgrades Virgin Money (LON:VMUK)

The Footsie has held firm as we approach mid-morning, up 22 points.

As Russ Mould investment director at AJ Bell noted stocks have been supported by “a good showing from parts of Asia, including a 1.8% rise in Hong Kong’s Hang Seng index as investors bid up energy and internet stocks,”

“The FTSE 100 was lifted by oil producers, miners, banks and utility companies. Investors noted price strength among major commodities which would support earnings for natural resources producers” he noted, adding “Brent Crude oil rose by 1% to $87.02 per barrel while copper this week hit its highest level since June 2022 on hopes for an increase in demand linked to China’s reopening and amid low inventories."

One stock on the wane was Virgin Money PLC which fell 1% as Deutsche Bank (ETR:DBKGn) downgraded to ‘hold’ from ‘buy’ with a 230p price target.

Analyst Robert Noble pointed out Virgin Money's c.60% share price performance from October lows brings the stock trading broadly in line with UK banks.

He felt Virgin “has less ability to offset mortgage spread compression and we expect the c.11% 2024 ROTE target will be hard to reach.”

Noble also said he does not expect any further expansion in Virgin Money's net interest margin 2023/24, in 2023/24e, in contrast to significant increases at other UK banks.

9.17am: Hargreaves Lansdown (LON:HRGV) falls as Jefferies downgrades

Some other movers and shakers in London in early exchanges.

Hargreaves Lansdown PLC is top of the FTSE 100 fallers following the downbeat trading update from Close Brothers PLC and as Jefferies downgraded the stock to underperform.

The broker said two things have changed since its 9 January update on the UK wealth names it covers: “Vanguard has said that it recruited more new customers than Hargreaves Lansdown/ and AJ Bell's D2C platform combined in 2022 “ and AJ Bell has given “a quarterly update showing slower customer growth.”

“With renewed doubt about HL's ability to replace or retain departing customers, and a price target target well below the price, we downgrade to underperform” the broker said.

On the upside and despite the drop in retail sales was ASOS PLC (LON:ASOS) which surged 9.3% as Bank of America (NYSE:BAC) upgraded to buy from underperform.

On the downside was De La Rue (LON:DLAR) PLC which said it has been implicated in an investigation in India into the activities of Arvind Mayaram, the country’s former Finance Secretary.

The banknote printer said it had not served the Government of India or the Central Bank of India in any capacity since 2016, adding that it believes that there is no merit to the allegations and it is seeking legal advice in this regard.

Shares fell 6.22%.

9.03am: FTSE higher but Close Brothers tumbles

FTSE 100 continued its steady path upwards on Friday supported by gains in oil stocks, as the oil price rose, and by an upbeat trading statement from SSE (LON:SSE) PLC.

At 9.00am London’s lead index was up 31 points at 7,778 while the FTSE 250 advanced 60 points to 19,634.

Victoria Scholar, head of investment, interactive investor said: “After yesterday’s sell-off, European markets have opened higher with SSE at the top of the FTSE 100 after an upbeat trading update”

She also noted that after a rally in China overnight, “China-sensitive stocks on the FTSE 100 are outperforming including Prudential (LON:PRU), Glencore (LON:GLEN) and Rio Tinto (LON:RIO) ahead of the Chinese New Year.”

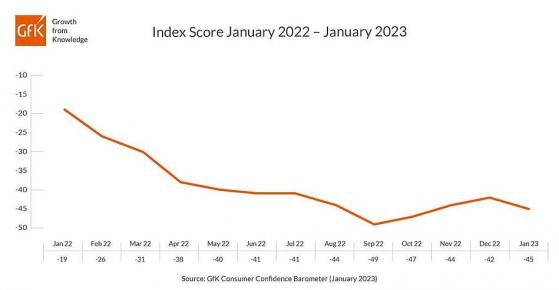

A surprise fall in retail sales was largely shrugged aside while GfK’s consumer confidence index fell in January adding to the mood that 2023 will be a challenging year for the UK’s economy.

One notable faller was Close Brothers PLC as it warned of reduced revenue and increased provisions at Novitas Loans, which it bought in 2017.

Net income related to Novitas will reduce from c.£36mln in the fiscal year 2022 to c.£8mln by 2024, the company said.

Peel Hunt noted that including Novitas, the bad debt ratio increased to 1.7% (from 1.2% in the first quarter of the fiscal year), reflecting a £24.8mln provision, with the anticipation of a further up to £90mln provision in the interim financial statement.

The company also said Winterflood's performance has been adversely impacted by the continued market-wide slowdown in trading activity in higher margin sectors.

Shares fell 11.9% and pulled others in the sector lower with Hargreaves Lansdown PLC down 2.6%.

8.24am: Consumer confidence falls in January - GfK

GfK’s long-running consumer confidence index decreased by 3 points in January to -45 with four measures down, and one up, in comparison to December.

In a statement, Joe Staton, client strategy director, GfK said: “After a short-lived and weak rally in Q4 last year, UK consumer confidence has slipped to -45 in January. Consumers have a New Year hangover – but it’s of the economic kind – with high levels of pessimism over the state of the wider economy.”

Staton suggested this hangover won’t vanish quickly either.

“The only glimmer of hope in the results is a slight uptick in the outlook for our personal financial situation, but this is of little comfort because it is still 25 points lower than this time last year” he noted.

But he added a “six-point decline in the major purchase index does not augur well” because consumer spending is a driving force of the economy and future growth.

He forecast a bumpy ride for the consumer in 2023 with the forecast for consumer confidence this year “not looking good.”

8.15am: FTSE 100 shrugs off weak retail sales figures

FTSE 100 has made a solid start to the last trading day of the week with the lead index up 26 points in early exchanges shrugging aside a surprise fall in retail sales as the cost of living crisis took its toll on the high street.

Richard Hunter, head of markets at interactive investor said: "UK markets continued to fly the flag, dodging the recessionary bullet fears for the time being. The FTSE 100 was buoyed by a return to risk-on behaviour, with the miners and oils especially in demand."

Retail sales fell 1% in December, against City expectations for a rise of 0.5%, while November’s figure was revised downwards to a fall of 0.5% from 0.4%.

Gabriella Dickens, senior UK economist at Pantheon Macroeconomics, suggested that while heavy snowfall and intensifying strike action in December likely contributed to the further drop in retail sales, “the underlying picture is weak too.”

“Looking ahead, households likely will have to contend with rising energy prices, higher new mortgage rates and falling employment” she pointed out, while “falling employment will reduce households’ spending both directly and indirectly, as people likely will save more for precautionary reasons and borrow less.”

Better than-expected subscriber numbers from Netflix (NASDAQ:NFLX) after the US market close gave a lift to sentiment after US markets posted further losses helping to support gains in Asia with the Nikkei and Hang Seng both rising.

On a quieter day for corporate news, SSE PLC jumped 3.14% as it raised its EPS guidance for the year to 150p from 120p boosted by rising gas prices. It also pledged a bumper dividend.

Seraphine Group PLC soared 196% as Purple Bidco Limited made a 30p per share bid valuing the company at £15.3mln, while 4imprint Group Plc rose 4.47% after it said it anticipates revenue and pre-tax profit at the upper end of guidance.

7.43am: SSE generates big jump in EPS guidance

SSE PLC has raised full-year EPS expectations for the full-year 2022/23 as higher gas prices and better gas storage optimisation offset lower-than-expected renewables output and hedge buy-back costs,

The FTSE 100 listed generator said it now expects EPS to be more than 150p against previous guidance of 120p.

SSE also pledged to pay a full-year dividend of 85.7p per share plus RPI for 2022/23 followed by a rebase to 60p in 2023/24 to support the group's significant investment and growth plans.

The dividend is then expected to increase by at least 5% per annum in 2024/25 and 2025/26, it said.

The update “reflects the strength of the group's diverse business mix, which continues to create value, alongside the increased certainty from strong operational performance and supportive market conditions” SSE said.

7.18am: Retail sales in surprise fall in December

UK retail sales volumes unexpectedly fell in December by 1% confounding City expectations for an increase of 0.5% adding to signs that the cost of living crisis has squeezed consumer spending power.

The data from the Office for National Statistics (ONS) showed that November’s figure was revised to a fall of 0.5% from 0.4% and the data now mean sales volumes are 1.7% below their pre-coronavirus (COVID-19) February levels.

Retail sales volumes fell by 1.0% in December 2022, following a fall of 0.5% in November.Retail remains 1.7% below its pre #COVID19 level.

➡️ https://t.co/BItPplBcFX pic.twitter.com/bkH0vVQEnT

— Office for National Statistics (ONS) (@ONS) January 20, 2023

Non-food stores sales volumes fell by 2.1% over the month, with continued feedback from retailers and other wider evidence that consumers are cutting back on spending because of increased prices and affordability concerns, the ONS said.

Food store sales volumes fell by 0.3% in December 2022 from a rise of 1.0% in November, with comments from some retailers suggesting that customers stocked up early for Christmas, the report added.

The proportion of online sales fell to 25.4% in December 2022 from 25.9% in November, with anecdotal evidence that Royal Mail (LON:IDSI) strikes led to consumers shopping in stores more.

7.00am: FTSE set to bounce back

The FTSE 100 is expected to open higher on Friday, recouping some of yesterday’s heavy losses despite further falls in the US overnight, as strong subscriber figures from Netflix after the New York bell lifted the mood.

Spread betting companies are calling the lead index up by around 37 points.

US markets suffered further falls Thursday as disappointing housing market data added to worries that the US economy has tipped into recession.

At the close, the Dow Jones was down 252 points, or 0.76%, to 33,045, the S&P 500 was 22 points lower, or 0.57%, to 3,906 and the Nasdaq Composite fell 105 points, or 0.96%, to 10,852.

But after the market close, streaming service Netflix reported much stronger than expected subscriber numbers alongside slightly better revenue figures.

Back in London, UK retail sales numbers, due shortly, will provide the early focus.