Proactive Investors -

- FTSE 100 slips back from session highs, up 0.2%

- IAG (LON:ICAG) tumbles despite return to profit and Air Europa deal

- Consumer confidence improves in February - GfK

ONS data confirms food shortages

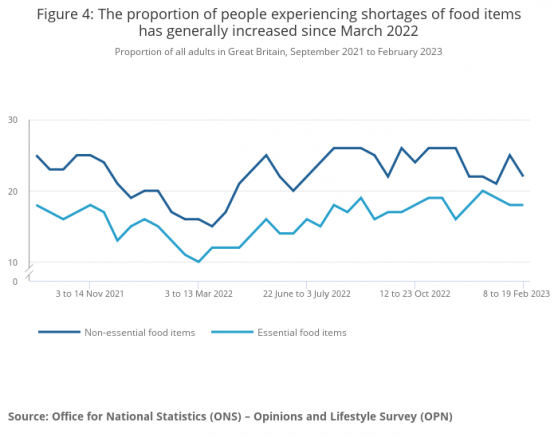

The shortage of food in the shops is reflected in new data from the Office for National Statistics.

An ONS report showed a quarter of adults reported that they could not find a replacement when the items they needed were not available when food shopping in the past two weeks.

This proportion has increased from 15% in a similar period a year ago, indicating that Britain’s fruit and vegetable shortages are not just down to seasonal factors.

Nearly 2 in 10 adults experienced shortages of essential food items that were needed on a regular basis in the past two weeks, up from 13% a year ago.

Around 22% adults experienced shortages of non-essential food items in the past two weeks. Since March 2022, the proportion has seen a general increase to its current level, the ONS says.

Turning Japanese - incoming governor lifts markets

Equities in London look set the end the week on a positive note but globally shares are heading toward their biggest weekly fall of the year.

Providing support on Friday was news from Japan where Kazuo Ueda, incoming governor of the Bank of Japan, indicated he would maintain a loose monetary policy.

During a lower house confirmation hearing, Kazuo Ueda, who will take over as governor of the Bank of Japan (BOJ) in April, said ultra-low interest rates were still needed to support Japan's fragile economy, warning of the dangers of responding to cost-driven inflation with monetary tightening

Russ Mould at AJ Bell said, “markets breathed a sigh of relief that there would not be a radical shift in strategy.”

The Nikkei 225 jumped 1.3% to 27,453.48. Back in London and the FTSE 100 is close to best levels for the day, up 0.4% at 7,935.17.

Final screening for Cineworld?

“Is the end in sight for Cineworld as a listed business?” That was the question posed by AJ Bell’s Russ Mould after the cinema operator said it had received various expressions of interest for parts of its estate, suggesting a break-up of the group could be on the cards.

Shares in the firm crashed a further 21% on the news.

Mould said, ““From where we stand today, two things look almost certain – one, that we won’t see a bidder for the whole business; and two, that shareholders will be left with nothing.”

“Even if the company does sell some of its subsidiaries, the end game still appears to be a debt-for-equity swap whereby creditors take control of the business.”

He felt, “Cineworld has paid the price for being too aggressive with its growth ambitions, weighed down by significant debt when the pandemic struck and the subsequent reopening of the cinema industry being too weak to repair its finances.”

“Selling subsidiaries doesn’t mean it will be suddenly swimming in cash. Any interested party in Cineworld’s assets knows that the cinema group is desperate and so they are likely to pitch any offers at a low level.”

But no signs of a slowdown in the FTSE 100 which is close to session highs at 7,933.38, 25.66 points, or 0.32%.

Car production stable in January

British car production was stable in January, down -0.3% with just 215 fewer units made, according to figures from industry body Society of Motor Manufacturers and Traders.

The decline was driven chiefly by structural changes, reflecting a move from car to van making at one major plant, but with supply chain shortages still afflicting some manufacturers.

The ongoing shift to electrified car production continued, with combined battery electric, plug-in hybrid and hybrid electric vehicle volumes up 49.9% to 28,329 units.

They represented more than four in every 10 (41.3%) cars made in January, a near record monthly share, and further evidence of the UK’s capability in making these important models, most of which (77.0%) are exported to meet global demand.

Production for the UK rose 5.6% to 12,196 units, while exports declined by -1.5%, largely due to the suspension of shipments to Russia, which accounted for 83.6% of the loss.

In total, some 56,379 cars – more than eight in 10 of all those produced – were destined for overseas markets, with over half of these (56.6%) for the EU, with next most important global destinations the US (9.3%), China (8.8%), Japan (4.4%) and Australia (3.3%).

Mike Hawes, SMMT chief executive, said, "Automotive manufacturing can drive long-term growth for the low carbon economy but the sector needs competitive conditions to attract investment."

“We now look to the forthcoming Budget for the necessary measures that will enable the automotive sector to deliver its undoubted potential.”

Germany on brink of recession as Q4 GDP falls

Not good news from Germany where fourth quarter GDP in Europe’s largest economy fell 0.4% compared to the third quarter.

The figure released by Destatis was worse than expected and below a previous estimate of negative 0.2%.

Economists said it left Germany on the brink of recession.

Good Morning from Germany where economy fared worse than exp. GDP shrank 0.4% in Q422 vs prev reading of -0.2%. Private consumption plunges 1% QoQ, cap investment crashed 2.5% QoQ. Public spending rose 0.6% QoQ. Economists predict another neg quarter, would tip GER into recession pic.twitter.com/HJDeVhF9zS— Holger Zschaepitz (@Schuldensuehner) February 24, 2023

ING Economics said, “today’s numbers mark the first part of what could become a technical recession in Germany.”

“We think that the risk of yet another contraction in the first quarter and, thus, a technical recession is high and that the German economy is still miles away from staging a strong rebound.”

Pantheon Macroeconomics agreed. “Looking ahead, the recent upturn in the surveys is positive, but we doubt that the economy has enough momentum to avoid another fall in GDP in Q1, and as a result, a technical recession.”

The news failed to stop the Dax opening higher but a gain of 0.1% meant it underperformed London, FTSE and Paris where the FTSE 100 and CAC 40 are botj up 0.3%.