Proactive Investors -

- FTSE makes steady progress

- House prices rise in March says Halifax

- Shell (LON:RDSa) rises after first quarter update

House price data resilient but challenges remain

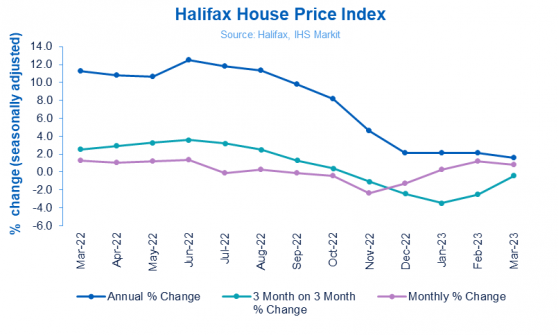

The latest house price data from mortgage lender Halifax is resilient but can’t hide the fact that a “slowdown in the housing market is at play.”

That was the view of Myron Jobson at interactive investor noted prices were holding up despite “a double whammy of rampant inflation and rising interest rates.”

“The recent fall in mortgage rates, with lenders seemingly engaged in a mortgage price war, and a strong labour market, with unemployment at a near record low, has helped keep prices elevated,” he explained.

“But there is mounting evidence that the housing market is seemingly in a pendulum moment — swinging back in a buyer’s market direction,” he cautioned.

He said the crucial spring-buying season could give us a clear indication of the state of the property market.

“In spring, home prices tend to rise due to increased seasonal demand, but current indicators do not signal that the season will be a robust one,” he pointed out.

The EY ITEM Club said taking the Halifax measure in isolation, “it offers another sign that the economy is holding up against headwinds from high inflation and rising interest rates much better than many expected.”

They noted mortgage approvals and survey evidence of housing transactions both appear to have bottomed out while there are signs of green shoots in the economy.

“However, prices still look very stretched on most affordability measures,” they added.

Housebuilders were mixed after the release. Persimmon PLC (LON:PSN) rose 1.5%, Bellway (LON:BWY) gained 0.8% and Redrow (LON:RDW) firmed 0.6% but Barratt Developments PLC (LON:BDEV) slipped 1.0%.

Miners lead the Footsie higher

The FTSE 100 has motored higher, now up 38 points, led by gains in oil major Shell after its first quarter trading update and the mining sector.

Miners were given a lift by encouraging data from China where the services sector showed strong growth boosting hopes for an overall recovery in the country, a major consumer of base metals and other minerals.

Anglo American (LON:AAL), Antofagasta (LON:ANTO) and Rio Tinto (LON:RIO) were all prominent risers.

Duncan Wrigley at Pantheon Macroeconomics said: "Consumer services led China’s reopening rebound, as elsewhere in the world."

"But now the services rebound is broadening out. Business activity readings in the official PMI were over 60 for retail, rail, road and air transport, internet services, financial services and leasing and business services."

He felt "China’s recovery is gaining momentum, though still uneven."

Ferrexpo (LON:FXPO) was also on the rise with shares up 5.4% in early deals after it reported a significant increase in first-quarter production thanks to an improved electricity supply for its operations in central Ukraine.

The company more than doubled its total iron ore pellet output to 900,000 tonnes during the quarter, compared to 420,000 tonnes in the three months prior.

THG (LON:THG) advanced 6.5% after announcing a 10-year strategic partnership with beauty eCommerce retailer Maximo Group, whose websites include allbeauty.com and fragrancedirect.co.uk.

The partnership is expected to add over £150mln in gross merchandise value to the Ingenuity platform annually, with the ambition to re-platform the site by the end of Q2 2023.

FTSE 100 pushes ahead

The FTSE 100 pushed ahead in early trading boosted by news of rise in China’s service sector, a resilient housing market survey and gains in Shell after a first quarter trading update.

At 8.15am London’s lead index was at 7,695.31, up 32.37 points, or 0.42% while the FTSE 250 was little moved.

China’s service sector expanded at its fastest rate in more than two years in March, according to a closely watched private gauge, boosted by a recovery in demand as the country left behind strict Covid-19 curbs.

The Caixin China General Services purchasing managers’ index reached 57.8 for the month, ahead of February’s reading of 55 and the highest level since November 2020. A 50-point reading separates expansion from contraction.

The news was welcome after disappointing data in the US this week which raised concerns of a global economic slowdown.

Elsewhere, UK house prices unexpectedly rose by 0.8% between February and March according to mortgage lender Halifax, owing to an easing of mortgage rates.

The rise marks a slowdown from the 2.1% growth registered in the previous month but was above City forecasts for a fall of 0.3%.

The rise also contrasted to data from Nationwide which reported a 3.1% annual rate fall in March.

Kim Kinnaird, director at Halifax Mortgages, attributed the reading to an easing of mortgage rates and said borrowing costs had “largely reversed” after their November spike.

Sarah Coles, head of personal finance, Hargreaves Lansdown (LON:HRGV) said: “The spring bump has brought a second month of rising house prices, and a whiff of optimism to the housing market.”

“Annual price rises at their lowest in three and a half years will keep a lid on enthusiasm, and sticky inflation could prove its undoing, but there’s an air of hope that the correction may not be as painful as had been feared.”

Shell PLC (LSE:SHEL, NYSE:SHEL) firmed 1.7% in early trading after its first quarter update. The oil major forecast a rise in Integrated Gas production in the first quarter though it predicted an adjusted corporate loss due to a number of one-off tax charges.

Shell forecast an adjusted loss in its corporate segment between US$900mln and US$1.2bn widening from US$600mln in the fourth quarter of 2022.

The oil major forecast integrated gas output would rise to between 930,000-970,000 boe in the quarter, up from 917,000 a quarter prior.

But international recruiter Robert Walters declined 3% after issuing cautious comments on recruitment activity in its first quarter update.