Proactive Investors -

- FTSE 100 higher as China ramps up vaccination programme

- Asian-focused stocks lead the risers, Prudential (LON:PRU) and Standard Chartered (LON:STAN) firmer

- Mortgage approvals hit lowest levels since June 2020

9.45am: Mortgage approvals hit lowest levels since June 2020

The number of mortgages approved by lenders in Britain fell in October to its lowest level since June 2020, according to Bank of England data that underscored a sharp slowdown underway in the housing market.

Lenders approved 58,977 mortgages for house purchase last month, down from 65,967 in September. A Reuters poll of economists had pointed to approvals of 60,200

UK Mortgage Approvals Oct: 59.0K (est 60.0K; prevR 66.0K)- UK Net Lending Sec. On Dwellings Oct: £4.0B (est £5.0B; prevR £5.9B)

- UK Net Consumer Credit Oct: £0.8B (est £0.9B; prevR £0.6B)

- UK Consumer Credit (Y/Y) Oct: 7.0% (prev 7.1%)

— LiveSquawk (@LiveSquawk) November 29, 2022

9.00am: FTSE 100 extends gains

The bright start continued with the FTSE 100 now up over 60 points at 7,535.

Asian-focused stocks were strong early performers on hopes that the accelerated vaccination programme announced today in China might be the prelude to an easing of restrictions.

Prudential PLC, up 6.6%, led the risers in the blue-chip index with Standard Chartered PLC, up 3%, another prominent stock on the move upwards.

Neil Wilson at markets.com said despite the continued uncertainties surrounding supply chains, Covid cases and ongoing protests “there is also a sense that the direction of travel can only be towards easing restrictions sometime in the New Year.”

“When exactly that will be depends on many things, not least the pace of vaccinations, but it seems likely to regime will have to relent at some point.“

Shell PLC benefited from a rally in the oil price and its acquisition of Denmark’s Nature Energy, Europe’s largest biogas producer which follows BP PLC (LON:BP.)’s similar acquisition of US biogas producer, Archaea Energy for $4.1bn last month.

Victoria Scholar, head of investment, interactive investor said: “With increased focus on the energy transition and climate change, green energies are a major growth avenue for oil and gas giants like Shell and BP particularly given the lack of long-term investment in fossil fuel projects.”

“Plus, they can also help with energy security, reducing the West’s dependence on Russia for natural gas. Biogas is an alternative to natural gas but is produced using agricultural and other waste.”

But shares in Safestyle UK PLC (AIM:SFE) slumped 21% as it said reduced sales, lower installation volumes, higher costs of order acquisition and costs of maintaining capacity levels in the short-term will adversely impact gross margins.

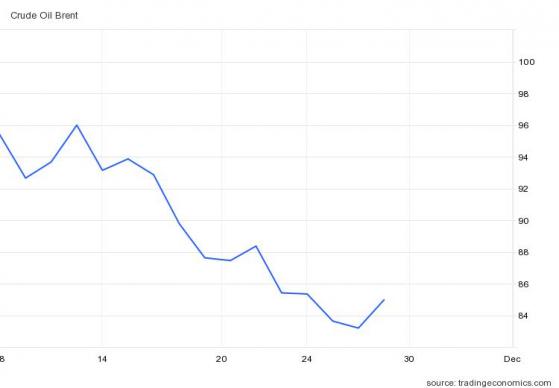

8.40am: Oil price jumps

Oil prices rallied strongly on news that China was ramping up its vaccination programmes aimed at quashing Covid numbers.

Brent crude was up 2.2% to $84.99 while WTI prices rose 2.1% to $78.92.

At the same time, there was also speculation that OPEC+ might agree on another production cut at its meeting on 4 December.

Metal prices were also broadly higher with copper prices up 1.6%, silver up 1.7% while the coal price soared 8.8%.

8.15am: FTSE 100 makes bright start

FTSE 100 made a strong start to the day as commodity prices rallied as China reported a fall in Covid cases for the first time since 19 November and as authorities ramped up its vaccination programme especially aimed at the elderly.

By 8.15am the lead index was up 49 points at 7,523 and the FTSE 250 was up 6 points at 19,299.

The oil price and other commodity prices rallied as yesterday’s volatile session and this was reflected in the leading risers in London’s blue chip index with Rio Tinto (LON:RIO) Ltd up 3.5%, Glencore PLC (LSE:LON:GLEN) up 1.5% and Anglo American PLC (LON:AAL) up 2.2%.

Oil majors and index heavyweights also rose with BP PLC up 1.9% and Shell PLC up 1.85% with the latter also boosted by news that the global energy titan is set to buy Europe’s largest renewable gas producer Nature Energy Biogas A/S in a deal worth $2bn, in a bid to accelerate the major's net-zero goal.

EasyJet PLC slipped in early trading, down 3.25%, despite in line full-year results and a sharp reduction in full-year losses.

Analysts at Peel Hunt noted “The outlook statement is slightly lower than we are assuming across capacity, load factor and unit revenue, but the group is a beneficiary of the recent US dollar weakness, which is supportive of forecasts.”

Richard Hunter, head of markets at interactive investor, commented “Freed from the holding pattern restrictions of the pandemic, easyJet (LON:EZJ) is beginning to emerge from the clouds.”

7.53am: AstraZeneca (NASDAQ:AZN) snaps up Neogene in $320mln deal

AstraZeneca PLC has agreed to buy biotechnology group Neogene for up to $320mln, as it looks to accelerate its ambition in oncology cell therapy.

Neogene is a clinical-stage company pioneering the discovery, development and manufacturing of next-generation T-cell receptor therapies (TCR-Ts) that offer a novel cell therapy approach for targeting cancer.

The purchase prices includes an initial payment of $200mln upon closing, and a further up to $120mln in both contingent milestones-based and non-contingent consideration.

7.46am: easyJet upbeat for 2023 as it reports hefty reduction in losses

easyJet PLC said bookings for next year were looking positive as it reported a hefty reduction in annual losses of £178mln from £1,136mln last time.

Total revenue increased by 296% to £5,769mln from £1,458mln last year predominantly due to the increase in capacity flown and as ancillary products continue to deliver incremental revenue.

The budget airline operator said EBITDAR was a record £674mln in quarter four, and up from £82mln last year, while the operational performance was improved compared to 2019 with fewer on day cancellations.

Looking head, easyJet forecast quarter one revenue per passenger seat (RPS) to be up more than 20% year-on-year with load factor growth of more than 10 percentage points in the period.

For the first half, capacity is forecast to be up 25% at around 38mln seats and this is expected to increase further in the second half of the year to 56mln seats. By quarter four capacity is seen at around pre-pandemic levels.

Johan Lundgren, easyJet chief executive said: “The summer saw easyJet achieve its highest ever earnings for a single quarter with headline EBITDAR of £674mln, ancillaries up by 59% on FY19 and easyJet holidays well on its way to its £100mln target.”

"easyJet does well in tough times.”

“Consumers will protect their holidays but look for value and across its primary airport network, easyJet will be the beneficiary as customers vote with their wallets.”

7.30am: Euro hawks square up to US dollar hawks, Sterling makes early morning gains

Investors are underestimating just how aggressive the Federal Reserve will be in the new year.

That’s according to Federal Open Market Committee (FOMC) member James Bullard, who yesterday stated that the base rate needs to rise as high as 5.25% in order to be "sufficiently restrictive" on inflation.

FOMC members John Williams and Thomas Barkin made similar comments on Monday, although the latter stated his preference for slowing the pace of rate hikes.

Those hawkish comments offered a boost to the US Dollar Index (DXY), which closed yesterday’s session at 106,29, a full 1.3% higher from intraday lows.

This morning’s Asia session has seen the greenback retract though, with DXY heading back to 106.1 and the GBP/USB pair gaining 30 pips to 1.198.

GBP/USD cuts back on hawkish Fed comments – tradingview.com

After cutting back 1.5% from yesterday’s intraday highs, the EUR/USD pair opened this morning at 1.034 and has since inched upwards to 1.035.

It should be noted that European Central Bank president Christine Lagarde also made some hawkish comments to the European Parliament yesterday, even if today’s consumer price index readings from Spain and Germany are expected to see a reduction in prices.

Today’s mortgage approvals data should shed some light on the UK’s struggling housing market.

FTSE 100 expected to open slightly higher this morning despite heavy falls in the US as the Hang Seng rebounded sharply after yesterday’s falls as China reported its first fall in Covid cases since 19 November.

Spread betting companies are calling the lead index up by around 18 points.

US markets endured a tough day with all three major indices closing sharply lower as the fall-out from the Covid protests in China unsettled sentiment.

At the close the Dow Jones Industrial Average slumped 497 points, or 1.45%, to 33.850, the S&P 500 dropped 62 points, or 1.54%, to 3,964 and the Nasdaq Composite fell 177 points, or 1.58%, to 11,050.

Back to London and investors will be eyeing further data on the strength of the housing markets with today’s mortgage approval numbers predicted to fall to 60,000, their lowest levels since June 2020.

Results are also expected from easyJet PLC, Greencore Group PLC (LON:GNC), Marstons PLC, Redrow PLC (LON:RDW), and Treatt PLC amongst others.

Read more on Proactive Investors UK