Proactive Investors - 8.19am: FTSE heads lower, banks fall after Barclays' numbers

FTSE 100 opened lower as better than expected UK inflation numbers were offset by disappointing results from high street lender Barclays PLC (LSE:BARC).

At 8.15am London's blue-chip index was at 7,930.32, down 23.53 points, or 0.30% while the FTSE 250 was little changed at 20,011.61, down 6.62 points, or 0.033%.

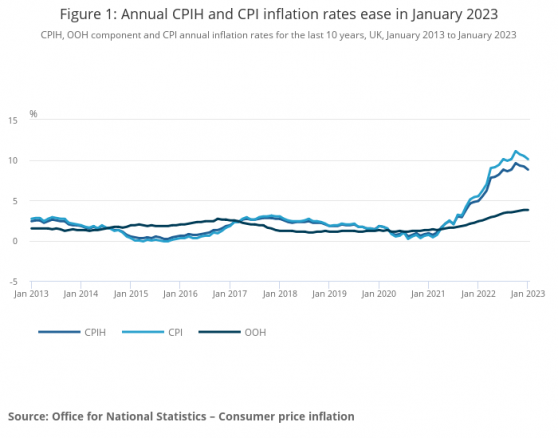

UK CPI rose 10.1% in the year to January, below City expectations for a 10.3% increase, and down from December’s 10.5% rise.

ING Economics said the numbers certainly “throw in a curveball for the Bank of England’s March meeting.”

They highlighted that core inflation was “was also much lower than expected, and slipped below 6% for the first time since last June.”

ING still expects the Bank of England to raise interest rates by 25bps next month but added “if this trend in services inflation persists, then it would be a strong argument in favour of pausing in May.”

Simon French at Panmure Gordon agreed.

He tweeted “An encouraging UK inflation report. There were just signs in the November & December reports that UK was at risk of becoming an outlier.” Less compelling in today's report. Core inflation pressures easing to +5.8% YoY (+6.3% prev.) probably the most pleasing data point.”

But the brighter inflation news was in contrast to disappointing results from Barclays PLC (LSE:BARC) where shares tumbled 7.5% hit by a hefty litigation charge relating to the over-issuance of securities.

The high street lender booked litigation charges of £1,597mln for the year (2021: £397mln) which took pre-tax profits for 2022 to £7.01bn, down 14% from £8.19bn in 2021 and below the City consensus of £7.2bn.

Net income totalled £24.96bn, up 14% from £21.94bn a year ago with fourth quarter net income of £5.8bn, up 12%, from £5.16bn in 2021. Earnings per share were 30.8p compared to 36.5p in 2021.

Credit impairment charges soared to £1.22bn compared to a release of £653mln in 2021 reflecting the deteriorating macroeconomic conditions.

John Moore, senior investment manager at RBC Brewin Dolphin, noted: “While the bank is benefitting from the tailwind of better interest rate economics and has been razor sharp on costs, it has also had to set capital aside for overselling securities and seen fee income drop significantly at its investment banking division.”

“That said, profits may have taken a hit but they remain at a healthy level and are underpinning shareholder returns through an increased dividend and share buyback programme.”

“When Barclays can turn its back on errors and legacy issues, which have been a consistent part of results in recent years, the bank should be the best placed of the major UK lenders in the current environment.”

Other banks fell with NatWest Group PLC down 3% and Lloyds Banking Group PLC down 2%.

8.00am: Inflation eases

Price rises in the UK slowed for a third month in a row but inflation remains near a 40-year high, official figures show.

UK CPI fell to 10.1% in the year to January from 10.5% in December, better than City forecasts of 10.3%, according to the Office for National Statistics (ONS).

On a monthly basis CPI fell by 0.6% in January 2023, compared with a fall of 0.1% in January 2022.

The largest downward contribution to the change came from transport and restaurants and hotels, with rising prices in alcoholic beverages and tobacco making the largest partially offsetting upward contribution to the change.

Food inflation also remained high in January at 16.7% and is one of the main drivers fuelling overall inflation, along with energy bills, according to the ONS.

Core Consumer Prices Index including owner occupiers' housing costs which excludes energy, food, alcohol and tobacco fell to 5.3% in the 12 months to January 2023 from 5.8% in December 2022.

7.53am: Barclays profits fall

Barclays PLC reported a fall in annual pre-tax profits hit by litigation charges relating to the over-issuance of securities.

The high street lender booked litigation charges of £1,597mln for the year (2021: £397mln) which took pre-tax profits for the year to £7.01bn, down 14% from £8.19bn in 2021 and below the City consensus of £7.2bn.

Net income totalled £24.96bn, up 14% from £21.94bn a year ago with fourth quarter net income of £5.8bn, up 12%, from £5.16bn in 2021. Earnings per share were 30.8p compared to 36.5p in 2021.

The FTSE 100 listed bank reported momentum across all business areas and benefited from favourable forex movements notably the stronger dollar against the pound.

Credit impairment charges soared to £1.22bn compared to a release of £653mln in 2021 reflecting the deteriorating macroeconomic conditions.

Returns on equity booked by the international unit which houses Barclays' transatlantic investment bank fell to 10.2% from 14.4% a year earlier, as fees from advising on deals particularly in debt and equity capital markets, plunged by almost two-fifths year on year.

The Tier 1 ratio deteriorated to 13.9% in the year, down 120bps from December 2021, and Barclays expects to operate within a ratio range of 13-14%.

Despite the fall in profits shareholders were rewarded with a 21% increase in the dividend to 7.25p while the lender also announced plans for a new £0.5bn share buy-back.

In 2023, Barclays UK net interest margin is expected to be greater than 3.20% while it is targeting a return on total equity of greater than 10% in 2023.

Barclays said its diversified income streams continue to position the group well for the current economic and market environment including higher interest rates.

Chief Executive CS Venkatakrishnan, commented: “"Barclays performed strongly in 2022. Each business delivered income growth, with group income up 14%.”

“We achieved our RoTE target of over 10%, maintained a strong common equity Tier 1 (CET1) capital ratio of 13.9%, and returned capital to shareholders. We are cautious about global economic conditions, but continue to see growth opportunities across our businesses through 2023."

7.30am: FTSE seen slightly higher

FTSE 100 is expected to slightly higher on Wednesday as investors digest the latest UK inflation numbers and as Barclays kicks off the banking reporting season.

Spread betting companies are calling the lead index up by around 4 points.

Michael Hewson at CMC Markets said: "Unlike the US and Europe, headline CPI in the UK is proving be a lot stickier having fallen only modestly from its October peaks of 11.1%, with today's January CPI number expected to see a fall to 10.3%. This seems fairly modest when compared to the bigger slowdowns we've seen in both the US and Europe, where headline inflation is much lower."

In the US, the Dow closed Tuesday down 157 points, 0.5%, at 34,089, while the Nasdaq Composite added 68 points, 0.6%, to 11,960 and the S&P 500 lost 1 point to 4,136.

It was a choppy day for the benchmarks as investors digested slightly higher-than-expected consumer price index numbers. The 6.4% annual rate figure wasn't a big surprise, but the question remains how long it will take for inflation to fall to normal levels.

Read more on Proactive Investors UK