Proactive Investors -

11.30am: Oil bubbles up

The oil price is heading higher again on renewed optimism about global growth, particularly in the US and China.

Brent crude is up 1.7% at US$87.38 a barrel while West Texas Intermediate is 2.07% better at US$81.84.

Craig Erlam at Oanda said: "Oil prices are a little higher again on Wednesday trading around the peak we saw earlier this month. The optimism that's driving equity markets higher is filtering through to commodity markets as well, with the prospect of stronger growth in the world's two largest economies boosting demand expectations.

"A move back towards $90 in Brent would take us to levels not seen since early November and suggest traders are feeling much better about the global economic outlook. Of course, that's probably going to be subject to frequent change unless we get a steady stream of good data, while earnings season could put a dampener on sentiment."

10.55am: Currys helps lift FTSE 250

The mid-cap index is also heading higher, helped by a jump in the share price of Currys PLC (LSE:CURY) following its update.

The FTSE 250 is up 0.21% at 19,990, with Currys leading the way with an 8.01% rise.

Retail expert Nick Bubb said: "There is more good news/bad news in the Currys trading update (for the 10 weeks to 7 Jan), but the headline sums it up: 'UK performance continues to strengthen, compensating for weak International'.

"The UK was only 5% down in like for like sales, but the Nordics was down 10%, although the overall message is that 'The continued strengthening of the UK business means we remain confident of delivering adjusted PBT between £100m-125m, despite the further deterioration we have seen in our Nordics business'."

Other risers include cruise company Carnival PLC (NYSE:CCL), up 2.56% to 792p after analysts at Bank of America (NYSE:BAC) lifted their price target from 770p to 900p.

But TI Fluid Systems PLC (LON:TIFS) has fallen 13.13% as it reported a negative sales impact from China following the country's Covid lockdowns and warned of a possible non-cash impairment charge.

10.20am: House prices dipped in November - Land Registry

The UK housing market continued to cool towards the end of last year, according to the latest official figures from the Land Registry.

In November, house prices fell by 0.3% month on month.

The annual rise slowed to 10.3% from the 12.4% recorded in October, to take the average property price in the UK to £294,910.

But these figures probably take little account of the chaos caused to - among other things - mortgage rates by Kwasi Kwarteng's disastrous mini budget, as Noble Francis, economics director at the Construction Products Association, points out.

The average UK house price in November 2022 was £294,910 according to ONS/Land Registry, which is 0.3% lower than in October & 10.3% higher than a year ago (down from 12.4% annual house price growth in October) but...#ukhousing #housing #houseprices pic.twitter.com/EpBiZxe3pK— Noble Francis (@NobleFrancis) January 18, 2023

... note that ONS/Land registry house prices in November were still based on transactions (& often mortgage deals) agreed before the fallout from the Mini Budget & sharp rise in mortgage rates so we haven't seen the impact as yet.#ukhousing #housing #houseprices pic.twitter.com/u54j990G6R— Noble Francis (@NobleFrancis) January 18, 2023

9.50am: Market's mood improves

Leading shares have been drifting between positive and negative following the inflation figures but are now a little more certain in a positive direction.

The FTSE 100 is currently up 14.25 points or 0.18% at 7865.28.

Victoria Scholar, head of investment at interactive investor said: “European markets have opened mostly higher with the DAX in Germany lagging behind. On the FTSE 100, Ocado is attempting to climb back after yesterday’s slide while inflation-sensitive businesses like IAG (LON:ICAG), British Land and Rightmove are trading near the top of the index after UK inflation figures eased for the second straight month.

"The FTSE 100 has started the year strongly, rallying almost 4% since the start of January, inching closer to its all-time high."

Russ Mould, investment director at AJ Bell, said: “After a strong start to the year for UK stocks amid better-than-expected corporate results from retailers and signs of falling inflation, the FTSE 100 has taken a breather over the past few days.

“Importantly for investors, the FTSE hasn’t given up the year-to-date gains, merely staying firm, with investors waiting for the next nuggets of information on inflation and interest rate expectations before plotting their next move."

9.05am: Devil in the inflation detail?

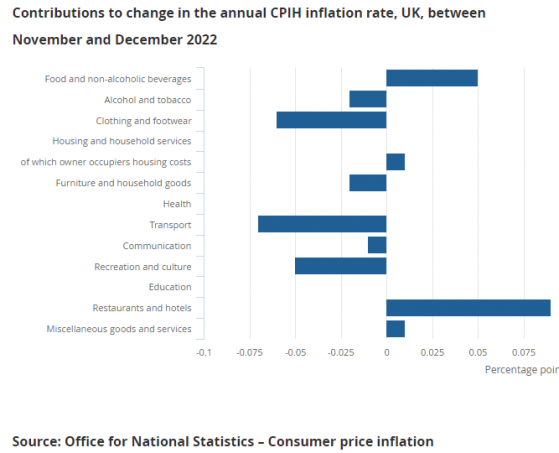

Back with inflation, and despite the good headline figures, analysts are worrying about some of the detail.

Danni Hewson, AJ Bell financial analyst, said: “It’s the first time since the start of the pandemic that inflation has fallen for two months in a row. Though the fall won’t feel significant to people heading off to do their weekly shop, in fact they won’t feel it all because hidden within today’s good news is quite a bit of bad news.

“Whilst prices at the pump have been falling, now back to levels last seen in February 2022, a lot of the important stuff is still going up. Energy costs, despite the government shaped cushion that’s in place, are still making a big impact on our lives and as temperatures plummet our energy saving measures have done all they can to limit bill rises.

“Then there’s food. The Christmas shop had to be spread out over a couple months just to make all those treats vaguely affordable. Chocolate and sweets that are a staple of most homes over the festive season were among those items in our basket with a much bigger price tag than we’re used to. And other less seasonal staples like milk, cheese and eggs are still driving prices up at a rate that will keep making life difficult for many people.

“But there is a little balance, rather than everything creeping relentlessly upwards at an ever-increasing rate, there is a now a spread. Price rises in clothing, shoes, furniture and recreation have slowed somewhat with pre-Christmas sales by retailers designed to draw us into stores."

She added: "For central bankers there are a couple of warning signs flashing furiously. First service inflation has shot up from 6.3% in November to 6.8% suggesting that the tight labour market which has pushed up wages is filtering through to prices. And the core figure that strips out energy, food, tobacco and alcohol has remained stubbornly static at 6.3%.

“There will be plenty of focus today on the Bank of England’s next move with markets currently pricing in another 0.5% hike at the next meeting in February."

And the worst may not be over, according to the National Institute for Economic and Social Research.

"Due to ‘base effects’, we expect to see a rise in the January 2023 headline figure – meaning inflation may not yet have peaked," said Paula Bejarano Carbo, NIESR associate economist.

8.45am: Ocado (LON:OCDO) and Smiths Group (LON:SMIN) lead the FTSE 100 risers

After its recent slump Ocado Group PLC is attempting a recovery.

Its shares, which were hit yesterday after a disappointing update from its retail joint venture with Marks and Spencer Group PLC (LSE:LON:MKS), have recovered 3.82%, making them the biggest riser in the leading index so far.

Engineer Smiths Group (LON:SMIN) is up 2.62% after a positive statement.

It said it expected to deliver low double-digit organic revenue growth for the first half through a combination of volume growth and price increases to offset cost inflation.

Despite supply chain issues and the current economic uncertainty, it is also forecasting full year revenue growth to be at least 7%, with moderate margin improvement.

British Land Company PLC (LON:BLND) is 2.04% better at 450.6p as Bank of America (NYSE:BAC) moved from neutral to buy and raised its price target from 640p to 740p.

But SEGRO PLC has slipped 1.18% to 840p as the same bank cut its rating from buy to neutral and its price target from 850p to, yes, 840p.

8.22am: Footsie buoyed by inflation figures

Leading shares have edged higher following the news that UK inflationary pressures had eased slightly.

The FTSE 100 is up 11.59 points at 7862.62, moving ever closer to its all time high of 7903 reached in May 2018.

Burberry Group PLC (LON:BRBY) shares are up just 5p at 2248p following its latest mixed update.

Susannah Streeter, senior investment and markets analyst at Hargreaves Lansdown (LON:HRGV), said: "Burberry’s shares had been climbing back towards pre-pandemic highs buoyed by expectations of higher demand due to China’s re-opening but this isn’t yet showing up in the figures, with sales growth overall disappointingly slowing to 1%.

"The Chinese market continues to be sideswiped by the pandemic, with store sales down 23%. Investors will need another big dose of patience before well-heeled Chinese shoppers snap back into boutiques and international stores.

"However, elsewhere festive sales surged particularly across Europe with double digit growth recorded. In particular, the acceleration of sales of leather ranges are an encouraging sign. Efforts to elevate the brand have been paying off, given that a luxe image is rewarded by improved loyalty among its wealthy customers, who are far more insulated from inflationary pressures."

Still with retail, but a rather different sort, and Currys PLC has climbed 3.04% as it held its guidance for the current year as a stronger-than-expected performance in the UK offset a weaker performance from its international business.

Elsewhere Just Eat Takeaway.com NV has jumped 14.28%as the company reported second half earnings of €150mln compared to a first half loss of €134mln. Full year earnings of €16mln compare to a €350mln loss in 2021.

Chief executive Jitse Groen said: "Our improved profitability and strong capital position strengthen our business for further growth and underpin our ability to both deliver on our adjusted EBITDA targets and invest in food and non-food adjacencies."

7.41am: Petrol price and clothing falls offset by travel and food increases

A fall in petrol prices as well as clothing helped the dip in inflation, said ONS Chief Economist Grant Fitzner.

But this was offset by increases for coach and air fares as well as overnight accommodation.

Food costs continued to spike, said Fitzner, with prices also rising in shops, cafes and restaurants.

The Consumer Prices Index including owner occupiers’ housing costs (CPIH) rose by 9.2% in the 12 months to December 2022 – down from 9.3% in November.The Consumer Prices Index (CPI) rose by 10.5%, down from 10.7% in November.

➡️ https://t.co/y0NYgn847k pic.twitter.com/UrOgtSIzTo

— Office for National Statistics (ONS) (@ONS) January 18, 2023

Daniel Casali, Chief Investment Strategist at wealth management firm Evelyn Partners, said: ‘Another slowing in annual inflation – the second since October’s peak of 11.1% - will add to the newfound sense of optimism in the UK economy, triggered by last week’s surprisingly positive monthly GDP growth data.

"But these are fairly marginal decelerations in prices, inflation remains elevated and together with likely negative annual GDP growth in 2023 this remains a risk for both markets and households.

"The Bank of England will welcome softening inflation but for its rate-setters the receding of price pressures has some way to go before they take the foot off the rates pedal, and particularly if growth continues to surprise on the upside and if growing wage demands prove successful."

And average earnings continue to lag inflation substantially, with yesterday's figures showing they rose by 6.4% including bonuses.

7.34am: Signs of inflation easing

UK inflation showed signs of easing in December but remains much higher than the Bank of England's target.

The Consumer Price Index dipped from 10.7% to 10.5% last month, in line with expectations. But core inflation - stripping out food and energy - was higher than expected at 6.3% rather than 6.2%, according to the Office for National Statistics.

Inflation easing but its very slow....Tilts towards another 50bps for BOE in Feb #gbp

— Michael Hewson ???????? (@mhewson_CMC) January 18, 2023

6.59am: Markets set to dip at open.

The FTSE 100 is expected to open slightly lower on Wednesday with investors eyeing the latest inflation figures in the UK to see if pricing pressures are easing.

Spread betting companies are calling London’s blue-chip index down by around 5 points.

The big news overnight was from Japan where the Bank of Japan kept monetary policy unchanged, sending the yen lower while bonds notched their biggest rally in two decades on Wednesday.

Michael Hewson at CMC Markets said this wasn’t a surprise but “ but they also announced they would continue large scale bond buying and be more flexible about duration in order to keep policy settings loose.”

The Nikkei jumped 2.5% in reaction but elsewhere Asian markets were muted.

In the US markets endured mixed fortunes on Tuesday with the Dow tumbling close to 400 points, weighed by heavy falls in Goldman Sachs (NYSE:NYSE:GS), while the Nasdaq posted a small gain.

At the close the Dow Jones Industrial Average was down 393 points, or 1.15%, to 33,910, the S&P 500 shed 8 points, or 0.2%, to 3,991 while the Nasdaq Composite rose 15 points, or 0.14%, to 11,094.

But in London and inflation numbers will be a key early indicator while there is a raft of corporate updates in the diary.