Proactive Investors -

- FTSE 100 recovers after fall last week

- US stocks also expected to push higher

- AB Foods (LON:ABF) higher after guidance upgrade

Half-term retail boost fades

Retail footfall fell across most of the UK last week, according to industry data from retail consultancy MRI Springboard, as children returned to school following the half-term break.

MRI Springboard said footfall was down 5.3% week-on-week in the seven days beginning 19 February 2023. A week earlier, when it was half-term for most of the country, footfall jumped by 7.6%.

Of the UK's ten geographies, only Wales and the West Midlands - which had their half-terms last week - recorded increases, MRI Springboard said.

Footfall declined across all three destination types last week, with the largest drop, 7.1%, seen in shopping centres, where it had risen the most in the previous week. In retail parks footfall was down 2.8% and by 5.6% on high streets.

Year-on-year, footfall was ahead 3.9% but it remains sharply below pre-pandemic levels, down 14.4% when compared to the same week in 2019. In the previous week, footfall was down 10.9% when compared to 2019.

In the report, Diane Wehrle, insights director at MRI Springboard, said: "Somewhat inevitably, footfall fell back once again last week. Footfall declined across all the range of town types. However, the drop in central London and other city centres was more modest than the rise in the week before last, clearly cushioned by employees to their offices. In contrast, in coastal towns - which are attractive for day visits - and in smaller high streets, the reverse was true."

HSBC could downsize global HQ

HSBC Holdings PLC may downsize from its current headquarters, a Canary Wharf skyscraper, as the shift to flexible working continues to leave its offices unused.

According to news reports, the global bank is looking for a new headquarters of around 400,000-500,00 square feet, with the 45-storey tower it currently occupies totaling 1.1mln square foot.

Already close to ten floors have been left empty in the building in response to the bank's relaxed attitude to working from home, the Telegraph reported.

The tower in Canary Wharf is owned by Qatar’s sovereign wealth fund which agreed to lease the building to the FTSE 100 constituent in 2002. Now, with the agreement set to expire in 2027 HSBC could either move away to a smaller office in London or make renovations and reductions to the existing workspace in Canary Wharf.

London's movers

A quick look at some of London’s movers today.

Risers

Begbies Traynor (AIM:LON:BEG)- up 3% to 136p

Begbies Traynor said its third-quarter performance was in line with that seen in its first half and that it remains “confident” of meeting market expectations for the full year.

Analysts’ forecasts for the current year are for revenue of £117.7mln-£121.4mln and adjusted pre-tax profit of £19.7mln-£20.6mln, the business recovery, financial advisory and property services consultancy said.

Elixirr- up 23% 520p

Shares jumped higher on Monday after the global award-winning challenger consultancy said that trading for full-year 2022 was "strong with all metrics in line or above market expectations".

Fallers

Dechra- down 11% to 2,740p

Shares went tumbling after the veterinary products group said operating profit fell 22% to £44.6mln year on year, resulting in diluted earnings per share of 19.86p

However, this was largely due to the £13mln increase in research and development expenditure following the acquisition of Piedmont Animal Health in July 2022.

US seen higher

Wall Street is set to open higher following a tough week for US equities after hotter-than-expected inflation data increased expectations that the Federal Reserve will continue raising interest rates for longer than previously hoped.

Futures for the Dow Jones Industrial Average (DJIA) rose 0.4% in Monday pre-market trading, while those for the broader S&P 500 index gained 0.5%, and contracts for the Nasdaq-100 also added 0.5%.

Markets finished lower on Friday after the Personal Consumption Expenditures (PCE) price index, the Fed’s preferred inflation gauge, increased 0.6% in January and 5.4% for the past 12 months, above the consensus expectation of an annualized increase of 4.9% and up from December’s annualized reading of 5%.

The DJIA ended 1% lower at 32,817, enduring its fourth losing week in a row, while the Nasdaq Composite dropped 1.7% to 11,395 and the S&P 500 fell 1.1% to 3,970. The small-cap Russell 2000 index declined 1.3% to 1,884.

“A slew of better-than-forecast US data recently has caused a shift in the market’s expectations regarding Fed policy,” commented TickMill Group market analyst James Harte. “These better data points, along with a fresh uptick in inflation, have fuelled an increase in pricing for a larger 0.5% hike in March along with the view that the Fed will push ahead with tightening for longer than initially expected this year.

"Looking ahead this week, there will be more US data releases and Fed speakers to keep an eye on kicking off with durable goods and Fed’s Jefferson today," Harte added.

With the fourth-quarter 2022 earnings season drawing to a close, Harte highlighted results from Zoom Video Communications today. The company is due to report against Wall Street forecasts of EPS of $0.81 on revenues of $1.1 billion.

“However, there has been some market chatter regarding the potential for a negative EPS which, if seen, would be a heavy blow for the company and likely see shares come off sharply today,” he said. “Given the weak expectations, however, any surprise upside today will be strongly bullish for the stock.”

Also reporting this week are retailers Target and Dollar Tree, home improvement group Lowe and drinks group Monster Beverage.

The upbeat mood across the pond is supporting equities in London where the FTSE 100 is at 7,936.18, up 57.52 points, or 0.73%.

Lloyds tipped by Barclays , UBS

Lloyds Banking Group PLC shares could still show investors a massive 43% return, that’s according to analysts at Barclays which retain an upbeat view despite last week’s disappointing results.

Analysts at Barclays today published a note trimming its earnings forecast for this year, reflecting the conservatism shown by Lloyds last week though its price target stays untouched at 75p per share (versus the current price of 52p).

“While Net Interest Margin (NIM) [which is the amount the bank makes on lending versus what it pays out in interest] has likely peaked, earnings are building toward a higher and more sustainable level, underpinned by lower deposit risks and receding provision concerns,” the bank commented.

“Given sector leading capital returns and compelling value (at 6-7 times PE), we remain overweight," Barclays said.

UBS was also upbeat on Lloyds despite cutting its price target to 61p from 70p. It said the rating was too lowand reiterated a 'buy' rating.

“For a bank with a history of beating guidance, of paying all excess capital to shareholders via dividends and buybacks, investing to produce a >15% return on total equity in 2026, in a UK market trading at 10.9x 2024 estimated EPS, we think that's too low,” the broker said in a note.

"The outlook for earnings and payouts is more stable than the NIM guidance would suggest we think", UBS said.

Shares in the bank were 1% higher at 52.16p.

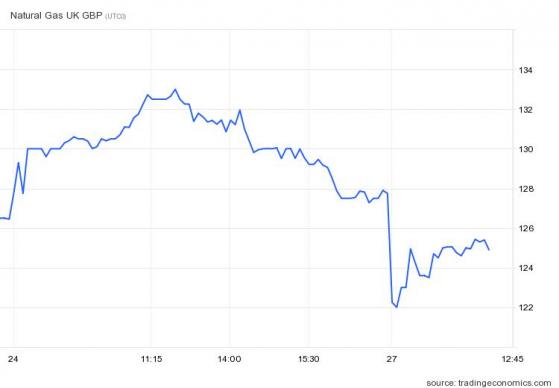

Gas prices fall as temperatures are forecast to rise

The impending rise in household energy bills comes as European natural gas prices fell today toward an 18-month low

Dutch front-month futures, the European benchmark, dipped 2.1% to €49.95MWh while UK prices were 2% lower at 124.90p/therm as temperatures were forecast to rise after a brief cold snap, denting demand.

UK hit a nine-month bottom of 119p/therm on February 21, as cold weather and lower wind power generation supported prices. Britain's wind power output dropped to 9.8 gigawatts on Saturday from 13.5 GW on Friday, Elexon data showed.

Breakthrough in NI talks positive for equities/sterling - Berenberg

Kallum Pickering senior economist at Berenberg thinks the widely reported breakthrough in talks between the UK and the EU on Northern Ireland would be positive for the markets.

He pointed out a deal could mark a line in the sand when six and a half years of damaging Brexit uncertainty finally comes to an end.

“Lifting the threat of a tit-for-tat trade war with the UK’s biggest market, the EU, is exactly what its businesses and financial markets need,” he suggested, adding, “it would improve confidence and unlock business investment which has been badly held back by the risk of a UK-EU trade dispute.”

He accepted the UK will suffer a lasting impact on its growth potential following its decision to increase the barriers of trade with the EU but this agreement would lift a major uncertainty.

“If this comes to an end, we expect the UK’s healthy fundamentals – well capitalised banks, cash flush households and firms, and well-regulated markets – to re-assert themselves,” he said.

“A breakthrough deal would suit our above consensus real GDP calls for the UK over the next three years,” he added.

After a mild 0.8% contraction in 2023 Berenberg expects the UK to grow by 1.6% in 2024 and by 1.7% in 2025.

“On the announcement of a deal, and then again following any sign-off in UK parliament, we would expect to see modest positive moves for both sterling and UK equites,” he said.

LSE results could sound the starting gun for share sales

Results from London Stock Exchange Group PLC this week could fire the starting pistol on the sale of as much as £4 billion of its shares by a consortium led by Blackstone, the American private equity group, and Thomson Reuters.

A report in The Times said a lock-up arrangement preventing these owners from selling an initial 10% stake in the group expired in January, but in practice as insiders with seats on its board they can only begin to sell on Thursday, after the company’s closed period ends.

Shares in the company slipped 0.6% in a buoyant market to 7,492p. The FTSE 100 is up 63 points at 7,941.

Full steam ahead for Trainline

Over in the FTSE 250 and Trainline PLC is the top riser, up 4% after Deutche Bank upgraded its rating to ‘buy’ from ‘hold’ despite cutting its price target to from 350p to 287p.

The German bank noted while its financial year will have been a year of significant recovery post-COVID-19, it has been overshadowed by ongoing strike activity in the UK, which is set to drive forecasts to below the bottom of management's guidance range, when it updates on trading in mid-March.

But it feels the impact from strikes is well known and is by nature one-off and that the medium-term risk should be receding, as Railway has demonstrated its ability to get back to pre-pandemic passenger volumes.

The FTSE 250 is now over 100 points to the good at 19,802.63.