Proactive Investors -

- FTSE 100 climbs 4 points

- UK inflation unexpectedly rebounded to 10.4% last month

- CBI industrial report shows improved factory gate expectations

Having erases earlier losses, London's blue-chip stocks are pressing further into positive territory, up four points to 7540.

There's good news on inflation within the UK industrial data published by the CBI, which also showing that output volumes fell modestly in the three months to March but that manufacturers expect output to rise in the three months to June.

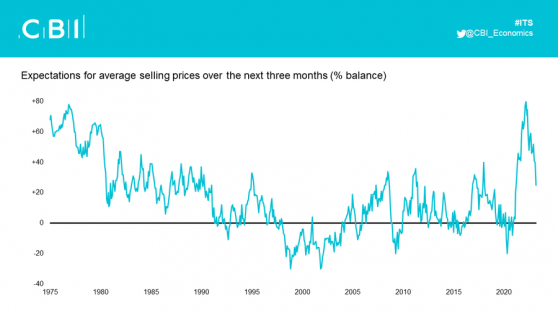

The CBI industrial trends survey found that factory price expectations fell to their lowest since March 2021.

The CBI total orders figure for March worsened to -20 from -16 in February, worse than the expected easing to -15.

But the selling prices trend improved to 25 for March, from 40 the month before (see chart above) and much better than the forecast 37.

Total order books were reported as below “normal” in March, leaving them in their weakest position since February 2021.

Export order books were also seen as below normal, but to a marginally lesser extent than last month.

FTSE joins Europe in the green

The FTSE 100 had been the odd one out among its European brethren this morning, though US futures are also in the red.

But London's equity benchmark is back to flat, led by the banks (see below), with HSBC (LON:HSBA) and Barclays (LON:BARC) now topping the leaderboard.

The wider FTSE 350 banks index is up 2.7% today and over 11% from the low on Monday morning.

Earlier, analyst Henry Allen at Deutsche Bank (ETR:DBKGn) noted that bank stocks yesterday experienced their best performance so far this year, while the VIX index of volatility also fell to its lowest level since the current turmoil began.

Also helping the index are Shell (LON:RDSa)'s losses also being pared, though BP (LON:BP) and the mineres are still in the red.

Miners are down as iron ore prices slumped on the back of weak Chinese steel data.

"The move follows price cuts from 10 major steelmakers in China, coinciding with sliding rebar spot prices," says analyst John Meyer at SP Angel.

"Beijing has been looking to crack down on elevated iron ore prices as it aims to shore up its construction sector following efforts to reduce leverage."

Elsewhere he noted the gold price was holds lower "as traders await today’s Fed rate decision and banking crisis moves backstage".

FTSE banks continue their rebound

London's listed banks are continuing to lead the risers today, some almost recouping their losses since the worrying major wobbles on both sides of the Atlantic in the last fortnight.

Barclays is now up 2.8% this morning (and over 7% over the past week), and NatWest (LON:NWG) and HSBC up 2.6% today.

Following the weekend deal to sell Credit Suisse (SIX:CSGN) to its major Swiss banking rival, UBS is now reported to be eyeing talks to unwind an earlier deal which would have seen veteran dealmaker Michael Klein gain control of part of Credit Suisse's investment bank, according to a report in the FT.

The talks suggest UBS sees some value in Credit Suisse's investment banking arm, having just snapped up its embattled rival for US$3.25bn.

The deal with Credit Suisse would have seen Klein merge his advisory firm with the Swiss bank's investment banking division to create CS First Boston. The First Boston brand takes the name of a US investment bank Credit Suisse absorbed in 1990.

However, the report revealed that some UBS executives believe the terms of the deal are too favourable for Klein. Klein would have owned a minority stake in the new entity, with Credit Suisse owning a larger holding.

UBS has a legal team looking at how to annul the contract Credit Suisse signed with Klein in the cheapest way possible, the report said.