By Nobuhiro Kubo, Takaya Yamaguchi and Tim Kelly

TOKYO (Reuters) -A collapse in the yen is forcing Japan to scale back a historic five-year, 43.5-trillion-yen defence build-up aimed at helping to deter a Chinese invasion of Taiwan, according to eight people familiar with the matter.

Since the plan was unveiled in December, the yen has lost 10% of its value against the dollar, forcing Tokyo to reduce its ambitious defence procurement plan, which was then-calculated to cost $320 billion, the sources said.

Reuters interviewed three government officials with direct knowledge of defence procurement and five industry sources, who said Japan will begin cutting back on aircraft purchases in 2024, the second year of the build-up, due to the weak yen.

Details of how Japan is paring back military procurement due to currency fluctuations have not been previously reported. The eight people, who attended numerous meetings on the purchases, spoke on condition of anonymity because they were not authorised to talk to media.

Tokyo assumed an exchange rate of 108 yen to the dollar - a rate last traded at in summer 2021 - when it began formulating purchase plans in December, the eight people said. By early November, the currency dipped to 151 to the dollar. The Bank of Japan on Tuesday took a small step toward ending the decade-long monetary stimulus, which has driven yen depreciation, by tweaking bond yield controls.

Unlike large companies that do business overseas, Japan's defence ministry does not hedge against currency rate fluctuations, one of the government officials said, meaning it has few means to mitigate the rising cost in yen of Tomahawk cruise missiles and F-35 stealth fighters.

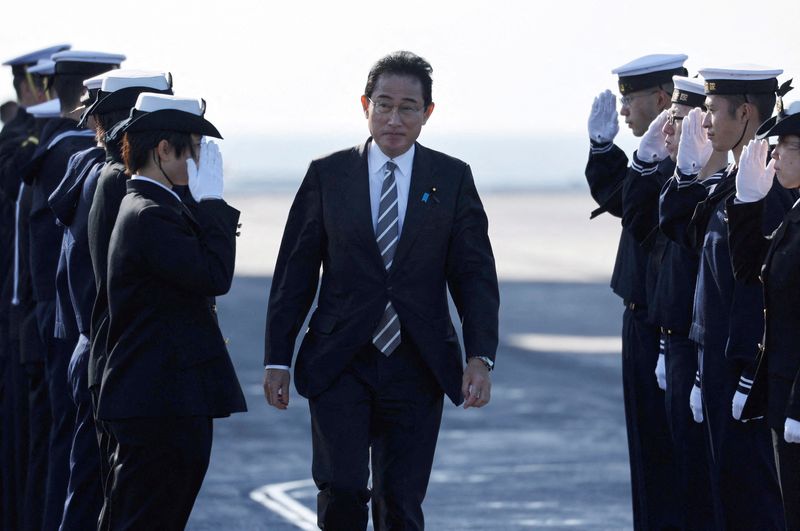

Any sign that Prime Minister Fumio Kishida will get less bang than anticipated from his military spending binge could stir unease in Washington about its key ally's ability to help contain Beijing, said Christopher Johnstone, Japan chair at the Center for Strategic and International Studies think tank.

"For now, the impact is modest. But there is no question that a long-term depreciation of the yen would sap the impact of Japan's build-up, and force cuts and delays to key acquisitions," said Johnstone, a former National Security Council director for East Asia in the Biden administration.

Japan's Ministry of Defence said it does not discuss details of procurement planning when contacted for comment.

The U.S. Embassy in Tokyo said it was unable to comment. The Pentagon did not immediately return a request for comment.

BUILD-UP

Kishida described Japan's biggest defence build-up since World War Two as a "turning point in history." The spending is meant gird the nation for possible conflict around its far-flung islands stretching along the edge of the East China Sea toward Taiwan, according to defence white papers. Tokyo also shares responsibility for protecting U.S. bases on its soil that Washington could use to launch counter strikes against Chinese forces attacking the self-governing democratic island.

In December, Kishida pledged to double annual defence outlays to 2% of gross domestic product. A move to transform the war-renouncing nation into potentially the world's third-biggest military spender was seen by analysts and lawmakers as improbable until two years ago.

That changed when Russian forces rolled into Ukraine in February 2022, in an invasion that Tokyo worries will embolden Beijing to strike Taiwan.

China stoked Japanese fears again that August by firing missiles into waters close to its territory in response to then-U.S. house speaker Nancy Pelosi's visit to Taiwan. That came after months of intensifying Chinese activity in East Asia, including joint sorties with Russian forces.

China, which has not ruled out using military force to bring Taiwan under its control, has expressed concern about Japan's military spending plans, accusing it of displaying a "Cold War mentality."

CHINOOKS AND SEAPLANES

With the cuts in its spending power, Japan decided to prioritize spending on advanced U.S.-made frontline weapons such as missiles that could halt advancing Chinese forces, the eight people said. That means less money on support aircraft and other secondary kit, much of it made by Japanese companies, they said.

In December, defence ministry officials discussed an order for 34 twin-rotor Chinook (NASDAQ:KDNY) transport helicopters at roughly 15 billion yen per aircraft, two of the sources said.

In the defence budget request for the year starting April 2024, which was published in August, that order was halved to 17 because the cost of the aircraft had jumped by around 5 billion yen each since December. About half that increase was due to the weak yen, said one of the government sources, who was directly involved in those discussions.

The aircraft are assembled by Kawasaki Heavy Industries under license from Boeing (NYSE:BA) Co. A Kawasaki spokesperson confirmed that the unit cost increase had resulted in a reduction in the Chinook order.

Japan also scrapped a plan to buy two ShinMaywa Industries US-2 seaplanes used for search and rescue missions after the price per aircraft almost doubled to 30 billion yen compared with three years ago, said two other people familiar with the spending plans.

"The price has risen considerably, and that is because the weaker yen and inflation have significantly pushed up costs," a company spokesperson said. She declined to comment on whether the defence ministry had dropped an order for the seaplane.

INDUSTRY BACKLASH

For Kishida, who must grapple with rival ruling-party factions that are sparring over whether to borrow money or hike taxes to pay for his defence build-up, pruning equipment purchases may be politically less fraught than asking lawmakers for top-ups, analysts said.

"Whether Kishida decides to increase the budget or do nothing will depend on his support rate in Japan," said Yoji Koda, a retired Maritime Self Defense Force admiral, who commanded the Japanese fleet. He expects the Japanese leader to opt for procurement cuts or delays because it's easier than convincing taxpayers to fork out more money.

But, by sidestepping that challenge, Kishida is also inviting a backlash from Japanese companies that worry they will bear the brunt of cuts to ensure Tokyo can afford Raytheon (NYSE:RTN) Tomahawks and the F-35 jets it has ordered from Lockheed Martin (NYSE:LMT).

In a sign of growing discontent, the Japan Business Federation, the country's most influential corporate lobby, joined several defence industry associations in October to press the defence ministry for extra military procurement funds in a supplementary budget now before parliament, one of the sources said.

A ministry spokesperson confirmed the companies delivered a letter on Oct 25 to Defence Minister Minoru Kihara urging the government to proceed with the defence procurement as planned.

The business lobby declined to comment.

Defence firms will struggle to get more money because the government will want to hold off on adding to the 43 trillion-yen plan to see if the currency situation changes, said Kevin Maher at NMV Consulting in Washington, who headed the U.S. State Department's Office of Japan Affairs.

"If they think it will impact capabilities then it is possible, but I think at the earliest that would be in the next to last year of the five-year plan," he said.

($1 = 150.4000 yen)