By Atul Prakash

LONDON (Reuters) - European auto and luxury goods shares face a bumpy ride due to their high exposure to China, where recent economic data has failed to dissipate investor concerns about growth and volatile stock markets.

China accounts for more than 30 percent of sales for European premium car producers, and companies such as watchmaker Swatch (VX:UHR) and beverages company Remy Cointreau (PA:RCOP) derive nearly a third of their total revenues from the world's second biggest economy, according to industry estimates.

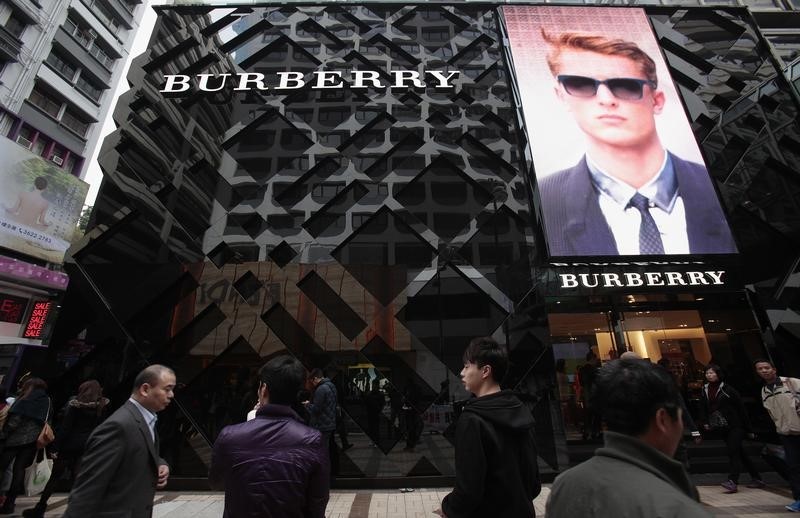

While European shares look poised to rally again after a Greek debt deal that reduces the risk of Greece leaving the euro zone, Credit Suisse (SIX:CSGN) said it was "underweight" on China-related luxury plays including LVMH (PA:LVMH) and Burberry (L:BRBY).

Shares in Burberry fell as much as 3.7 percent on Wednesday after the company reported weaker sales in the Asia-Pacific region in April-June, with a sharp slide in Hong Kong.

Chinese consumers account for 30-40 percent of Burberry's global revenue. Although the British luxury brand saw low single-digit percentage growth in China for the period, analysts stayed cautious on the stock, which is down 15 percent since mid-May.

China reported better-than-expected economic growth of 7 percent on Wednesday for the second quarter, but many consumers will have been hurt by a recent four-week equity rout that wiped nearly 30 percent off China's stock markets.

The government forecasts full-year economic growth of 7 percent, the slowest in 25 years.

"Retail investors in China have had their fingers burnt, and more tellingly, their wallets. This is likely to impact on their propensity to spend on discretionary items like cars and luxury goods," Laith Khalaf, analyst at Hargreaves Lansdown (LONDON:HRGV), said.

Credit Suisse has downgraded the European auto sector on concerns about German carmakers, which generate two-fifths of profits from China.

Kevin Lilley, European equities fund manager at Old Mutual Global Investors, said his fund sold shares in BMW (DE:BMWG) earlier this year on concerns over the Chinese economy.

PRESSURE ON EARNINGS

Worries about slowing growth in China's domestic demand and its equity market selloff have helped pull the European automobile index (SXAP) down by about 8 percent in the past three weeks. Not everyone is downbeat, though.

Some fund managers, including Ben Kumar at Seven Investment Management, remain positive on China-exposed stocks and said the recent selloff seemed temporary.

"The problem with autos and luxury goods is that they have been the sector choices of pretty much every active manager wanting to enter China. As China-listed stocks have fallen, investors have panicked," said Kumar.

Other investors, however, point to already lofty valuations.

European autos and personal and household companies (SXQP) now trade on 10 times and 17.6 times their 12-month forward earnings respectively, against a five-year average of 8.6 times and 15.2 times, according to Thomson Reuters Datastream.

Christian Stocker, equity strategist at UniCredit in Munich, said he had an "underweight" rating for autos as their business development strategies were dependent on Chinese demand.

"With respect to the uncertain economic development in China, we increasingly see the risk of disappointments in earnings estimates," he said. "In combination with high valuations, we only expect below average (share) performance."