Benzinga - by Piero Cingari, Benzinga Staff Writer.

Bitcoin (CRYPTO: BTC) surged by 4.5% between Monday and Wednesday, marking its most impressive performance since the third week of June.

The revival of positive sentiment in the cryptocurrency market indicates both favorable news developments and bold bullish bets from major investors. To gain a deeper understanding of this optimistic shift and what it could mean for your investments, don’t miss the upcoming Benzinga Future of Digital Assets Conference on November 14th in NYC.

Bitcoin: What Happened This Week

The most optimistic news stems from the triumph of the Grayscale Bitcoin Trust, a $16 billion reservoir of Bitcoins managed as a closed-end investment trust and traded over the counter with the ticker symbol (OTCPK: GBTC), in its legal tussle against the Securities and Exchange Commission. The SEC’s prior refusal to permit the conversion of $GBTC into an ETF was overturned by the U.S. Court of Appeals for the District of Columbia Circuit.Read also: Bitcoin ETF Imminent? Grayscale Wins Years Long Fight Against SEC That May Open Floodgates

Effectively, this ruling unbolts possibilities for other industry titans, including Bitwise, VanEck, Invesco, Fidelity, and Valkyrie, among others, to potentially secure approval for their Bitcoin ETF applications sooner rather than later.

Benzinga CEO Jason Raznick held an exclusive conversation with Cathie Wood – the full interview on “The Raz Report” is available here – during which she reiterated her prediction of Bitcoin surpassing $1 million by 2030 and envisioned exponential growth for the overall crypto market. The overseer of the ARK Innovation ETF (NYSE:ARKK) further added that Bitcoin will emerge as a pivotal topic for young voters in the 2024 elections.

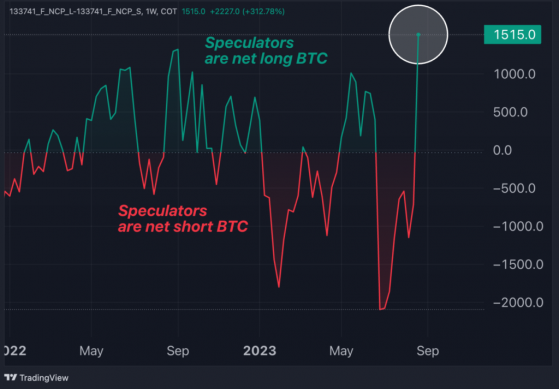

Bitcoin’s Commitment Of Traders: Record-Breaking Net Long Positions

Beyond the recent news that has reverberated throughout the realm of cryptocurrencies, a more fundamental facet has come to the fore in the latest weekly report on Commitments of Traders (COT) issued by the Commodity Futures Trading Commission (CFTC).The net-long positions in Bitcoin futures held by large speculators grew to 1,515 contracts during the week ending Aug. 22. This constitutes the highest net-long position since the CFTC initiated reporting on Bitcoin futures back in April 2018.

More specifically, long contracts increased from 11,981 to 13,427, scaling the summit reached in January 2023, while short contracts dwindled from 12,693 to 11,912.

Between late June and early July 2023, net short positions on Bitcoin futures lingered around 2,000 contracts, marking the lowest level since October 2021.

The notable increase in Bitcoin’s net long positions over recent weeks indicates a significant shift in the perspective of major investors regarding the cryptocurrency.

Chart: CFTC COT Non-Commercial Positions (Net) on Bitcoin Futures

Bitcoin Technical Analysis: Monitoring Fibonacci Levels

In the BTC/USD daily chart, the cryptocurrency effectively surpassed the pivotal 200-day moving average, which had previously been breached downward in mid-August, thereby dispelling bearish apprehensions.Nonetheless, Bitcoin still finds itself situated beneath the 50-day moving average, presently positioned at 28,885.

Considering the Fibonacci levels, Bitcoin has retraced 23.6% of the range between the 2022 troughs (15,439) and the 2021 peaks (15,479).

The subsequent noteworthy upward barrier rests at the July 2023 highs of 31,875, prior to casting its sights on the critical level of 36,000 – a point representing the 38.2% Fibonacci retracement.

Bitcoin 1-day Chart: Moving Averages and Fibonacci Levels

As the digital asset landscape continues to evolve, these developments will likely be a topic of discussion at the upcoming Benzinga Future of Digital Assets Conference.

Read now: EXCLUSIVE: Cathie Wood Flips The Script, Warns Of Looming Deflation

Photo: Shutterstock

© 2023 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga