Benzinga - by Piero Cingari, Benzinga Staff Writer.

Bank of America Chief Investment Strategist Michael Hartnett has turned bullish on bonds for the second half of the year, while raising heightened risks of a stock market sell-off as investors bet on the first Fed interest rate cut.

Hartnett, known for his bold contrarian market views, reiterated in his latest “The Flow Show” report that the “anything-but-bond” trade will play out for the remainder of the year.

According to Hartnett, a slowing economy will reduce the currently elevated equity valuations. Additionally, with fiscal policy expected to become more conservative in 2025, current market fears regarding bond yields are likely to ease.

He advised investors to “buy any dip in bond prices,” while recommending to “sell the first cut” for stocks.

Earlier this month, Hartnett suggested the 30-year US Treasury provided “the best hedge for weaker nominal growth.”

The Worst Equity Market Breadth Since 2009

Chart: Bank of America Securities

Despite many investors and analysts on Wall Street believing that a Fed rate cut would further sustain the stock market rally, Hartnett’s counterintuitive call is based on a detailed analysis of the so-called “market breadth.”

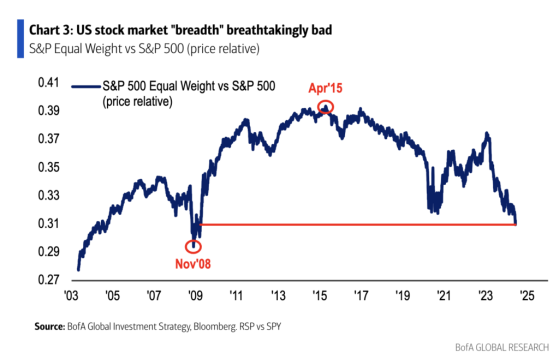

Hartnett highlighted that the Equal Weight S&P 500 Index, tracked by the Invesco S&P 500 Equal Weight ETF (NYSE:RSP), is trading at its lowest relative to the cap-weighted S&P 500 Index, tracked by the SPDR S&P 500 ETF Trust (NYSE:SPY), since March 2009.

According to Hartnett, “the worst stock breadth since March ’09” is a warning sign, reflecting the extreme market dominance of a few tech giants, namely Magnificent Seven.

“AI crowds out Wall St & Main St dollars,” Hartnett wrote in the note.

He reminded investors that since 2020, there has been “pain trade after another” and predicted that the next trend will be “value outperforming growth” stocks, with “breadth winning” as economic growth slows.

A Benign PCE Failed To Support “Wobbly Tech” The catalyst for this shift would be a benign April Personal Consumption Expenditure (PCE) report, which turned out to be unable to “support wobbly tech,” according to Harnett.

This appears to be the case, as on Friday, May 31, the Fed’s favorite inflation gauge came in as expected, alleviating fears of a reawakening in price pressures.

Despite this, the Nasdaq 100 index, tracked by the Invesco QQQ Trust (NASDAQ:QQQ), tumbled 1.4% during midday trading in New York. As a result, tech stocks are set to snap a five-week winning streak.

You were right, Michael.

Read now: Are Rate Cuts Imminent After Fed’s Preferred Inflation Data Holds Steady? ‘Be-Careful-What-You-Wish-For Moment’

Photo: Funtap on Shutterstock

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga