Proactive Investors - Applied Nutrition, the producer of sports supplements, is closing in on a £500 million float in London, providing a well-needed boost to the capital’s struggling stock market.

Tom Ryder, the founder of the group backed by JD Sports, is said to have met with nearly 30 fund managers in London to discuss the possibility of an IPO in the fourth quarter of this year.

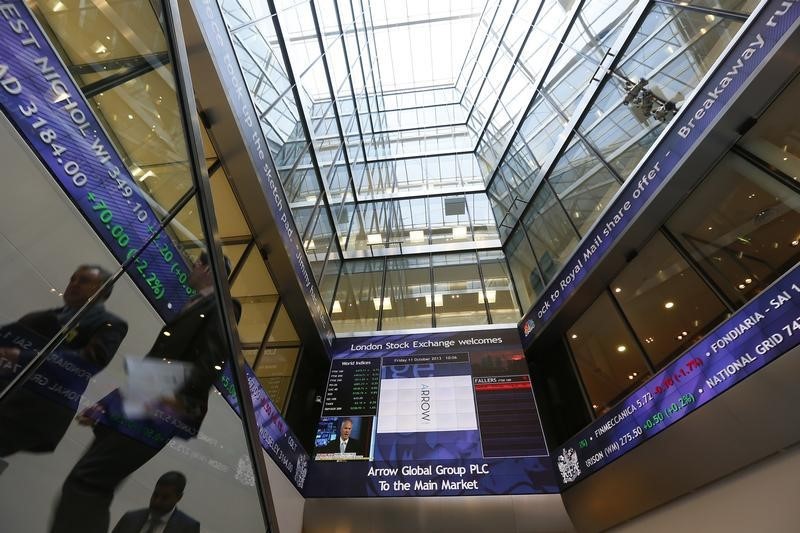

“We have realised that it [going public] ticks all our boxes. We firmly believe we could be the company that kicks the doors in on the London Stock Exchange this year,” Ryder explained.

However, he warned that a definitive decision is yet to be made.

Applied Nutrition typically sells protein products, collagen powders and pre-workout supplements, most of which are produced in Liverpool before being stocked in the likes of Asda, Holland & Barret and Tesco (LON:TSCO).

It has also found a footing in the States, with its products sold across some 4,100 Walmart (NYSE:WMT) stores.

Andy Bell, the company’s chairman and the co-founder of AJ Bell, is believed to be looking for a valuation of a minimum of £500 million and is working with advisers from Deutsche Numis.

Ryder said: “We want a sensible valuation to assure investors that we are not front-ending this. We want to say, ‘Come and join us. Let’s continue on this path.”

Applied Nutrition is expected to see pre-tax profits of £25 million in the 12 months to July, supported by revenues climbing by a third to between £80 and £85 million.

Ryder, who currently owns around 55% of the group, is believed to be wanting to sell down his stake to 30%, which could see him paid out £125 million.

JD Sports Fashion PLC (LON:JD), which bought a 32% shareholding in 2021 for £25 million, is also expected to sell down its stake to around 5% to 10%.