By Kevin Buckland, Medha Singh and Gertrude Chavez-Dreyfuss

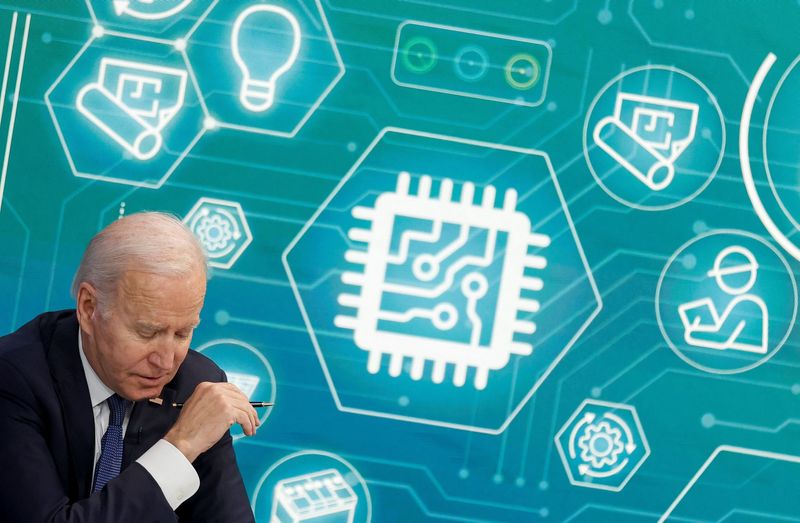

(Reuters) - Bitcoin soared on Wednesday after President Joe Biden signed an executive order that requires U.S. government agencies to assess the benefits and risks of creating a central bank digital dollar and other cryptocurrency issues.

The executive order potentially expands the adoption of virtual currencies in the U.S. financial system.

Biden's order will require the Treasury Department, the Commerce Department and other key agencies to prepare reports on "the future of money" and the role cryptocurrencies will play.

"With the recent sanctions regime in place as a result of the war in Ukraine, it is doubly imperative that we have a regulatory framework in place for digital assets that counters illicit finance, and prevent risks to financial stability and national security," said Michael Pierson, managing partner at law firm FisherBroyles.

The White House last year said it was considering wide-ranging oversight of the cryptocurrency market - including an executive order - to deal with the growing threat of ransomware and other cyber crime.

In midday trading, bitcoin rose 9.1% to $42,280, on track for its largest percentage gain since Feb. 28, while smaller peer ether, the coin linked to the Ethereum blockchain network, added 6.3% to $2,740, also set for its best day this month.

"At 21Shares, we've always believed that the best way to introduce and expose investors to crypto is through a safe and regulated approach," said Hany Rashwan, chief executive officer and co-founder of 21Shares, the world's largest provider of crypto exchange traded products.

"Today's action will help the U.S. establish itself as a leader in crypto for years to come."

U.S. exchange traded funds (ETFs) tracking bitcoin futures that gained regulatory approval late last year also jumped. ProShares Bitcoin Strategy ETF and Valkyrie Bitcoin Strategy ETF surged 9.8% and 10.2%, respectively, in early trading.

U.S. crypto miners that act as a proxy for moves in digital coins also advanced. Riot Blockchain soared 11.9% and Marathon Digital Holdings surged 14.6%, while crypto exchange Coinbase (NASDAQ:COIN) Global Inc added 9.4%.