By Ambar Warrick

Investing.com-- Asian currencies moved little on Tuesday as investors weighed potential risks from a hawkish Federal Reserve and strong dollar, while the Singapore dollar inched up ahead of key inflation data due later in the day.

Regional currencies took little respite from a slight dip in the dollar index, which fell 0.1% but remained pinned at six-week highs. Dollar index futures were largely unchanged.

Focus is now on Fed Chair Jerome Powell’s address to the Jackson Hole Symposium later this week, which is expected to shine more light on a potential dovish pivot. But Fed officials have largely dismissed speculation that the central bank will slow its pace of rate hikes.

Traders are now pencilling in a higher chance of a 75 basis point hike by the Fed during its September meeting, with a minority of investors expecting a 50 bps hike.

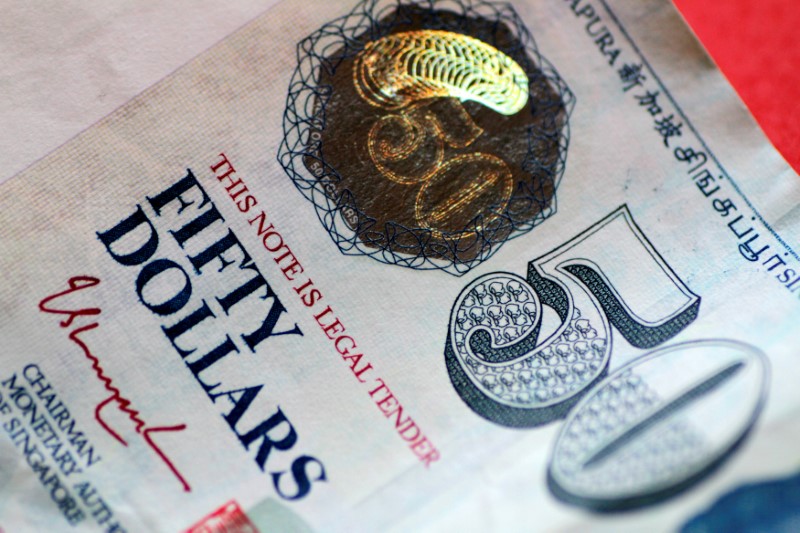

The Singapore dollar rose 0.1% ahead of data indicating a likely rise in the city state’s consumer price index in July, stemming from the increasing price of commodity imports.

The reading is likely to spur more interest rate hikes by the Monetary Authority of Singapore, which is beneficial to the dollar in the near-term.

But the Singapore economy is facing an uphill battle for economic growth, amid rising commodity prices and a slowdown in China- the island state’s biggest trading partner.

Singapore’s CPI is expected to read at an annual rate of 7% in July, up from 6.7% in June. The level is at its highest point since 2008.

Among other Asian currencies, China’s yuan fell slightly to a near two-year low on Tuesday. The outlook for the currency deteriorated further after the People’s Bank of China’s second interest rate cut in a week on Monday, amid a drastic slowdown in economic activity this year.

The Japanese yen rose 0.2%, recovering slightly from a one-month low to the dollar. Preliminary data on Tuesday showed growth in Japan’s manufacturing sector slowed to a 19-month low, weighed down by the rising cost of raw materials.

The yen is one of the worst performing Asian currencies this year, largely due to the Bank of Japan’s hesitance to tighten policy despite overheated inflation.