Investing.com – China equities were higher at the close on Thursday, as gains in the Life Insurance, Banking and Financials sectors propelled shares higher.

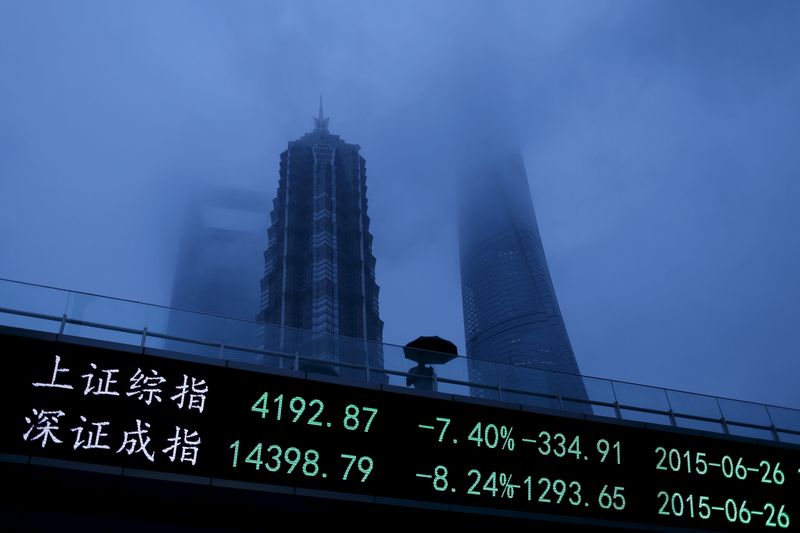

At the close in Shanghai, the Shanghai Composite rose 5.40%, while the SZSE Component index added 3.58%.

The biggest gainers of the session on the Shanghai Composite were Cn Citic Bank (SS:601998), which rose 10.09% or 0.570 points to trade at 6.220 at the close. Shenma Indu (SS:600810) added 10.08% or 0.670 points to end at 7.320 and Rebecca (SS:600439) was up 10.08% or 0.520 points to 5.680 in late trade.

Biggest losers included Jingyuntong Te (SS:601908), which lost 10.01% or 1.590 points to trade at 14.290 in late trade. Sc Langsha (SS:600137) declined 10.00% or 3.550 points to end at 31.960 and Changjiang Ele (SS:600584) shed 10.00% or 1.900 points to 17.100.

The top performers on the SZSE Component were Sichuan Meifeng Chemical Industry Co Ltd (SZ:000731) which rose 10.06% to 7.55, Cangzhou Mingzhu Plastic Co Ltd (SZ:002108) which was up 10.04% to settle at 12.39 and Sichuan Kelun Pharmaceutical Co Ltd (SZ:002422) which gained 10.03% to close at 16.24.

The worst performers were Shanghai Luxin Packing Materials Science&Technology Co Ltd (SZ:002565) which was down 10.02% to 7.81 in late trade, Hebei Iron and Steel Co Ltd (SZ:000709) which lost 10.00% to settle at 4.59 and Zhejiang JIULI Hi-tech Metals Co Ltd (SZ:002318) which was down 10.00% to 34.74 at the close.

Advancing stocks outnumbered falling ones by 872 to 69 on the Shanghai Stock Exchange.

The CBOE China Etf Volatility, which measures the implied volatility of Shanghai Composite options, was down 11.13% to 47.13.

In commodities trading, Gold for December delivery was up 0.08% or 0.90 to $1125.50 a troy ounce. Meanwhile, Crude oil for delivery in October rose 3.07% or 1.19 to hit $39.78 a barrel, while the October Brent oil contract rose 2.92% or 1.26 to trade at $44.40 a barrel.

USD/CNY was down 0.07% to 6.4063, while EUR/CNY rose 0.03% to 7.2545.

The US Dollar Index was down 0.04% at 95.26.