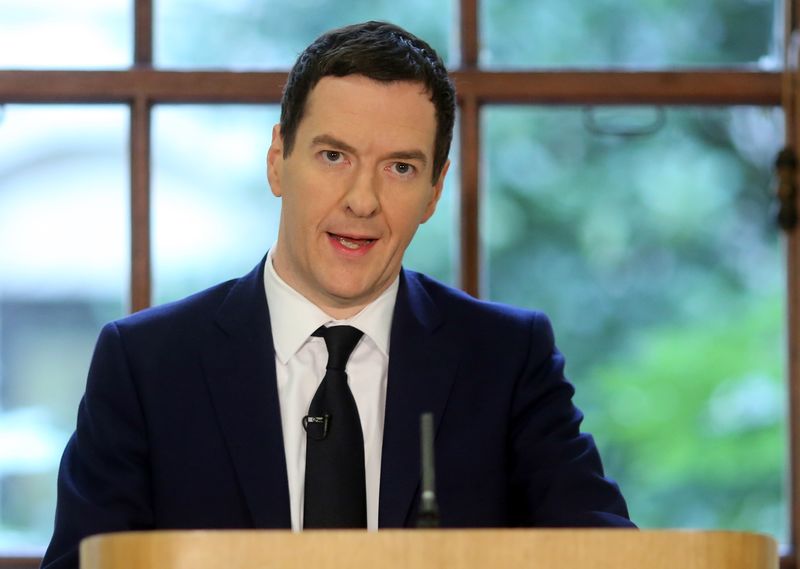

(Reuters) - British chancellor George Osborne said not radically restructuring Royal Bank of Scotland (L:RBS) in 2010 was a mistake and now says he would like "to get rid of the stake as quickly as we can" after the general election, the Financial Times reported.

"When I say 'get rid of it', I mean put it into the good hands of the private sector", Osborne said in an interview with the FT. (http://on.ft.com/1H1GxTM)

Osborne said that for several years he has been going along with the bank's then insistence that it was going to be a viable business with operations all over the world, the FT said.

Osborne is looking to follow a "Tell Sid"-type privatisation model for the sale of the taxpayer's stake in Lloyds Banking Group Plc (L:LLOY), the FT added. Osborne was referring to the "If you see Sid...Tell him!" advertisements to promote the 1986 privatisation of British Gas.

Royal Bank of Scotland's is open to reduce the size of its investment bank as an attempt to increase the bank's value, the newspaper said.

Royal Bank of Scotland could not immediately be reached for comment outside regular business hours.