By Geoffrey Smith

Investing.com -- It’s easy to dismiss President Joe Biden’s climate summit last week as empty showmanship, a bit of political virtue-signaling by an elite anxious to avoid being cast as the global villain in the great drama of our age

Easy, but wrong.

Donald Trump’s defeat last November almost certainly marked the last time that Climate Change deniers will hold power in a major advanced economy. Among G20 states, Brazil’s Jair Bolsonaro is the last holdout and he seems certain to be evicted from power next year, after a disastrous slump in his ratings due to mismanagement of the pandemic.

The consensus forged at the Paris climate talks back in 2015 has thus been restored. Generational changes in attitudes will probably ensure that It sticks this time. There will still be arguments over the solutions, but the world seems unlikely ever again to question that there is a problem.

This matters. Settling that question removes many of the political hurdles to profound changes in how taxes are raised and spent. An international accord of this nature will ensure that states keep a very active role in directing where capital does and doesn’t go, most notably as regards the energy sector, but also in areas such as construction and transportation.

The state in general (and Communist states in particular) may have a long history of misallocating capital when it chooses winners in such circumstances, but history suggests that the payoff for investors willing to bet against such political momentum will be very poor indeed.

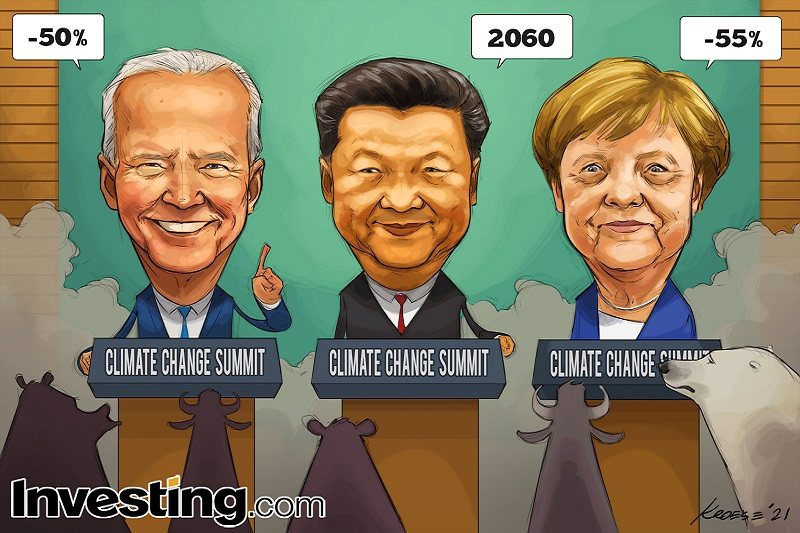

The degree of unanimity shown last week was remarkable for a collection of leaders who at other times can hardly agree what day it is: the U.S. committed to cut its greenhouse gas emissions by 50% from 2005 levels by 2030, a much more ambitious goal than President Obama’s promise of 26-28% by 2025 at the original Paris talks.

Even more eye-catching was China’s new target, adopted a few weeks earlier, to be carbon-neutral by 2060, accelerating the phase-out of coal as an energy source. Behind those pledges is not some starry-eyed environmental idealism, but rather a jockeying for position in the quest for dominance of the technologies that will power the coming industrial revolution. China, the EU and now the U.S. are acknowledging that countries who want to lead globally need to legislate nationally to create a framework that will nurture such technologies.

The first effects of this renewed global consensus on markets are already clear: copper futures hit their highest in 10 years this week amid a widening scramble for a metal needed in much greater quantities for electric cars. Nickel – another essential battery metal – is near a seven-year high for similar reasons. Silver, whose unparalleled electric conductivity makes it an essential input into items such as solar power cells, is within 10% of the eight-year high that it hit in August.

But the impacts aren’t limited to primary resources for industry. The carbon-footprint-shrinking qualities of Zoom Video Communications ' (NASDAQ:ZM) conference call technology, to name but one example, look likely to win it a place in most ESG-focused model portfolios, underpinning its valuation for years to come.

On the flip side, one of the factors behind the sell-off in cryptocurrencies over the last week has been unease at the thought of the energy-intensity of the whole crypto sphere. Governments bound to pursue greater energy efficiency can only watch for so long as vast amounts of coal and gas are burned to generate an asset with no social or political advantage for them, after all.

Skeptics will doubtless point to the sky-high valuations of the highest-profile Green stocks, such as Nextera Energy (NYSE:NEE) or Orsted (OTC:DOGEF), a Danish operator of wind and solar parks. Investors in hydrogen, notably, have already lived through more than one boom and bust.

That doesn’t appear to have stopped people buying: the Nasdaq Renewable Energy Generation index up over 43% from pre-pandemic levels, while the S&P 600 Energy index, a basket of old-school energy companies, is down over 20%.

Hype cycles and charlatans will ensure that investors never lack opportunities to lose their savings on individual stocks, and it’s not impossible that a dying oil and gas industry will churn out cash as abundantly as the tobacco industry has for the last 30 years. Still, the direction of travel is clear. Let the trend be your enemy if you insist, but don’t expect to be rewarded for your loyalty to the old guard.