By Dawn Chmielewski and Svea Herbst-Bayliss

(Reuters) -Walt Disney's battle with activist investor Nelson Peltz heated up on Thursday when the hedge fund manager said his candidates to the entertainment company's board of directors were better suited to plan for life after CEO Bob Iger than two current board members.

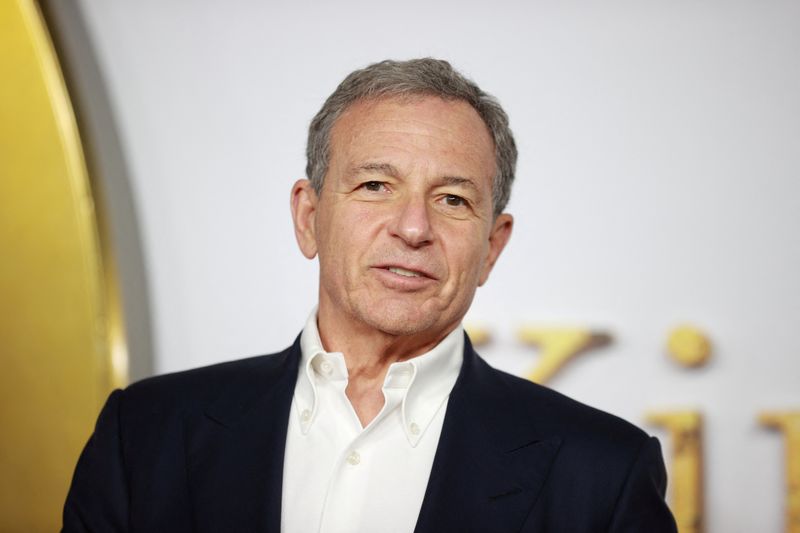

Disney set the shareholder meeting for April 3 when investors will get a say in who guides the entertainment and media giant's future. It reiterated that Iger, 72, who returned to the CEO position after his handpicked successor was fired in 2022, will leave at the end of 2026 and noted that his contract has been extended.

"Both the Board and Bob remain actively engaged in the high-priority work of succession planning," the company said.

Those promises do not impress Peltz, the octogenarian billionaire pushing the home of Mickey Mouse to cut costs, create a profitable streaming business, improve the performance of its movie studio and clean up its succession planning. He said in a letter to investors the company's "strategic missteps" can be "laid at the feet of its board."

On Wednesday his firm, Trian Fund Management, made a regulatory filing in which it said shareholders should replace Disney directors Michael Froman and Maria Elena Lagomasino with Peltz and former Disney chief financial officer Jay Rasulo.

On Thursday, Trian wrote to shareholders that according to Disney's own criteria, Froman and Lagomasino lack skills in succession planning, media and entertainment, and strategic transformation. Peltz and Rasulo, the letter says, have skills in all areas central to Disney's strategy.

Disney issued a press release saying its 12 nominees are the best qualified to create value for shareholders, and urged investors to reject Trian's nominees. It has said Peltz lacks media experience and has failed to present any strategic ideas, while Rasulo's perspective is "stale," since he left the company in 2015.

The company also said it does not endorse the three board candidates nominated by Blackwells Capital, another Disney investor that has largely been supportive of Iger's efforts to cut costs and improve operations. Again Disney argued they lack the range of talent, skill or expertise to drive growth.

Disney described its succession planning in an updated proxy filed Thursday with the U.S. Securities and Exchange Committee. The company said it has contacted 96% of its largest 25 shareholders and held nearly 100 conversations with investors about topics including the ongoing leadership succession process.

The board's succession planning committee met six times last year, and in fiscal 2024 it added James Gorman, a former Morgan Stanley (NYSE:MS) CEO who has successfully led CEO succession processes at global institutions, to its board and the committee that is searching for Iger's replacement. The board has also received reports from advisors and a search firm regarding CEO candidates.