By Sinéad Carew

NEW YORK (Reuters) - A global index of stocks fell on Friday while U.S. Treasury yields rose after a July inflation reading showed prices rising slightly faster than expected, fueling expectations the Federal Reserve will keep interest rates higher for longer.

The U.S. producer price index (PPI) for final demand rose 0.3% in July, according to the Labor Department. This compared with economist expectations for 0.2%. And in the 12 months through July, the PPI rose 0.8% against estimates for 0.7%.

On Thursday, Wall Street's main indexes had finished flat, giving up most early gains on milder-than-feared consumer price inflation data.

But also on Friday a survey showed U.S. consumer sentiment climbing to the highest level in nearly two years in July with calming inflation and a strong labor market boosting consumers.

While he saw the sentiment survey as good news for investors, John Augustine, chief investment officer at Huntington National Bank, said the bond market's reaction to the inflation data was causing a ripple effect in the stock market.

"It's bond yields driving the day. Higher bond yields generally take the Nasdaq down," he said, noting that investors were focused on the Fed, earnings estimates and the rising price of oil futures.

Friday's data suggested to Paul Christopher, head of global investment strategy at Wells Fargo (NYSE:WFC) Investment Institute in St. Louis, that the Fed will need to keep rates higher for longer and he said "it puts additional rate hikes back on the table for this year."

"We think there's some reassessment of inflation going on with investors looking further under the hood. Disinflation has been very rapid in the past months at the top level but that may be leveling out here a little," Christopher said.

In stocks, the Dow Jones Industrial Average rose 105.25 points, or 0.3%, to 35,281.4. The S&P 500 lost 4.78 points, or 0.11%, to end at 4,464.05 and the Nasdaq Composite dropped 76.18 points, or 0.56%, to finish at 13,644.85 after both hit their lowest levels in a month earlier in the day.

For the week the Dow rose 6.2%. The S&P fell 0.3% and the Nasdaq dropped 1.9%, marking two consecutive weeks of losses for both indexes the first time this year.

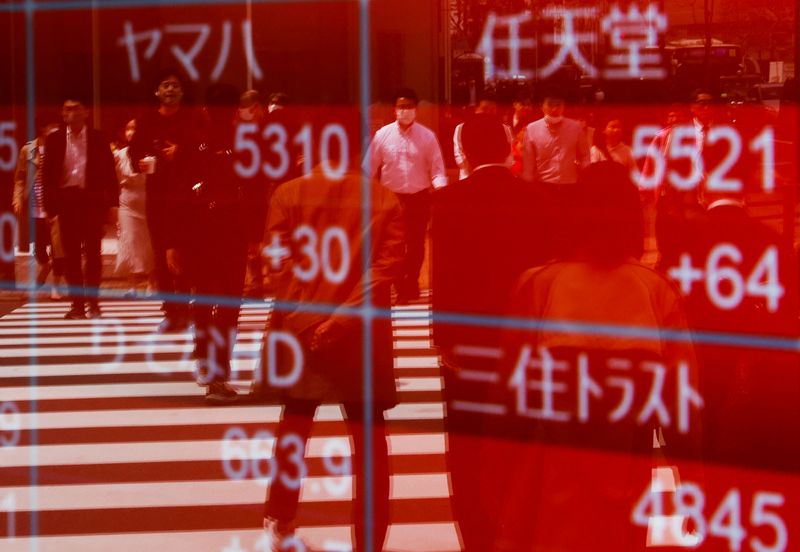

MSCI's gauge of stocks across the globe shed 0.54%. for the week the global index was down 0.70% marking its first back-to-back weekly loss since May.

In currencies, the U.S. dollar touched 145.00 against the yen, which was its highest since June 30. The Japanese yen was last down 0.14% versus the greenback at 144.94 per dollar.

{{2126|The dodollar index, which measures the greenback against a basket of major currencies, rose 0.214%, with the euro down 0.32% to $1.0944.

Sterling was last trading at $1.2698, up 0.18% on the day after GDP data showed Britain eked out unexpected growth in the second quarter, helped by a strong June performance.

On the U.S. Treasuries side, benchmark 10-year notes were up 8.4 basis points at 4.166%, from 4.082% late on Thursday. The 30-year bond was last up 3.9 basis points to yield 4.2717%. The 2-year note was last up 7.6 basis points to yield 4.8968%.

In commodities, oil prices rose for their longest weekly gaining streak since a run that ended June 10, 2022, after forecasts for tightening supplies from the International Energy Agency (IEA).

U.S. crude settled up 0.45% at $83.19 per barrel and Brent ended the session at $88.81, up 0.47% on the day.