Last week’s budget has made life more complicated for the Bank of England. A rate cut is all but certain, but the combination of extra fiscal stimulus and a volatile US election aftermath means officials won’t want to comment on its next steps. A December rate cut has become less likely, although a lot hinges on the two inflation reports we get before Christmas.

How has the Bank of England reacted to last week’s budget?

Last week’s budget, the first under Labour Chancellor Rachel Reeves, promised big tax hikes and even bigger spending increases. Borrowing will be materially higher over the next couple of years, and that revelation caught bond markets off-guard. Above all, investors latched onto new Office for Budget Responsibility forecasts which showed GDP and inflation higher in 2025 as a direct result of government policy. Financial markets are now pricing a shallower easing cycle from the Bank of England.

BoE officials certainly can’t ignore the budget. By any reasonable definition, it represents a material fiscal stimulus in 2025.

But the impact on the economy is unlikely to be quite as dramatic as the OBR’s forecasts suggest. Those projections compare the budget to the previous one in March, which pencilled in dramatic real-term spending cuts that were never likely to be implemented. Departmental spending was always likely to rise, a fact that won’t have passed the BoE by at its summer meetings.

The economic impact of higher spending is also blurred by the substantial tax hikes that come alongside it. The longer-term impact of higher investment, which will boost supply potential, also muddies the water.

So how does the BoE react? Awkwardly, it's not clear whether the budget will have come too late to be factored into the new set of forecasts, or at least fully. In the absence of fiscal news, those projections were unlikely to change significantly. The forecasts are based on market expectations for Bank Rate, which ahead of the budget, were roughly where they were ahead of August’s meeting.

Regardless, you can expect policymakers to give a broad estimate of what the budget means even if the impact isn’t formally in the forecasts. Following the March budget, the Bank commented on tax cuts saying it would lift GDP by a quarter of a percent. But crucially, it also said the impact on the supply side of the economy would mean inflationary pressures were “likely to be smaller”.

The budget won’t change the Bank’s decision to cut rates again this week. But it does question our long-held view that rate cuts will speed up from now on. The risk is that this happens later, and the Bank decides to keep rates on hold again in December. A cut at the final meeting of the year looks fairly 50:50, and a lot will depend on the two inflation reports we get between now and Christmas.

Either way, we still see rates falling below 3.5% by next summer, which is well below what markets are now pricing.

How much weight does the BoE put on the recent decline in services inflation?

Speaking of inflation, services CPI has undershot the BoE’s August projections by some margin, and remember this has been the guiding light for monetary policy for some time. It now stands at 4.9%, more than half a percentage point below the BoE’s 5.5% forecast. More importantly, the Bank’s measure of “core services inflation”, which strips out lots of volatile and irrelevant stuff, has also fallen materially over recent months.

This improvement, we think, is much more important for the Bank than anything to do with the budget. In the near term, we think services inflation will remain sticky at around 5%, before falling more noticeably again in the new year. The Bank’s survey of Chief Financial Officers, which policymakers put a lot of faith in, has consistently pointed to more muted price and wage rises.

Will the Bank change its forward guidance?

Unlike the European Central Bank, which sped up easing in response to growth concerns, or the Federal Reserve, which is putting more emphasis on the weaker jobs market, the Bank of England has so far resisted calls to move faster on rate cuts. Having cut rates once so far, it has seemed content with moving gradually.

We don’t hear much from Bank officials, but in an interview in early October, Governor Andrew Bailey hinted that rate cuts could become more aggressive if inflation allowed.

If it wasn't for the budget, or the US election, the result of which might not be clear by the time the committee votes on Wednesday, then Bailey might have been tempted to double down on that guidance this week.

But the budget has made life more complicated for the Bank, not least because bond markets remain twitchy. In a volatile week, officials will be acutely aware that this is not the time to start meddling with market expectations. The Bank rarely decides to comment on market pricing, anyway.

We expect the Bank to simply reiterate that further “gradual” cuts are likely if the data moves in line with its forecasts.

What will the vote split be?

Even if the committee doesn’t change its guidance, the vote split will be an interesting signal of whether the consensus is turning more dovish. In August, the rate cut was voted through on a narrow 5-4 majority. Since then, one of those four dissenters has left the committee. Jonathan Haskel’s successor, Alan Taylor, has yet to comment on his policy preferences. The one to watch is Huw Pill. If he, and perhaps even Meghan Greene, another hawk, vote for the cut, then that would be a clear signal that consensus is cementing around the need to lower rates to neutral.

We suspect the vote will be either 6-3 or 7-2 in favour of cutting rates. There's a tail risk that Swati Dhingra, the arch-dove on the committee, votes for a 50bp cut at this meeting.

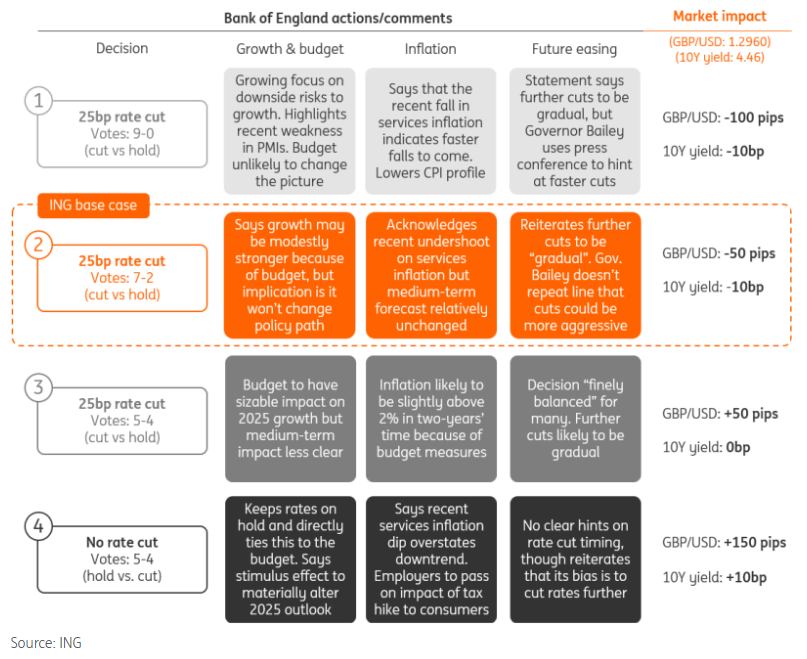

How will markets react?

The Gilt market is still on edge and volatility is likely to remain elevated with the US elections on our doorstep. A dovish BoE could help yields settle lower again after the significant jump higher during the aftermath of Reeve’s budget. Having said that, the scope for yields to go lower is likely to be limited. Nervousness about inflationary pressures and increased borrowing from the budget remains in the minds of Gilt investors. An overly dovish BoE could even backfire and trigger higher yields as markets could interpret this as a policy mistake; one in which the BoE underestimates the inflationary impact from the budget. But we see this as a tail risk and is not part of our scenario set.

If the BoE turns more hawkish than expected, and refrains from cutting, Gilt yields could nudge higher again. The room to go higher is, however, also contained as rates are already incorporating a more hawkish stance from the BoE.

Sterling has been buffeted around by dollar and euro trends over recent weeks and notwithstanding a little wobble on the back of last week’s UK budget, the sterling trade-weighted index is barely 1% off the highs of the year. Given that interest rate markets since mid-September have re-priced the BoE landing point some 75bp higher, we think upside risks to sterling from BoE communication are quite limited. Instead, a BoE staying focused on the easing cycle this week could see sterling correct lower. And if the very recent ECB pushback against a faster easing cycle continues, EUR/GBP can retest the highs near 0.8450/60. GBP/USD remains very much beholden to the US election outcome but tends to be a lower beta story than many of its G10 FX peers.