By Wayne Cole

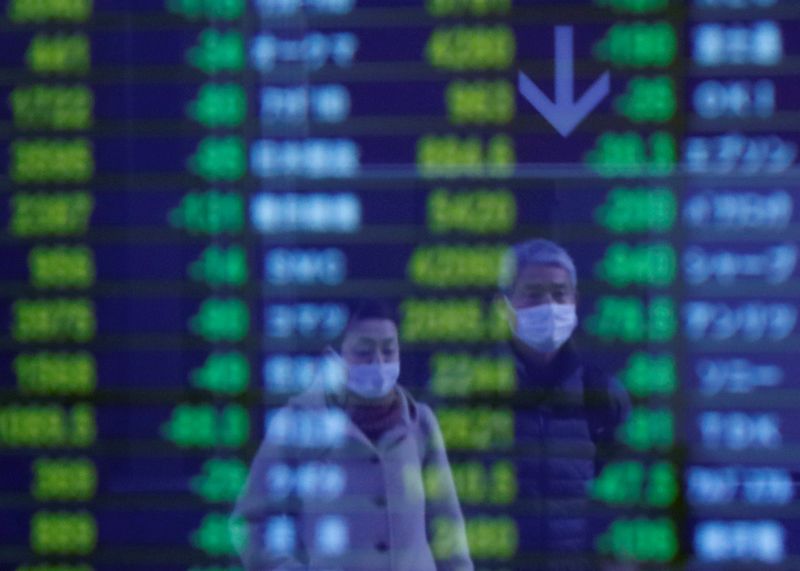

SYDNEY (Reuters) - Asian shares touched two-year peaks on Thursday in the wake of Wall Street's record run as cheap cash drove up big-cap tech darlings, although Sino-U.S. tensions caused caution to creep in as the session progressed.

MSCI's broadest index of Asia-Pacific shares outside Japan (MIAPJ0000PUS) had edged up 0.1% after earlier reaching its highest since August 2018.

Japan's Nikkei (N225) eased 0.4% from levels not seen since mid-February, while South Korea (KS11) fell 0.8% as a jump in coronavirus cases ended four days of rises.

Even S&P 500 futures (ESc1) dipped 0.2%, although that followed five straight sessions of gains. Both EUROSTOXX 50 futures (STXEc1) and FTSE futures (FFIc1) were little changed.

Asian investors turned more circumspect because of the military face-off in the South China Sea, as Washington blacklisted 24 Chinese companies while Beijing reportedly test fired missiles into the area on Wednesday.

Yet markets globally are still focused on the endless liquidity being pumped out by central banks.

Federal Reserve Chair Jerome Powell is expected to outline a more flexible approach to policy on Thursday including a shift to targeting an average inflation rate around 2% that will allow rates to stay super-low for longer.

"So with U.S.-China tensions seemingly not a major concern, the deluge of fiscal and monetary support remains the overriding tail wind for risk assets with large cap the beneficiaries," said Rodrigo Catril, a senior FX strategist at NAB.

The Dow (DJI) ended Wednesday up 0.3%, while the S&P 500 (SPX) climbed 1.02% and the Nasdaq (IXIC) 1.73%. Gains were again concentrated in the tech majors with Netflix Inc (O:NFLX) surging 11.6% and Facebook Inc (O:FB) 8.2%.

The liquid largesse from central banks has kept sovereign bonds well supported even as stocks reach new highs. Yields on 10-year Treasuries (US10YT=RR) have steadied at 0.68%, after finding solid bids around 0.73%.

At the same time, the prospect of even more easing from the Fed has kept the dollar on the defensive. Against a basket of currencies, it was stuck at 92.916 (=USD) on Thursday and uncomfortably close to the recent two-year trough of 92.124.

The euro held at $1.1832 (EUR=) and near its recent top of $1.1965, while the dollar backed off to 105.96 yen

The dollar has also been steadily trending lower on the Chinese yuan to reach depths not seen since mid-January at 6.8809 yuan

In commodity markets, gold eased back to $1,943 an ounce

Oil prices were underpinned as U.S. producers shut output in the Gulf of Mexico ahead of Hurricane Laura. The storm may be the most powerful to crash into Louisiana and is headed directly for the major oil refining town of Port Arthur, Texas. [O/R]

Brent crude (LCOc1) futures edged up 11 cents to $45.75 a barrel, while U.S. crude (CLc1) dipped 2 cents to $43.37.