By David Milliken and Ana Nicolaci da Costa

LONDON (Reuters) - The Bank of England showed no sign it was close to raising interest rates as it voted once again to keep them at a record low and said the outlook for inflation in coming months looked weaker than it previously thought.

British consumer price inflation, which stands at zero, was unlikely to reach 1 percent until the spring of 2016, the BoE said, slightly later than forecast in August. Pressure on prices from rising wages remained muted.

"Although rising, increases in labour costs remain lower than would be consistent with meeting the inflation target in the medium term," the BoE said on Thursday in a summary of the debate among its policymakers who decided to hold rates at 0.5 percent.

Sterling fell against the dollar after the decision and British government bond prices rose slightly as some economists rethought the previous majority view that the BoE's first rate rise since 2006 would come in February.

"The language on inflation was relaxed," BNP Paribas's Dominic Bryant said as he pushed back his forecast for the first rate hike to May. "The Bank is more likely to conclude that there is relatively little cost to waiting a few more months to be confident that domestic price pressures are rising."

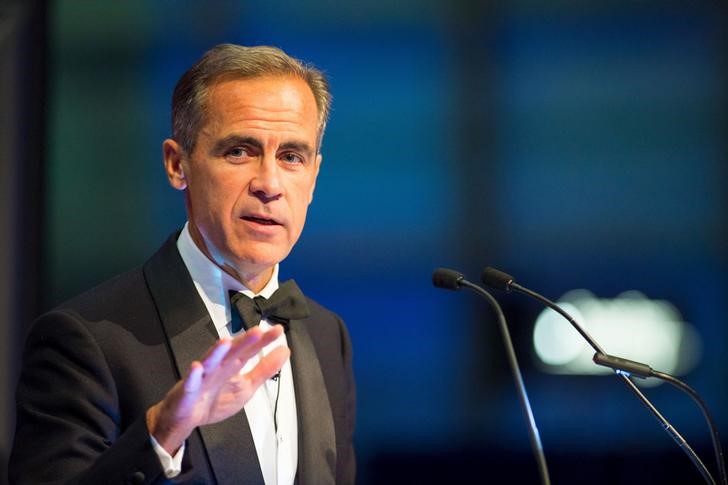

BoE Governor Mark Carney said in August the timing would come into sharper focus around the turn of the year. Since then, concerns about a slowdown in the global economy and the U.S. Federal Reserve's decision not to start raising rates have steadily pushed back expectations for when the BoE might move.

The lone dissenter on the nine-member Monetary Policy Committee came from Ian McCafferty, who for a third month called for a rise in rates to 0.75 percent because he felt inflation risked overshooting its target in the medium term.

But some other policymakers cited evidence that interest rates affected inflation faster than they previously thought -- suggesting they might delay a rate hike until inflation is closer to the BoE's 2 percent target.

The BoE also said data which showed a rise in labour costs probably overstated the strength of wage pressures. Parts of the labour market were hit by skills shortages but productivity was rising, neutralising some of the impact of higher wages.

Policymakers acknowledged the slowdown in emerging markets but disagreed about whether it was any worse than they expected earlier this year with China showing steady levels of activity.

Instead the MPC focused more on revisions to official British data that confirmed a "gentle deceleration" over the past year as growth slowed to nearer its long-run average.

Combined with ongoing government spending cuts this "might presage a slightly weaker outlook", though it could also reflect the economy returning to balance after the financial crisis.

On Wednesday, the National Institute of Economic and Social Research estimated quarterly growth had fallen to 0.5 percent in the three months to September from 0.7 percent in the previous quarter, but kept its 2.5 percent forecast for 2015 as a whole.

The BoE said it saw growth of 0.6 percent in the third quarter. It will publish a fuller quarterly update to its forecasts next month.