By Minami Funakoshi

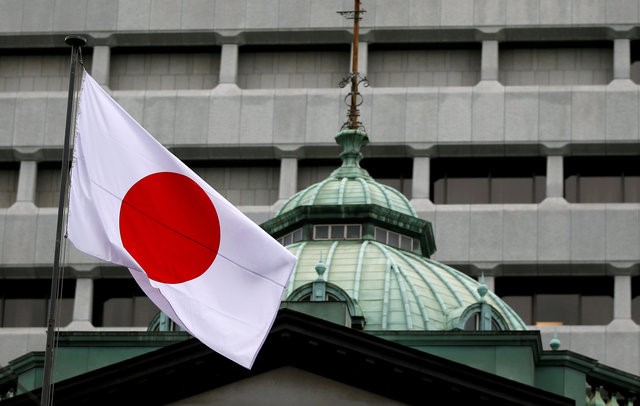

TOKYO (Reuters) - Japan's government upgraded its overall assessment of the economy on Wednesday, echoing the Bank of Japan's more upbeat view, in a sign the economy may be steadying.

The government also upgraded its view of household spending, exports and business sentiment, saying consumers' mindsets are improving and exports to Asia are recovering.

The brighter assessment from the government comes a day after the BOJ kept monetary policy steady and upgraded its views on the economy, saying exports and output were picking up.

"The economy is on a moderate recovery, while delays in improvement can be seen in some parts," the Cabinet Office said its monthly economic report, marking the first upgrade since March 2015.

Like the central bank, the government revised up its view on private consumption, considered a soft spot for the world's third-largest economy. The government upgraded this assessment for the first time in three months.

"Pick-up can be seen in private consumption," the monthly report said. "Going forward, private consumption is expected to pick up as employment and wages improve."

The government was also more upbeat on exports, saying that gains can be seen and these should continue as global economies gradually recover. This was the first upgrade in nine months, and was revised from the previous month's description of exports as being "largely flat."

In another encouraging sign, the government raised its view on business sentiment, saying it is recovering moderately.

However, the report warned of uncertainties in the global economy and fluctuations in financial and capital markets.

Japan's economy expanded for a third straight quarter in July-September as exports recovered, but domestic activity remained weak.

Export performance improved strongly in November as a rapid decline in the yen and a recovery in overseas demand boosted shipments from the trade sector, handily beating economists' expectations.