Investing.com - The cryptocurrency sector is trading in the green across its major assets on Tuesday, with Bitcoin breaking above the 28,000-mark.

Ben Laidler, Global Markets Strategist at eToro, discusses the sensitivity of Bitcoin and the digital asset market to any good news that drives adoption in this industry.

CATALYSTS

Bitcin today maintains the gains seen since yesterday following rumours of the approval of a bitcoin ETF on spot prices. "This news proved premature, but illustrates the sensitivity of the asset class to any good news and should encourage investors ahead of the long list of potential catalysts ahead," says Laidler.

"From the US SEC's deadline for final approval of the spot bitcoin ETF in January 2024 to the 'halving' or halving of mined block rewards expected in March, to new US global banking and corporate accounting regulations that make it easier to own cryptocurrencies. There is also the possibility that we could see the first central bank declaring and holding bitcoins in its reserves," he adds.

"Bitcoin is by far the smallest, youngest and most minority of all asset classes, and is disproportionately sensitive to any signs of market development. It has remained at the forefront of its asset class gains this year, but volumes, volatility and correlations have plummeted, even as its global adoption continues and an uneven regulatory framework develops," Laidler notes.

ADOPTION

"Cryptocurrencies remain very popular with retail investors. Our global survey shows it is the most popular asset in the fourth quarter, ahead of cash and equities, with the average holder having a 21% allocation," Laidler highlights.

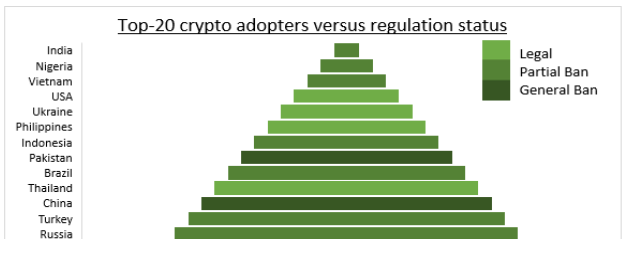

The latest cryptocurrency adoption index shows a recovery in ownership from last year's fourth quarter lows, following the FTX debacle and the latest "winter" of cryptocurrency performance. The index ranks the five countries that have adopted cryptocurrencies the most: India, Nigeria, Vietnam, the US and Ukraine. Countries where crypto is banned continue to rank at the top, including Pakistan (#8), China (#11) and Morocco (#20).

REGULATION

"A survey of global crypto regulation in 60 major economies shows that these assets are legal in more than half (see chart), partially banned in 32 and banned in 8, with China and Saudi Arabia leading this list," details Laidler.

"Two-thirds of these countries are in the process of introducing major changes to their regulations, and the regulatory pace is accelerating. From the entry into force of the EU's MiCA regulation in June to clarification from the SEC and CFTC authorities in the US, many have sandboxes. Many have regulatory sandboxes or testbeds for experimentation, although consumer protection rules seem to be lagging behind. In contrast, almost all countries are deploying central bank digital currency research and/or development programmes (CBDCs) to a greater or lesser extent," concludes the eToro expert.

Translated from Spanish using DeepL.