Benzinga - Bitcoin (CRYPTO: BTC) hit a new all-time high last week and I felt nothing. No FOMO. No regrets. Nada. I still own more than half a Bitcoin, but my thinking on crypto has changed quite a bit since Bitcoin was last at $69,000.

Back in November 2021, I was skeptical yet enthralled by what crypto had to offer. Though I didn’t think crypto would overthrow the legacy financial system, I did believe that it would overturn something in the world of finance. As I stated:

Cryptoland won’t solve all of our problems, but it will solve some of them. Figuring out which ones is the next step in the journey.Unfortunately, it looks like I was wrong. I can’t think of a single use case that came to fruition outside of the ones we already knew about (i.e. portability & decentralization). Yes, there is value in having portable, decentralized wealth. A store of value that is difficult to seize and that can be easily moved has some inherent worth. Bitcoin (and blockchains in general) are amazing for this purpose. However, is this particular use case worth $60,000 a Bitcoin? I’m not so sure.

But what I am sure of is that this rally feels different than the prior ones. Joe Weisenthal summarized the atmosphere of the current crypto environment beautifully in the Bloomberg Markets newsletter last week:

All that being said, there is something about this upturn that’s a little bit different than in the past. Typically there’s some sort of story or pretense that rides alongside the price. In 2021 there was a lot of talk about “DeFi” and how the various chains had the opportunity to disintermediate finance in some novel way.This rally is so different because no one is beating around the bush anymore. It’s not about technology. It’s not about use cases or improving the world. It’s just, “More people buy, number go up.” The veil has been lifted and we all know it. It’s a momentum trade plain and simple. We turned a bunch of computers into a casino and then dressed it up as something else.Other things in past cycles you heard about where how gaming would all go on chain, with people being able to own their own characters or their character skins or whatnot. Tokens were going to replace frequent flyer miles. Ethereum was going to be the new World Computer. Real-world assets would all be tokenized, creating smoother more liquid markets for various things that are currently hard to trade. None of this has panned out so far. At all.

But not only has none of this panned out, there’s not some new “fundamental” story that’s being told about this rally. There’s not some new crypto use case that people are excited about that wasn’t being talked about 3 years ago.

The only thing people are talking about really is flows. There’s the new inflows from the ETFs.

But people know the truth. I got my hands on an early copy of Nat Eliason’s upcoming book Crypto Confidential that convinced me of this point. The book, which provides an insider’s perspective on the 2021 crypto bull run, made me realize how much of a game crypto is. More importantly, it made me realize how many people know it’s a game as well. They understand the rules and they play accordingly. They know they can get scammed. They know they could lose it all. Nevertheless, they still play.

Why would someone do this knowing how bad things could turn out? Because many of them don’t have an easier way of becoming rich. It’s the same reason why people play the lottery. In both cases, there’s at least a chance that they can live the life of their dreams. Yes, the chance is very low (

Compare this to their alternative of working a lower paying job and saving 10% of their income. What’s the chance they become wealthy doing that? Basically zero. As I discussed last week, the typical American household is unlikely to reach millionaire status earning the median household income alone. Therefore, their most rational choice might be to try their luck in crypto.

Travis Kling, the CIO of a crypto asset management firm, believes that crypto seems so attractive today because of a growing sense of financial nihilism. As he states:

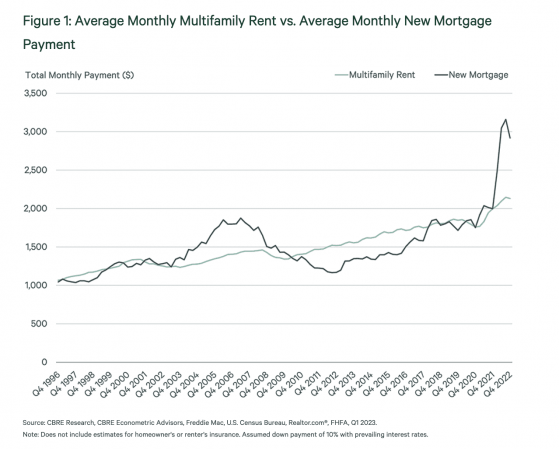

Financial nihilism—the idea that cost of living is strangling most Americans; that upward mobility opportunity is out of reach for increasingly more people; that the American Dream is mostly a thing of the past; and that median home prices divided by median income is at a completely untenable level.Kling argues that both crypto and sports betting are taking off due to the economic circumstances many find themselves in today. And while I’m fortunate enough to not be experiencing such struggles, I get the sentiment, especially when it comes to housing prices. As this chart from CBRE illustrates, new mortgage payments are well above the average monthly apartment rent:

I’ve looked for apartments in and around NYC and buying makes no sense compared to renting. The numbers just don’t add up. And, if they don’t add up for someone who isn’t experiencing difficult economic times, I can only imagine how out of reach they would feel for someone who is.

Now do you see why crypto has such an appeal? People are taking small amounts of money and turning them into small (or not so small) fortunes. I have a friend of a friend that spent $250 on 5 Solana Monkey NFTs that were worth over $500,000 at the peak in 2021. He only got out with $90,000 after tax when all was said and done, but it completely transformed his life. That $90,000 would’ve taken him over 5 years to save on his own through his job.

These are the kinds of returns that people hear about and tell stories about. These are the kinds of returns that bring people into the space. Of course, for every person that turned $250 into $90,000, there is someone that did the opposite. But that doesn’t matter right now. Because the ETF flood gates have opened and the new crypto bull market has begun.

I know what you might be thinking though, “Nick, if you’re so skeptical of crypto, why haven’t you sold it all?”

Because…if more people buy, number go up.

Thank you for reading!

If you liked this post, consider signing up for my newsletter or checking out my prior work in e-book form.

© 2024 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Read the original article on Benzinga