By Katie Paul and Anna Irrera

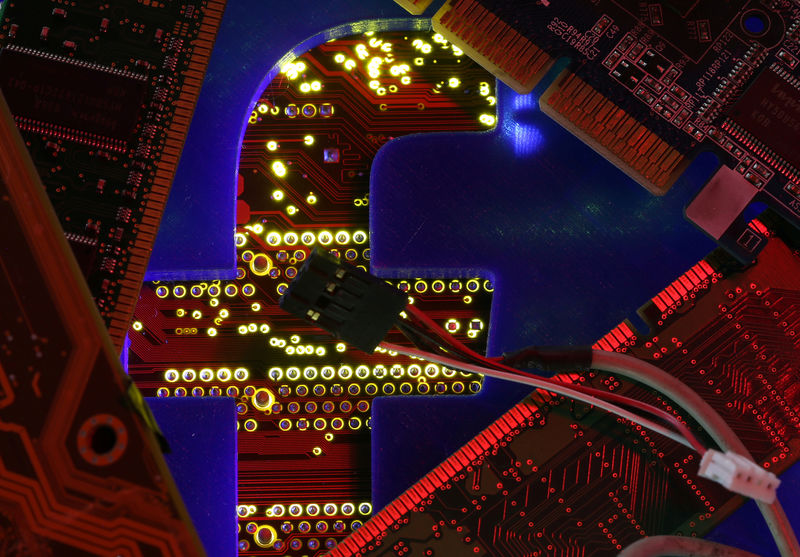

SAN FRANCISCO/NEW YORK (Reuters) - Facebook Inc (NASDAQ:FB) announced ambitious plans on Tuesday to launch a new global cryptocurrency called Libra, part of an effort to expand into digital payments that immediately raised privacy concerns.

The social networking giant has linked with 28 partners including Mastercard (NYSE:MA), PayPal and Uber (NYSE:UBER) to form Libra Association, a Geneva-based entity governing the new digital coin, according to marketing materials and interviews with executives. No banks are yet part of the group.

To facilitate transactions, Facebook also created Calibra, a subsidiary that will offer digital wallets to save, send and spend Libras. Calibra will be connected to Facebook messaging platforms Messenger and WhatsApp.

The whole system is scheduled to launch in the first half of 2020.

Facebook executives and others associated with Libra have big aspirations. They hope it will not only power transactions between established consumers and businesses globally, but offer unbanked consumers access to financial services for the first time.

Facebook is also betting Libra can squeeze more revenue out of its suite of apps, something already happening on Chinese social networks like WeChat.

Representative Maxine Waters, chairwoman of the U.S. House Financial Services Committee, called for Facebook executives to testify before Congress and asked the company to halt development of Libra until lawmakers and regulators have reviewed the project.

"With the announcement that it plans to create a cryptocurrency, Facebook is continuing its unchecked expansion and extending its reach into the lives of its users," Waters said in a statement.

Other regulators, lawmakers and government officials around the globe also quickly issued critical statements. France's finance minister said he had asked central bank heads from G7 countries to write a report on the project by mid-July.

A Facebook representative said the company looked forward to answering lawmakers' questions.

Before Tuesday's announcement, Facebook was already facing significant backlash over mishandling user data and not doing enough to prevent Russian interference in the 2016 U.S. presidential election. Those issues have led some government officials to call for Facebook to incur penalties, or be forcibly broken up.

Kevin Weil, who runs product for the Libra initiative, said Facebook hopes it can bring global regulators to the table by publicizing its plan.

"It gives us a basis to go and have productive conversations with regulators around the world," he told Reuters. "We're eager to do that."

The name "Libra" comes from Roman weight measurements, the astrological sign for justice and the French word for freedom, said David Marcus, who heads the project for Facebook.

"Freedom, justice and money, which is exactly what we're trying to do here," Marcus said in an interview.

Facebook shares closed up 0.1%.

UNREGULATED SECTOR

Facebook is using one of the least-regulated areas of finance for its foray into the sector.

Bitcoin, the best-known digital coin, was created in 2008 as an alternative to traditional currencies that are controlled by governments and central banks. Some countries have explored ways to regulate the market since then, but crypto trading remains largely unsupervised.

In the meantime, investors have lost hundreds of millions of dollars through steep price drops and crypto-exchange hacks. The market has also faced money-laundering and terrorist-financing allegations.

But Facebook's status as a Silicon Valley behemoth touching billions of people around the world could help legitimize what has so far been a niche and volatile market.

Other Libra Association members include companies like Visa (NYSE:V), Spotify, eBay (NASDAQ:EBAY) and Vodafone (LON:VOD), as well as venture capital firms like Andreessen Horowitz.

They hope to have 100 members by Libra's launch. Each gets one vote on substantial decisions and firms must invest at least $10 million to join.

The group aims to raise money through a private placement in coming months. Facebook does not plan to maintain a leadership role after 2019.

Though there are no major banks among the inaugural members, there have been discussions with them, said Jorn Lambert, executive vice president for digital solutions at Mastercard.

Big lenders are waiting to see how regulators and consumers respond to the project before deciding whether to join, he said.

Some Libra backers acknowledged that consumer privacy brawls or regulatory resistance could hinder their lofty goals, and detailed some steps they are taking to pre-empt those issues.

For instance, Calibra plans to conduct compliance checks on customers who want to sign up, using verification and anti-fraud processes that are common among banks.

The subsidiary will only share customer data with Facebook or external parties if it has consent, or in "limited cases" where it is necessary, Facebook said. That could include for law enforcement, public safety or general system functionality.

Sri Shivananda, PayPal's chief technology officer, said the project was still in its "very, very early days" in terms of getting necessary regulatory approvals and consumer buy-in.

And, Mastercard's Lambert said that if the project receives too much pushback, "we might not launch."

(Graphic - Bitcoin futures, https://tmsnrt.rs/2Wt4AwE)